What Encore Capital Group (ECPG)'s Q3 Earnings Beat and Insider Sale Mean For Shareholders

- In early December 2025, Encore Capital Group reported third quarter 2025 earnings per share that significantly beat market expectations, powered by stronger-than-anticipated collections, while Director Olle Laura completed a prearranged sale of 1,423 shares under a Rule 10b5-1 trading plan.

- The results spotlight how Encore’s collection performance is outpacing assumptions, reinforcing the importance of its operational execution and analytics-driven recovery model for investors.

- Next, we’ll examine how Encore’s stronger-than-expected collections performance fits into, and potentially reshapes, the existing investment narrative around the stock.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Encore Capital Group Investment Narrative Recap

To own Encore Capital Group, you need to believe its collections engine can keep converting charged off consumer debt into solid cash flow despite regulatory and funding headwinds. The latest earnings beat confirms collections are running ahead of expectations, but it does not remove the near term risk that tighter credit conditions or higher funding costs could pressure margins if capital markets become less accommodating.

Encore’s recent decision to issue US$500.0 million of 6.625% Senior Secured Notes due 2031, and the planned redemption of EUR 100 million of existing notes, ties directly into this story, because it highlights how dependent the model is on consistent, affordable access to debt financing to support portfolio purchases and benefit from stronger collections.

Yet even with collections surprising on the upside, investors should be aware of how rising interest expense and future borrowing conditions could...

Read the full narrative on Encore Capital Group (it's free!)

Encore Capital Group's narrative projects $2.1 billion revenue and $838.0 million earnings by 2028. This requires 11.8% yearly revenue growth and a $927.1 million earnings increase from -$89.1 million today.

Uncover how Encore Capital Group's forecasts yield a $60.25 fair value, a 14% upside to its current price.

Exploring Other Perspectives

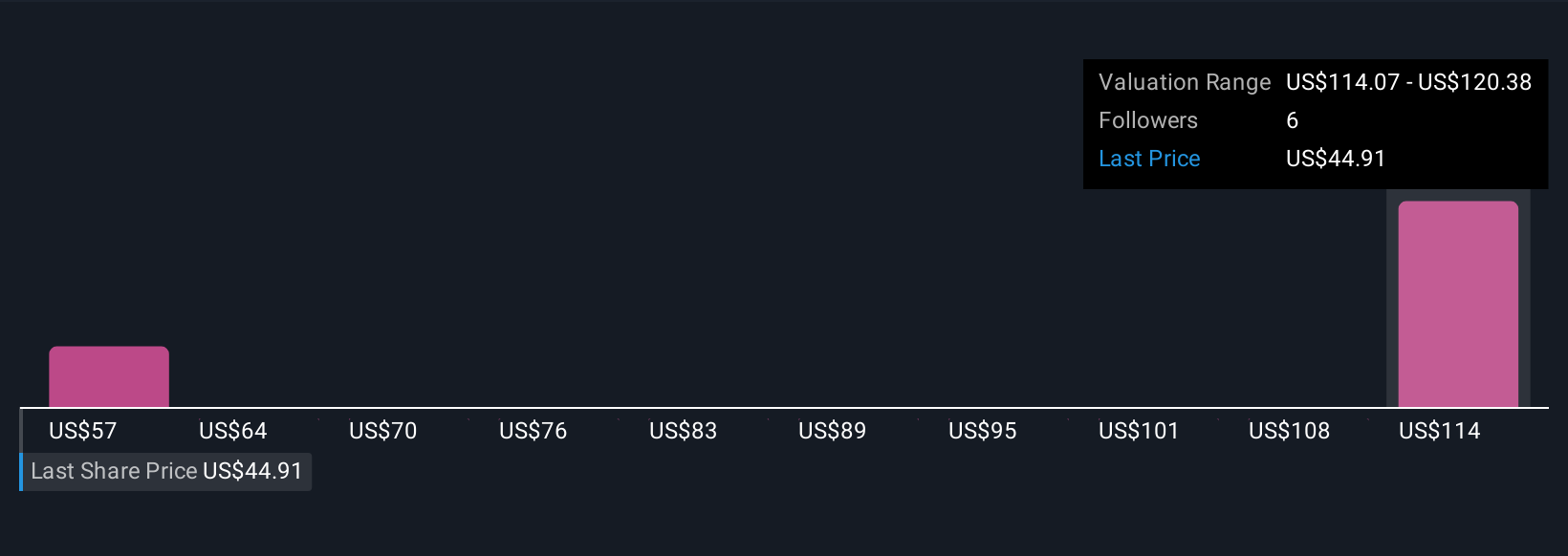

Simply Wall St Community members have only two fair value estimates for Encore, stretching from US$60.25 to US$120.38, showing just how far apart individual views can be. Against this backdrop, Encore’s reliance on capital markets for funding collections growth becomes a central issue for anyone weighing these contrasting expectations about its future performance, so it is worth looking at several perspectives before deciding what you think.

Explore 2 other fair value estimates on Encore Capital Group - why the stock might be worth over 2x more than the current price!

Build Your Own Encore Capital Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Encore Capital Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Encore Capital Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Encore Capital Group's overall financial health at a glance.

No Opportunity In Encore Capital Group?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报