How Investors May Respond To Lemonade (LMND) Cutting Reinsurance To Pursue 2026 Profitability Goals

- Earlier this month, Lemonade, Inc. raised its full-year 2025 guidance for in-force premiums and revenue and reiterated its goal of achieving EBITDA profitability by 2026, while also cutting its quota-share reinsurance dependence from 55% to 20% to retain more premium on its own balance sheet.

- This shift toward lower reinsurance use signals growing confidence in Lemonade’s AI-driven risk models and capital position, potentially amplifying both its growth prospects and exposure to insurance loss volatility.

- We’ll now examine how Lemonade’s reduced reinsurance reliance may reshape its investment narrative around growth, risk, and profitability.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Lemonade Investment Narrative Recap

To own Lemonade, you need to believe its AI-driven insurance model can convert rapid top line growth into sustainable profitability without excessive risk. The latest guidance hike and move to retain more premiums reinforce the near term EBITDA profitability goal, but they also sharpen the biggest current risk: higher exposure to claims volatility as reinsurance protection shrinks.

Among recent developments, the cut in quota share reinsurance from 55% to 20% stands out as most relevant. It directly ties to the raised 2025 in force premium and revenue guidance, potentially strengthening the growth catalyst while increasing sensitivity to large loss events that could affect the timing and consistency of progress toward EBITDA breakeven.

But investors should also weigh how this reduced reinsurance buffer could affect results if claims trends turn out to be more volatile than...

Read the full narrative on Lemonade (it's free!)

Lemonade's narrative projects $1.8 billion revenue and $201.4 million earnings by 2028.

Uncover how Lemonade's forecasts yield a $57.00 fair value, a 28% downside to its current price.

Exploring Other Perspectives

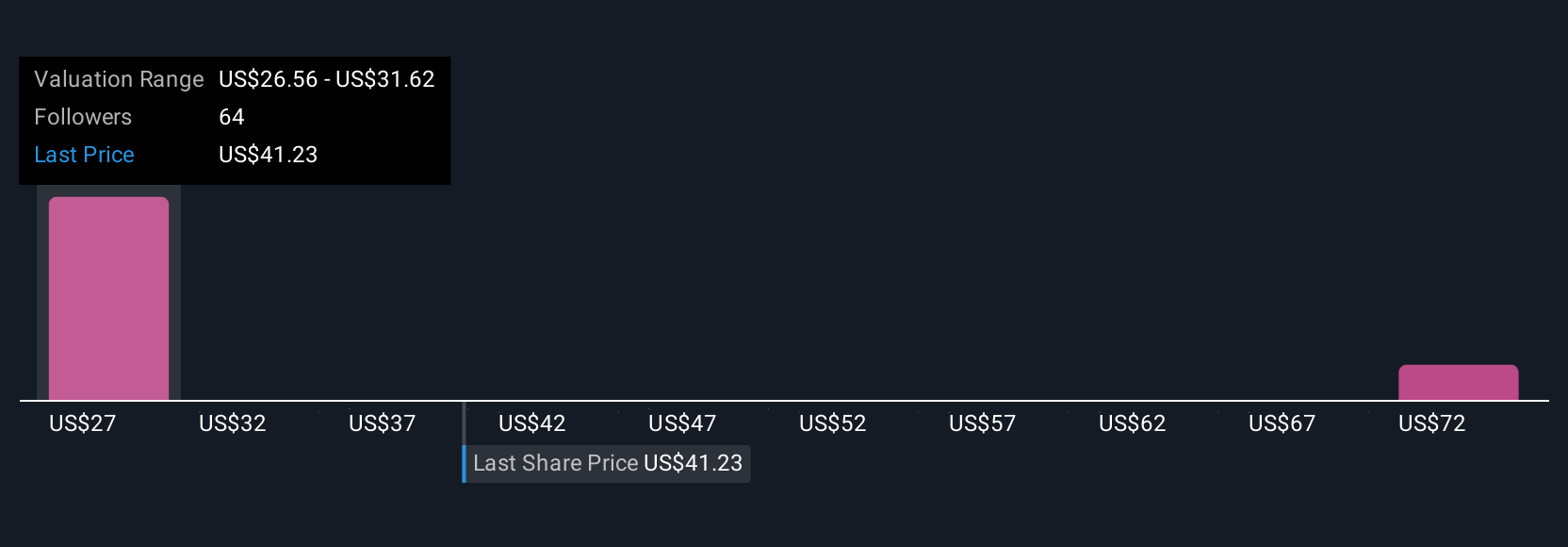

Ten fair value estimates from the Simply Wall St Community span roughly US$23 to US$60 per share, showing a wide spread of expectations. Against that backdrop, Lemonade’s reduced reliance on reinsurance heightens the importance of understanding how claims volatility might influence its path to profitability, so you may want to compare several viewpoints before forming your own view.

Explore 10 other fair value estimates on Lemonade - why the stock might be worth less than half the current price!

Build Your Own Lemonade Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lemonade research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Lemonade research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lemonade's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报