Sonos' Earnings Miss and Buybacks Could Be A Game Changer For Sonos (SONO)

- Earlier this week, Sonos reported its fourth-quarter fiscal 2025 results, posting a non-GAAP loss per share that missed analyst expectations even as revenue landed near the top of its own guidance range.

- The company emphasized ongoing cost optimization that has lowered operating expenses, committed US$20,000,000 to share repurchases in the quarter with US$130,000,000 still authorized, and projected fiscal first-quarter 2026 revenue of US$510,000,000 to US$560,000,000 alongside gross margin expansion and about 27% adjusted EBITDA growth.

- Next, we’ll examine how Sonos’s earnings miss but optimistic margin and EBITDA guidance could reshape its investment narrative and outlook.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Sonos Investment Narrative Recap

To own Sonos, you need to believe its premium, software-enhanced audio ecosystem can translate into durable revenue and margin improvement, even through a hardware lull and weak home electronics demand. The latest quarter’s earnings miss does not materially change that near term, but guidance for higher gross margins and adjusted EBITDA puts more pressure on management to show that cost cuts are strengthening, not hollowing out, the business.

The most relevant update here is Sonos’s guidance for fiscal first quarter 2026, which calls for US$510,000,000 to US$560,000,000 in revenue and roughly 27% adjusted EBITDA growth. For investors focused on catalysts, that outlook ties directly to the company’s cost base transformation and will likely be a key test of whether Sonos can grow profitability even before the next major hardware cycle arrives.

But while the margin story is encouraging, investors should be aware that...

Read the full narrative on Sonos (it's free!)

Sonos' narrative projects $1.6 billion revenue and $120.2 million earnings by 2028.

Uncover how Sonos' forecasts yield a $17.85 fair value, a 7% downside to its current price.

Exploring Other Perspectives

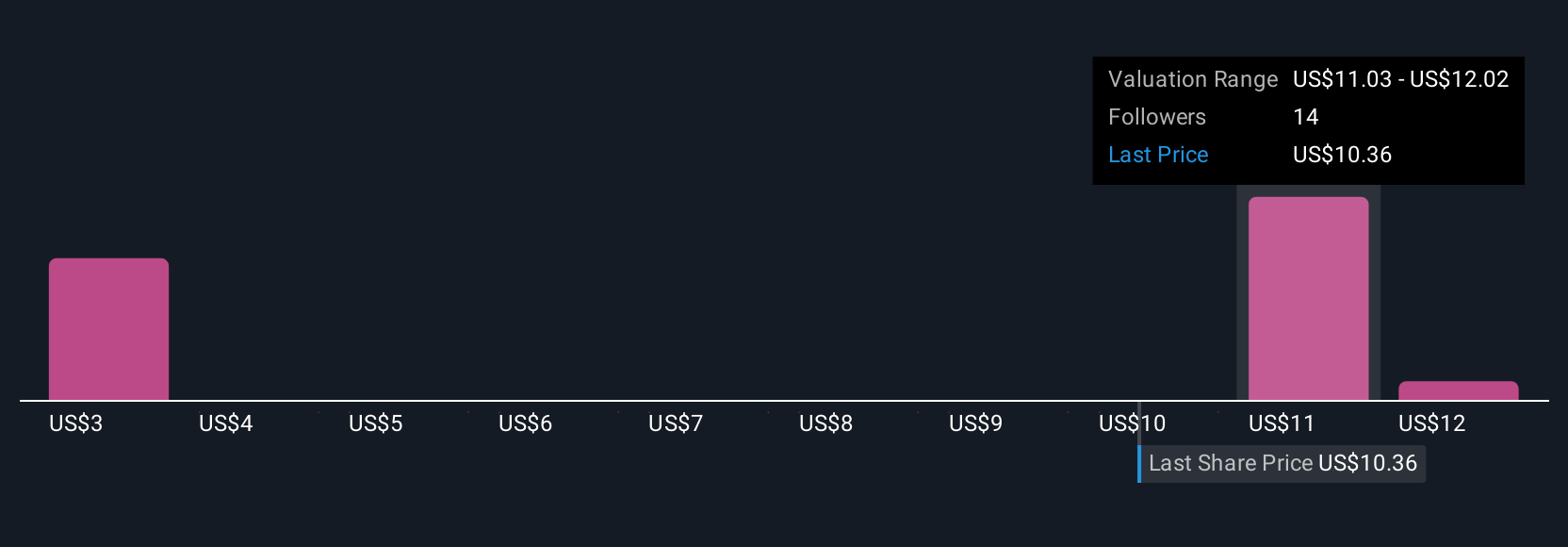

Four fair value estimates from the Simply Wall St Community span roughly US$6.23 to US$17.85 per share, underscoring how differently investors can view Sonos. Against that backdrop, the company’s plan for gross margin expansion and adjusted EBITDA growth puts execution risk front and center, which you may want to weigh alongside those varied opinions.

Explore 4 other fair value estimates on Sonos - why the stock might be worth as much as $17.85!

Build Your Own Sonos Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free Sonos research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sonos' overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报