RB Global (NYSE:RBA): Revisiting Valuation After Revenue Beat and Strong Quarterly Earnings

RB Global (RBA) drew investors’ attention after its latest quarterly earnings, with revenue rising about 11% and topping expectations, and the stock ticking higher as the market digested the stronger profit picture.

See our latest analysis for RB Global.

The latest earnings beat has helped RB Global’s short term share price performance stabilize after a tough few months. A 3 year total shareholder return of 88.16% shows the longer term momentum story remains firmly intact.

If RB Global’s execution has you rethinking what leadership-driven growth can look like, it could be worth exploring fast growing stocks with high insider ownership as your next hunting ground for ideas.

With revenue growth re-accelerating and the share price still sitting below analyst targets and some intrinsic value estimates, is RB Global quietly undervalued today, or is the market already pricing in the next leg of growth?

Most Popular Narrative Narrative: 18.8% Undervalued

With RB Global last closing at $99.63 versus a narrative fair value of $122.70, the most widely followed view sees meaningful upside still on the table.

Analysts are assuming RB Global's revenue will grow by 8.6% annually over the next 3 years. Analysts assume that profit margins will increase from 8.5% today to 16.1% in 3 years time.

Want to see how steady double digit earnings growth and a sharply higher margin profile can still justify a premium future multiple? The full narrative unpacks the exact revenue ramp, profitability shift, and valuation bridge that underpin this target, and why they think the story has further to run.

Result: Fair Value of $122.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat narrative could unravel if macro headwinds keep auction volumes muted or recent acquisitions fail to deliver the expected synergies.

Find out about the key risks to this RB Global narrative.

Another Lens On Valuation

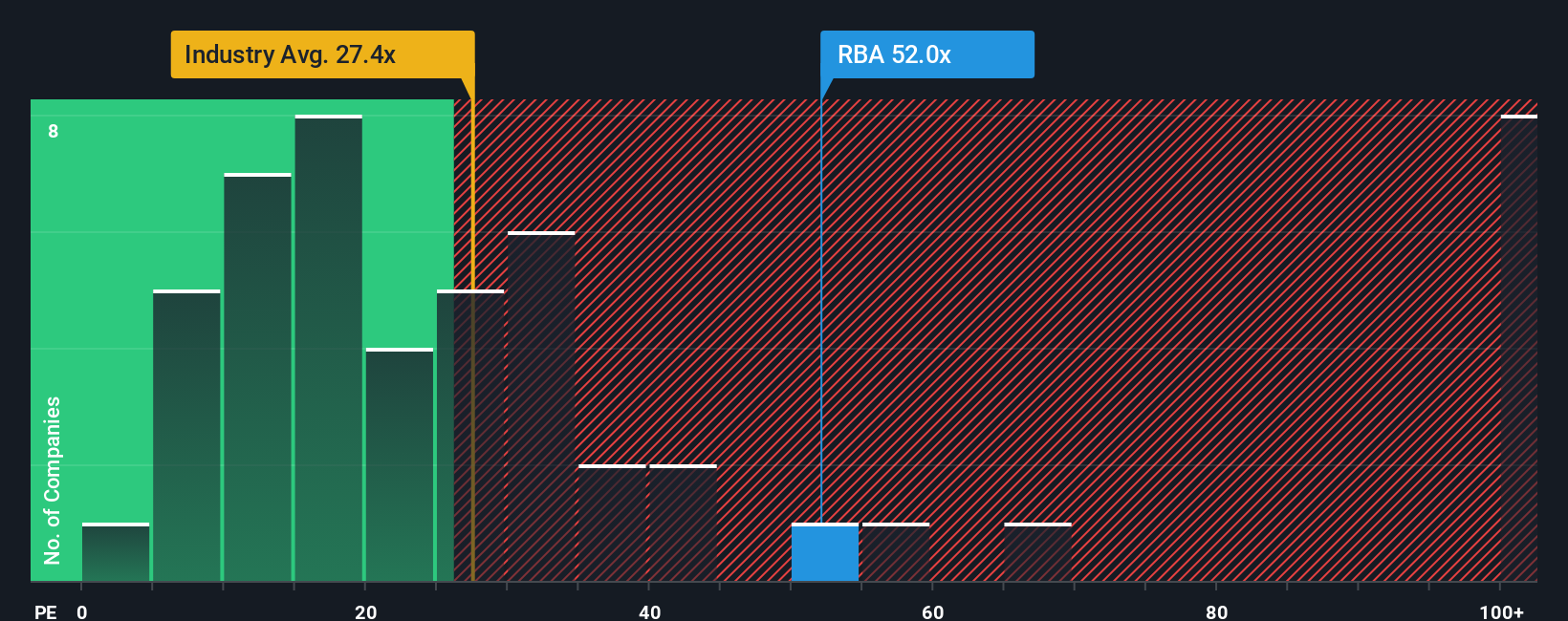

Price action and narratives suggest RB Global is attractive, but its 47.3x earnings multiple versus a 23.1x industry average and a 33.6x fair ratio indicate the stock is richly priced. If sentiment cools and the market gravitates toward that fair ratio, how much downside are investors really carrying?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RB Global Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft a personalized take in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding RB Global.

Looking for more investment ideas?

Before markets move on without you, put Simply Wall Street’s screener to work and line up your next set of high conviction opportunities in minutes.

- Capture potential mispricings by targeting companies trading below their intrinsic worth using these 905 undervalued stocks based on cash flows, and position yourself ahead of sentiment shifts.

- Capitalize on the AI transformation by filtering for innovators powering automation and intelligent software through these 26 AI penny stocks before the crowd chases them.

- Focus on reliable income streams by reviewing quality businesses with attractive payouts via these 15 dividend stocks with yields > 3%, so your portfolio keeps working even when prices stall.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报