What Do Director Insider Buys Reveal About Alumis’ (ALMS) Long-Term Alignment With Shareholders?

- Earlier in December, Alumis Inc director Srinivas Akkaraju bought roughly US$2,000,000 of common stock across three transactions, increasing his indirect holdings via Samsara Opportunity Fund and Samsara BioCapital, L.P.

- This cluster of insider purchases adds a fresh data point for investors watching how management’s own capital aligns with Alumis’s long-term outlook.

- With insider buying by a key director in focus, we’ll explore how this activity shapes Alumis’s investment narrative for shareholders.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Alumis' Investment Narrative?

To own Alumis, you need to be comfortable backing an early-stage, loss-making biotech that is spending heavily to advance its autoimmune pipeline, particularly ESK-001 and its broader TYK2 franchise, while relying on future clinical and partnership milestones rather than current earnings. The short term story hinges on clinical readouts, the ramp-up of the Phase 3 ONWARD program, progress in SLE, and how the Kaken deal translates into non-dilutive funding, all against a backdrop of a limited cash runway and rising losses. The recent US$2,000,000 insider buying by director Srinivas Akkaraju adds conviction around that roadmap, but it does not change the fundamental risks of ongoing cash burn, potential dilution, and execution pressure after a very large recent share price move.

However, investors should be aware of how the short cash runway might influence future dilution risk. The analysis detailed in our Alumis valuation report hints at an inflated share price compared to its estimated value.Exploring Other Perspectives

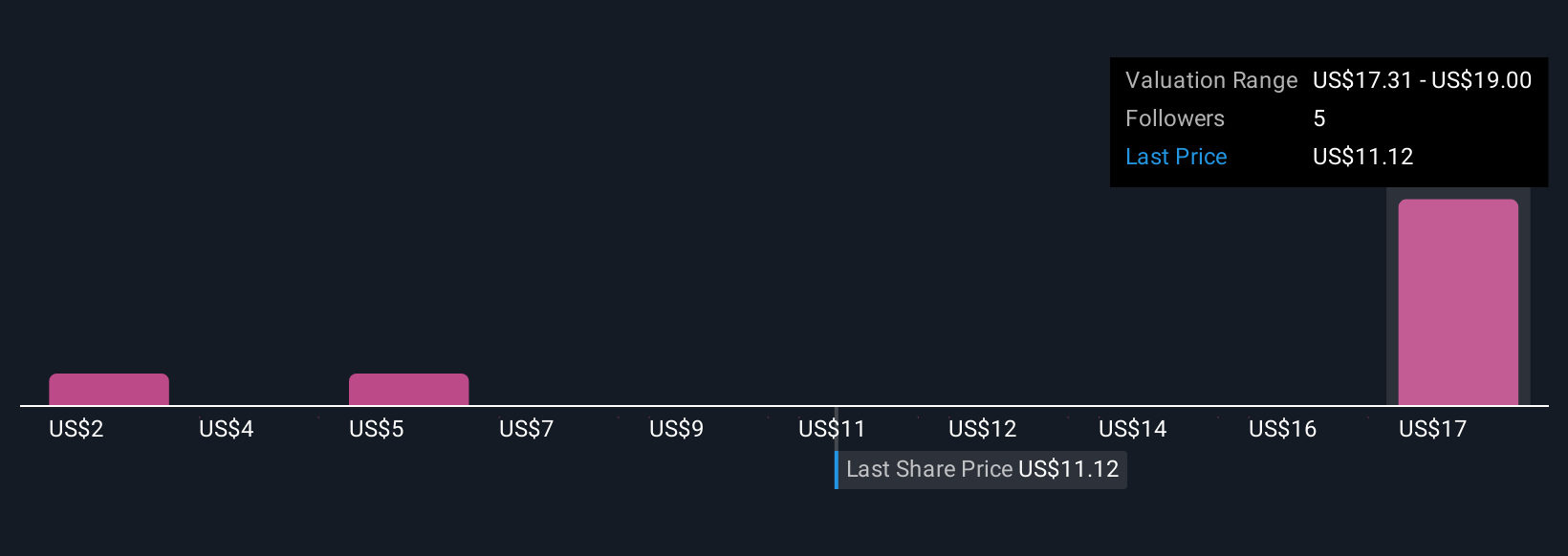

Simply Wall St Community members put Alumis’ fair value anywhere between roughly US$2 and US$19 across three independent views, underlining how widely opinions diverge. Set against that backdrop, the combination of rapid revenue growth expectations, persistent losses and a short cash runway gives these differing views real consequences for how you might think about the company’s future performance.

Explore 3 other fair value estimates on Alumis - why the stock might be worth less than half the current price!

Build Your Own Alumis Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alumis research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free Alumis research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alumis' overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报