Should Amylyx’s Clean Early AMX0114 ALS Data Shape How Investors View Its Pipeline Strategy (AMLX)?

- Amylyx Pharmaceuticals recently presented early safety and tolerability data from its Phase 1 LUMINA trial of AMX0114 in ALS at the 36th International Symposium on ALS/MND in San Diego, reporting no treatment-related serious adverse events in the first cohort and planning to begin enrollment of the second cohort in Canada and the US.

- The presentation at a major ALS/MND forum highlights Amylyx’s attempts to advance its ALS pipeline, potentially reinforcing confidence in AMX0114’s early clinical profile among researchers and investors.

- We’ll now examine how the clean early safety profile for AMX0114 shapes Amylyx Pharmaceuticals’ broader investment narrative around its ALS pipeline.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Amylyx Pharmaceuticals' Investment Narrative?

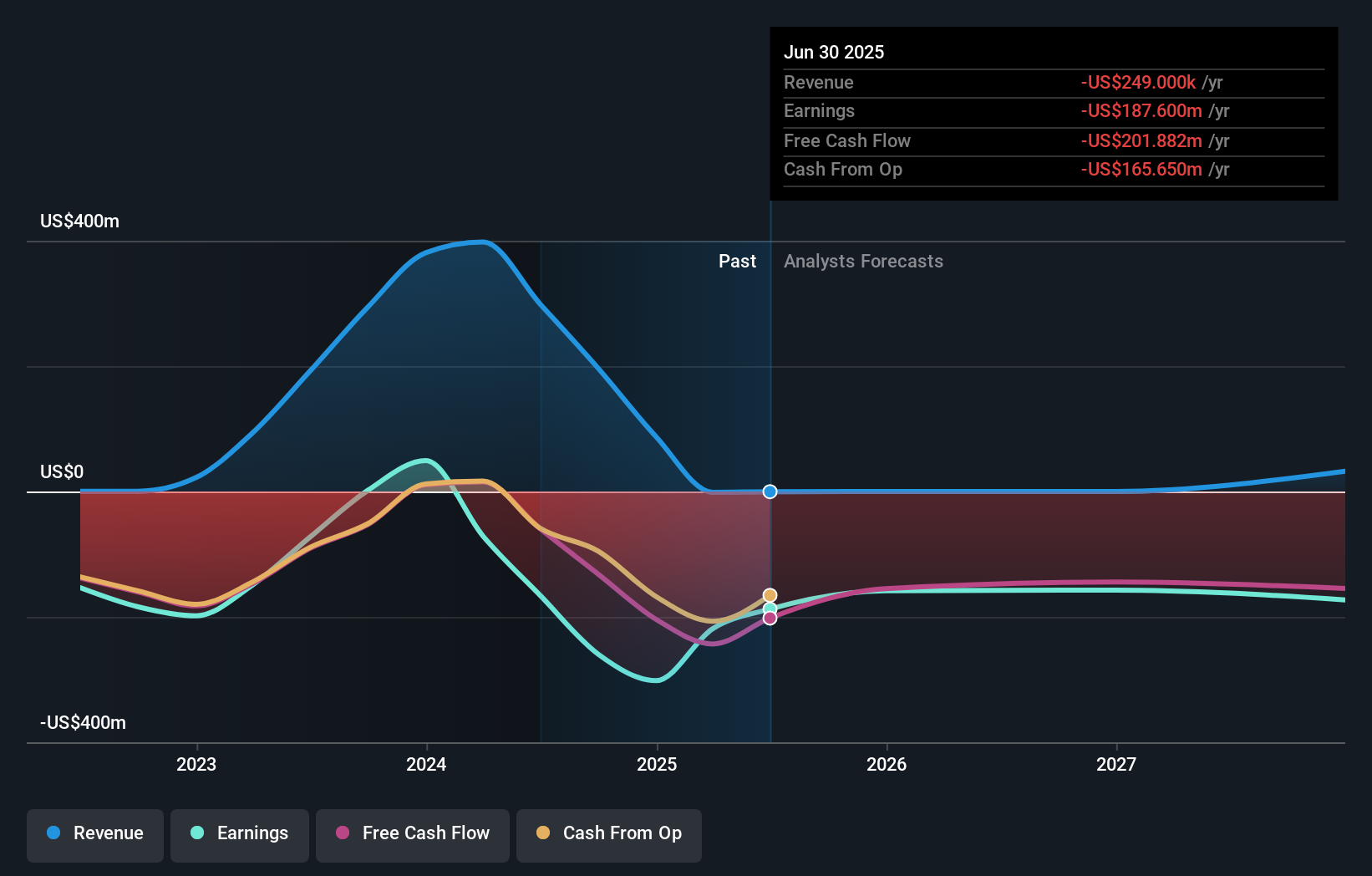

For Amylyx, the big picture an investor needs to buy into is that the company can turn its ALS and metabolic disease pipeline into a sustainable business before its cash and market goodwill wear thin. The fresh Phase 1 LUMINA data for AMX0114, with no treatment-related serious adverse events in the first cohort, modestly improves sentiment around the ALS franchise, but the main near term catalyst still looks to be the Phase 3 LUCIDITY readout for avexitide in post bariatric hypoglycemia, guided for the first half of 2026. Recent equity raises have extended the cash runway, while also diluting shareholders after a very large year to date share price move. The core risks remain: ongoing losses, no meaningful revenue yet, and reliance on clinical success to justify the current valuation.

However, one key funding and dilution risk is easy to miss at first glance. According our valuation report, there's an indication that Amylyx Pharmaceuticals' share price might be on the expensive side.Exploring Other Perspectives

Fair value estimates from 1 Simply Wall St Community member cluster at US$0, showing how far some private investors sit from current pricing. Set against Amylyx’s recent share price surge and persistent losses, these contrasting views underline why it can help to weigh multiple scenarios before forming your own stance on the company’s future.

Build Your Own Amylyx Pharmaceuticals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amylyx Pharmaceuticals research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Amylyx Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amylyx Pharmaceuticals' overall financial health at a glance.

No Opportunity In Amylyx Pharmaceuticals?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报