Exploring Three High Growth Tech Stocks in Asia

As global markets navigate a complex economic landscape, with the Nasdaq Composite and small-cap Russell 2000 Index showing gains amid hopes for interest rate cuts, Asia's tech sector continues to capture investor attention. In this environment, identifying high-growth tech stocks involves looking at companies that demonstrate resilience and innovation in response to shifting market dynamics and economic indicators.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Suzhou TFC Optical Communication | 35.80% | 36.87% | ★★★★★★ |

| Zhongji Innolight | 34.82% | 35.50% | ★★★★★★ |

| Fositek | 37.53% | 50.53% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

Essex Bio-Technology (SEHK:1061)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Essex Bio-Technology Limited is an investment holding company that develops, manufactures, and sells biologic drugs in China, Hong Kong, and internationally with a market capitalization of approximately HK$2.26 billion.

Operations: The company generates revenue primarily from its Surgical and Ophthalmology segments, contributing HK$884.30 million and HK$811.46 million respectively, with a smaller portion from the Provision of Services at HK$22.05 million.

Essex Bio-Technology's inclusion in the S&P Global BMI Index underscores its rising prominence in the biotech sector. With revenue growth at 11.5% annually, surpassing Hong Kong's market average of 8.5%, and earnings expanding by 19.1% last year—well above the industry's -4.1%—the company demonstrates robust financial health. Its R&D commitment, crucial for sustaining innovation and competitive edge, aligns with an impressive forecasted annual earnings growth of 13.7%, outpacing the local market prediction of 12.1%. This strategic focus on research not only fuels Essex’s growth but also enhances its standing in high-growth tech markets across Asia, promising a bright outlook despite not being the fastest-growing entity in its class.

Olympic Circuit Technology (SHSE:603920)

Simply Wall St Growth Rating: ★★★★☆☆

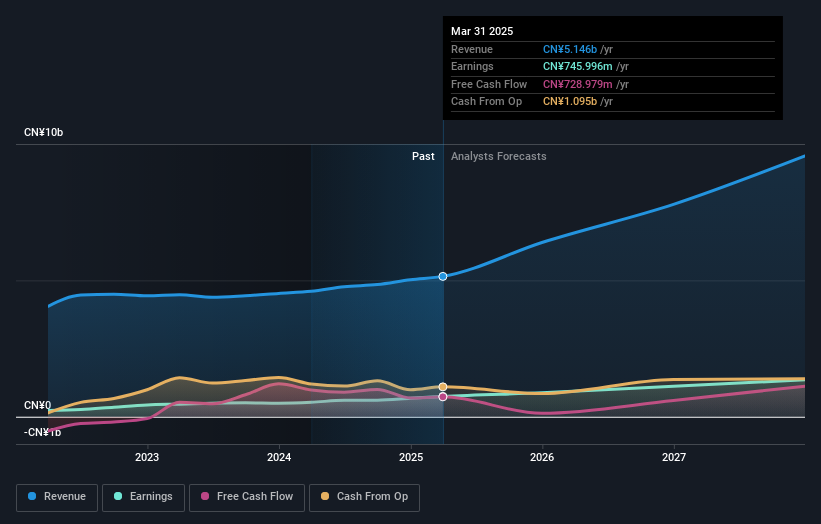

Overview: Olympic Circuit Technology Co., Ltd engages in the research, development, manufacture, and sales of printed circuit boards (PCBs) both in China and internationally, with a market cap of approximately CN¥29.60 billion.

Operations: The company generates revenue primarily through the sale of electronic components and parts, amounting to CN¥5.42 billion.

Olympic Circuit Technology has demonstrated remarkable financial performance with a 25.9% annual revenue growth, outpacing the Chinese market average of 14.4%. This growth is supported by a significant increase in earnings, up 35.3% over the past year, which exceeds the electronic industry's average of 9%. The company's commitment to innovation is evident from its R&D investments, aligning with its strategic goals and supporting sustained competitive advantage in a rapidly evolving tech landscape. Recent events such as their successful Q3 earnings report with revenues hitting CNY 4.08 billion and net income at CNY 625.15 million underscore their robust operational execution and market confidence.

