Why SoFi Technologies (SOFI) Is Down 6.5% After a US$1.5 Billion Stock Offering - And What's Next

- In early December 2025, SoFi Technologies completed a US$1.5 billion follow-on common stock offering of 54,545,454 shares at US$27.50 each, with a US$0.27 per-share discount, led by a syndicate including Goldman Sachs, Citigroup, BofA Securities, Deutsche Bank, and Mizuho.

- The cash raise, coming after a period of strong member growth and expanding fee-based businesses, has sharpened investor focus on how SoFi will deploy this new capital against dilution concerns and questions about its longer-term growth mix.

- We’ll now examine how this US$1.5 billion equity raise and resulting dilution reshapes SoFi’s investment narrative and risk-reward profile.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

SoFi Technologies Investment Narrative Recap

To own SoFi today, you have to believe its transition from a lender to a diversified, capital-light digital finance platform continues to support profitable growth, even as expectations run high and the stock trades at a premium. The US$1.5 billion equity raise and roughly 4% dilution do not change the core thesis, but they sharpen attention on how effectively management converts this larger capital base into earnings per share and whether enthusiasm around potential index inclusion remains the key near term catalyst versus dilution and valuation as the main risks.

The recent equity offering sits alongside SoFi’s push into newer fee-based lines like crypto trading, blockchain-enabled remittances and broader digital banking services discussed at its UBS Global Technology and AI Conference appearance, all of which are central to the idea that SoFi can grow higher margin, capital-light revenue faster than its lending book. How well these newer businesses scale from here, relative to the dilution and already elevated expectations, will likely do a lot to determine whether the stock’s recent rerating can be sustained or if investors begin to question the growth mix and return profile of each incremental dollar of equity capital.

But investors should also be aware that if growth in these capital-light businesses falls short of what the share price now implies, then...

Read the full narrative on SoFi Technologies (it's free!)

SoFi Technologies’ narrative projects $5.1 billion revenue and $954.1 million earnings by 2028.

Uncover how SoFi Technologies' forecasts yield a $27.15 fair value, in line with its current price.

Exploring Other Perspectives

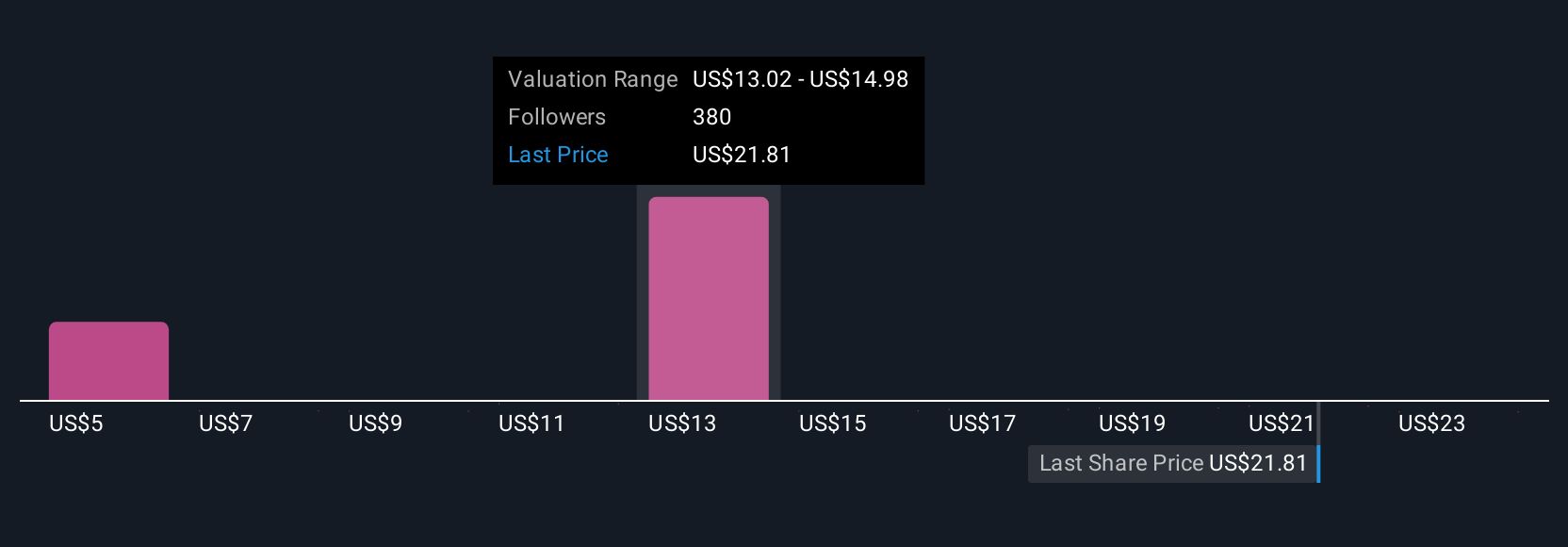

Fifty seven fair value estimates from the Simply Wall St Community span roughly US$9.49 to US$30.19, showing a wide spread of opinions on SoFi. Against that backdrop, SoFi’s fresh US$1.5 billion share sale and related dilution risk give you a concrete reason to compare those differing views and consider how much future growth in fee based businesses you think is realistic.

Explore 57 other fair value estimates on SoFi Technologies - why the stock might be worth as much as 9% more than the current price!

Build Your Own SoFi Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SoFi Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free SoFi Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SoFi Technologies' overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报