How ICBC’s 2025 Interim Dividend Plan Will Impact Industrial and Commercial Bank of China (SEHK:1398) Investors

- Industrial and Commercial Bank of China’s 2025 interim profit distribution plan was approved at the Second Extraordinary Shareholders’ Meeting, confirming a pre-tax cash dividend of RMB 1.414 per 10 shares for investors on the register after trading closed on 12 December 2025, with A-share payments on 15 December 2025 and H-share payments on 26 January 2026.

- The option for H-share holders to receive the dividend in either RMB or HK$ and the use of a defined RMB/HK$ reference rate underlines the bank’s cross-border focus and flexibility in rewarding both mainland and international investors.

- Next, we will examine how this confirmed interim cash dividend and distribution timetable influences Industrial and Commercial Bank of China’s broader investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Industrial and Commercial Bank of China Investment Narrative Recap

To own Industrial and Commercial Bank of China, you need to be comfortable with a large, policy-influenced lender where earnings are closely tied to domestic credit conditions and regulation, while dividends form a key part of the return. The approval of the 2025 interim dividend clarifies near term cash returns but does not materially change the most important short term catalyst, which remains how net interest margins and loan quality evolve, or the key risk from ongoing pressure on profitability.

The interim dividend decision sits alongside recent board changes, including the retirement of non executive director Lu Yongzhen at the end of his term, which comes as ICBC’s relatively new board and management team are still bedding in. For investors watching catalysts, the combination of confirmed cash payouts and continued board refresh highlights both the appeal of current income and the execution risk if returns are squeezed by policy driven lending and low rate conditions.

Yet investors should also be aware that if net interest margins stay under pressure for longer, then...

Read the full narrative on Industrial and Commercial Bank of China (it's free!)

Industrial and Commercial Bank of China's narrative projects CN¥937.1 billion revenue and CN¥386.4 billion earnings by 2028. This requires 12.1% yearly revenue growth and an earnings increase of about CN¥37.9 billion from CN¥348.5 billion today.

Uncover how Industrial and Commercial Bank of China's forecasts yield a HK$7.14 fair value, a 13% upside to its current price.

Exploring Other Perspectives

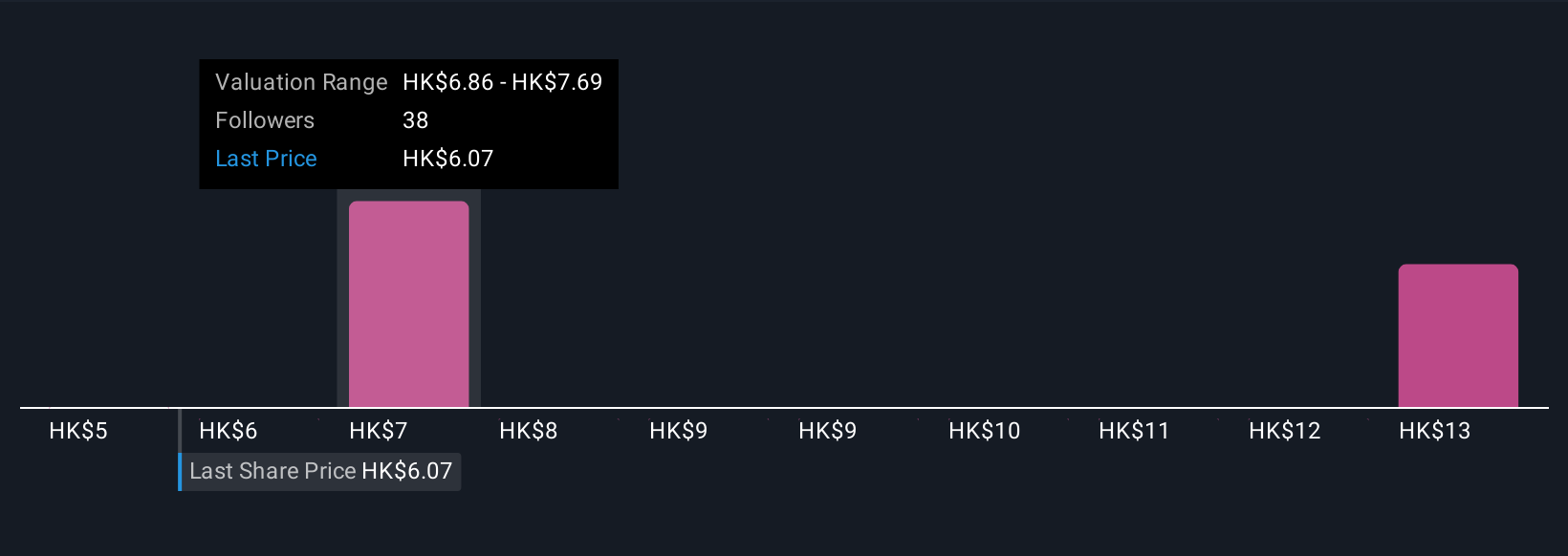

Seven members of the Simply Wall St Community currently estimate ICBC’s fair value between HK$5.21 and HK$13.95, showing wide disagreement on upside potential. When you set those views against the structural risk of persistent net interest margin compression, it underlines why many investors look at several perspectives before deciding how ICBC might fit into their portfolio.

Explore 7 other fair value estimates on Industrial and Commercial Bank of China - why the stock might be worth 18% less than the current price!

Build Your Own Industrial and Commercial Bank of China Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Industrial and Commercial Bank of China research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Industrial and Commercial Bank of China research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Industrial and Commercial Bank of China's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报