Beijing Labtech Instruments (SHSE:688056)

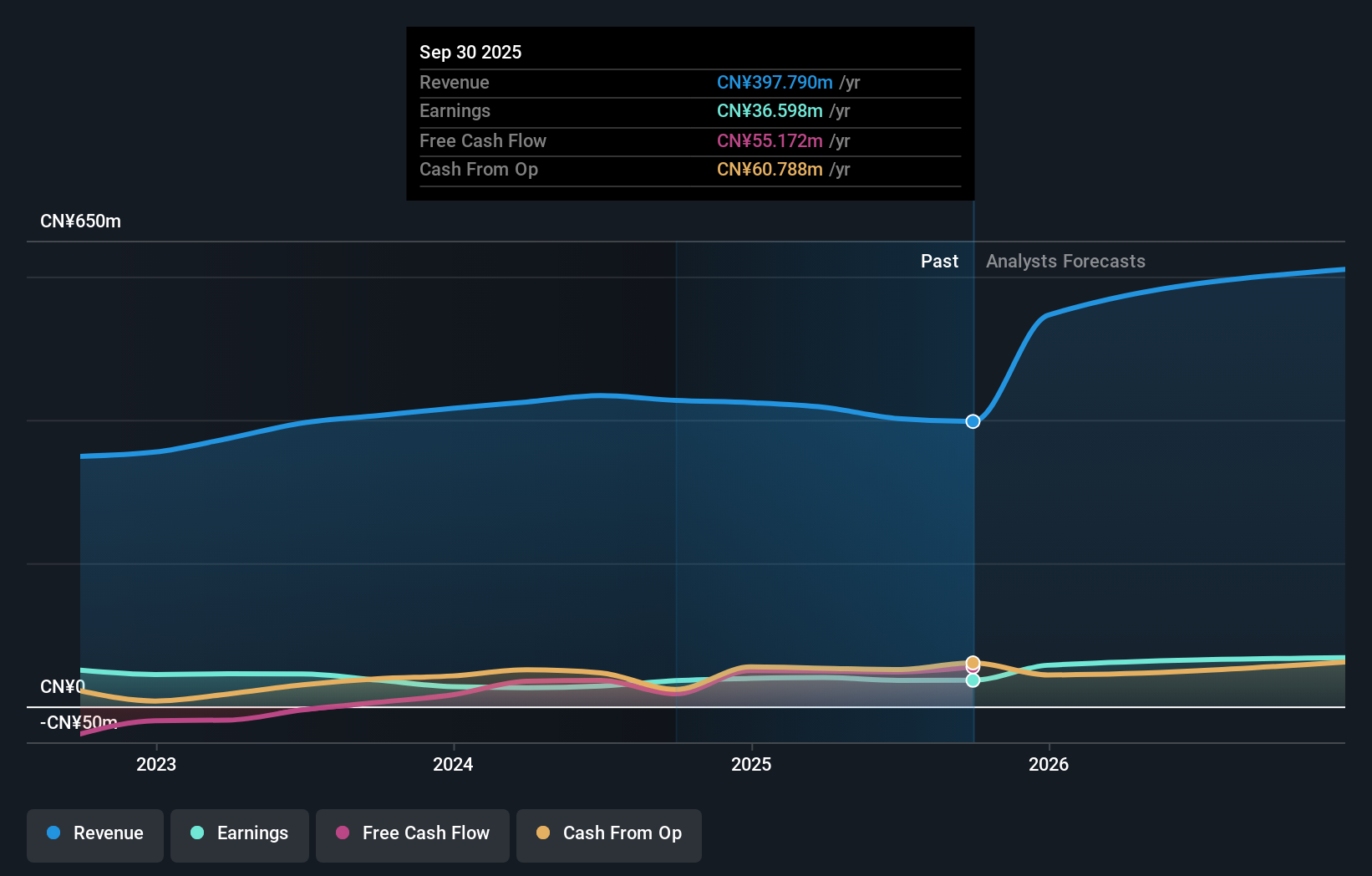

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Labtech Instruments Co., Ltd. manufactures and supplies laboratory products and solutions globally, with a market cap of CN¥2.34 billion.

Operations: The company generates revenue primarily through the sale of laboratory products and solutions on a global scale. It focuses on providing comprehensive offerings to the laboratory industry, contributing to its market presence.

Despite a slight dip in recent earnings, Beijing Labtech Instruments remains a compelling narrative in Asia's high-growth tech sector. With an impressive annual revenue growth forecast at 27%, the company significantly outpaces China's market average of 14.4%. This growth is complemented by an even more robust earnings projection, expected to surge by 39.1% annually. The firm’s strategic moves, including the recent share transfer agreement with Qingdao Innovation Investment, underscore its proactive approach to capitalizing on market opportunities and enhancing shareholder value. These elements collectively highlight Beijing Labtech Instruments' potential to leverage technological advancements and market dynamics effectively.

- Click here and access our complete health analysis report to understand the dynamics of Beijing Labtech Instruments.

Understand Beijing Labtech Instruments' track record by examining our Past report.

Next Steps

- Get an in-depth perspective on all 187 Asian High Growth Tech and AI Stocks by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报