How Investors Are Reacting To Jiangsu Expressway (SEHK:177) Abolishing Its Supervisory Committee And Revamping Governance

- Jiangsu Expressway Company Limited has announced plans, ahead of its 18 December 2025 EGM, to abolish its Supervisory Committee and amend its Articles of Association, marking a significant shift in its corporate governance structure.

- This move is drawing attention because reconfiguring oversight mechanisms can alter how investors assess accountability, control, and long‑term governance quality at the company.

- We will now examine how the proposed abolition of the Supervisory Committee could reshape Jiangsu Expressway’s investment narrative and risk profile.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Jiangsu Expressway's Investment Narrative?

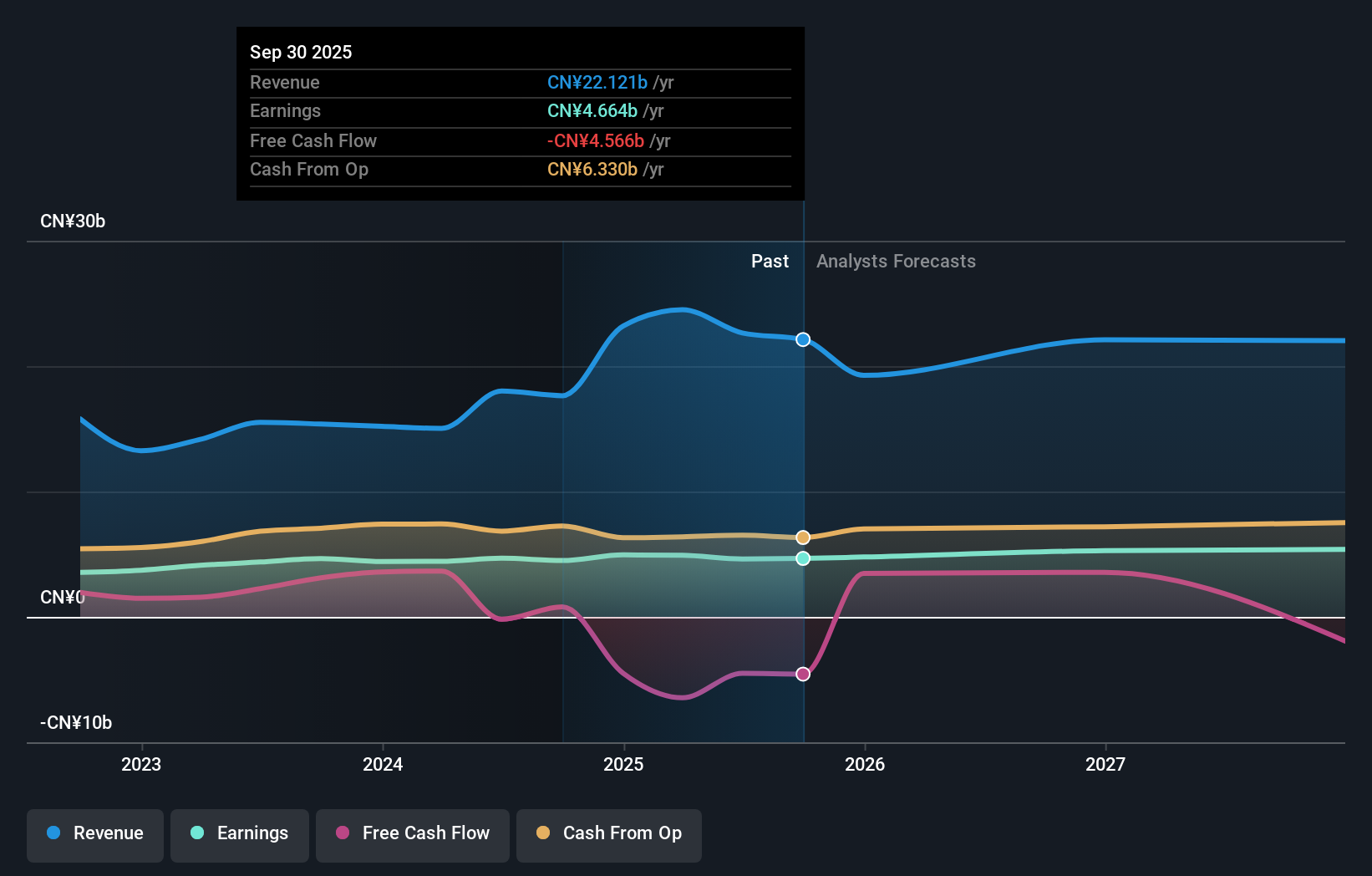

To own Jiangsu Expressway, you need to be comfortable with a relatively steady, lower‑growth toll‑road business that has historically coupled consistent earnings with a high dividend payout. Short term, the key catalysts still look operational rather than structural: traffic volumes, tariff adjustments, and how comfortably dividends sit against cash flows and debt coverage. Recent results show solid profitability, but margins have eased and free cash flow coverage of the dividend is tighter, which keeps balance sheet discipline front of mind. Against that backdrop, the proposal to abolish the Supervisory Committee is more about governance optics than immediate earnings, and the share price reaction so far suggests the market sees limited near term financial impact. Where it may matter is in how investors judge longer term oversight and board accountability.

However, this governance overhaul introduces an oversight risk you probably want to understand better. Jiangsu Expressway's shares have been on the rise but are still potentially undervalued by 15%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Jiangsu Expressway - why the stock might be worth just HK$12.04!

Build Your Own Jiangsu Expressway Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jiangsu Expressway research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Jiangsu Expressway research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jiangsu Expressway's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报