Does AltaGas’ 2026 Dividend Hike And Strike Resilience Change The Bull Case For AltaGas (TSX:ALA)?

- AltaGas Ltd.’s board has approved a 6% increase to the annual common share dividend to CA$1.34 per share for 2026, with the first quarterly payment of CA$0.334 per share scheduled for March 31, 2026, to shareholders of record on March 16, 2026.

- Alongside this dividend uplift, AltaGas has kept Ridley Island Propane Export Terminal exports running through a labour strike by activating contingency plans and signaling minimal expected financial impact, underlining the resilience of its utility and midstream operations.

- We’ll now examine how the 2026 dividend increase reshapes AltaGas’s investment narrative, especially around cash flow resilience and capital allocation.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

AltaGas Investment Narrative Recap

To own AltaGas, you need to believe in the durability of its mix of regulated utilities and export oriented midstream assets, and in management’s ability to balance dividends, debt and growth capex. The 6% dividend increase for 2026 reinforces a cash return focus, while the limited financial impact expected from the Ridley Island labour strike suggests the near term export operations catalyst and key risk around Western Canada to Asia flows are largely unchanged.

The 2026 dividend uplift sits alongside AltaGas reiterating its 2025 guidance and continuing to invest heavily in utility modernization and LPG export capacity. That combination of higher cash returns and ongoing capital deployment is central to the current investment case, but it also sharpens the importance of monitoring funding costs, payout sustainability and the company’s ability to keep delivering on its export platform.

But behind the growing dividend, investors should be aware of AltaGas’s continued reliance on Western Canadian supply and Asian LPG export demand...

Read the full narrative on AltaGas (it's free!)

AltaGas’ narrative projects CA$14.7 billion revenue and CA$756.5 million earnings by 2028. This requires 4.8% yearly revenue growth and an earnings decrease of about CA$22.5 million from CA$779.0 million today.

Uncover how AltaGas' forecasts yield a CA$46.18 fair value, a 9% upside to its current price.

Exploring Other Perspectives

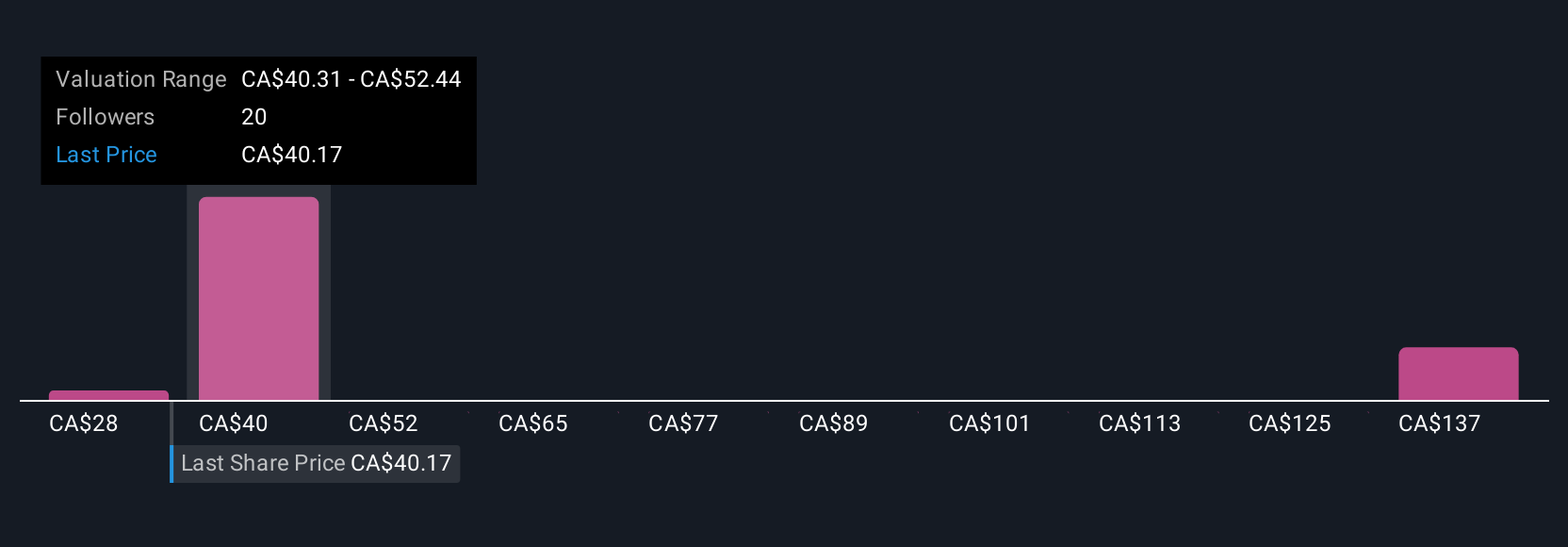

Four members of the Simply Wall St Community currently see AltaGas’s fair value anywhere between CA$35 and about CA$71 per share. Against that wide spread of opinions, the company’s rising dividend commitment and export exposure highlight why it can be useful to weigh several risk and return scenarios before you decide where you stand.

Explore 4 other fair value estimates on AltaGas - why the stock might be worth as much as 69% more than the current price!

Build Your Own AltaGas Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AltaGas research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free AltaGas research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AltaGas' overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报