How Investors Are Reacting To Dutch Bros (BROS) Raised 2025 Guidance And Strong Same-Store Sales

- Dutch Bros recently reported robust third-quarter 2025 results, including revenue growth of 25% year over year and system-wide same-store sales growth of 5.7%, and raised its 2025 revenue guidance while continuing to expand its U.S. store footprint and digital platform.

- These developments, alongside an ongoing food program rollout and enhanced Order Ahead adoption, have prompted upbeat analyst commentary that emphasizes Dutch Bros’ execution on transaction growth, margins, and long-term unit expansion.

- We’ll now examine how Dutch Bros’ raised 2025 revenue guidance and strong same-store sales performance affect its existing investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Dutch Bros Investment Narrative Recap

To own Dutch Bros, you need to believe it can keep growing shops and transactions fast enough to offset wage pressure and expansion costs. The latest Q3 2025 beat, higher 2025 revenue guidance, and same-store sales strength support that near term catalyst, while the biggest risk remains whether rapid unit growth can avoid market saturation and margin strain. Recent analyst target hikes mainly reflect existing trends rather than changing the core risk‑reward profile in a material way.

Among recent updates, Dutch Bros’ focus on its Order Ahead platform stands out as most relevant. Order Ahead accounted for 13% of Q3 2025 transactions, helping lift transactions 4.7% and same‑shop sales 5.7%. That digital traction directly ties into the key short term catalyst of sustaining same-store sales growth, which is critical as the company continues to open new units at a brisk pace.

Yet, even with solid recent execution, investors should be aware of how quickly aggressive unit growth could start to...

Read the full narrative on Dutch Bros (it's free!)

Dutch Bros' narrative projects $2.6 billion revenue and $197.4 million earnings by 2028. This requires 21.8% yearly revenue growth and about $140 million earnings increase from $57.2 million today.

Uncover how Dutch Bros' forecasts yield a $75.61 fair value, a 29% upside to its current price.

Exploring Other Perspectives

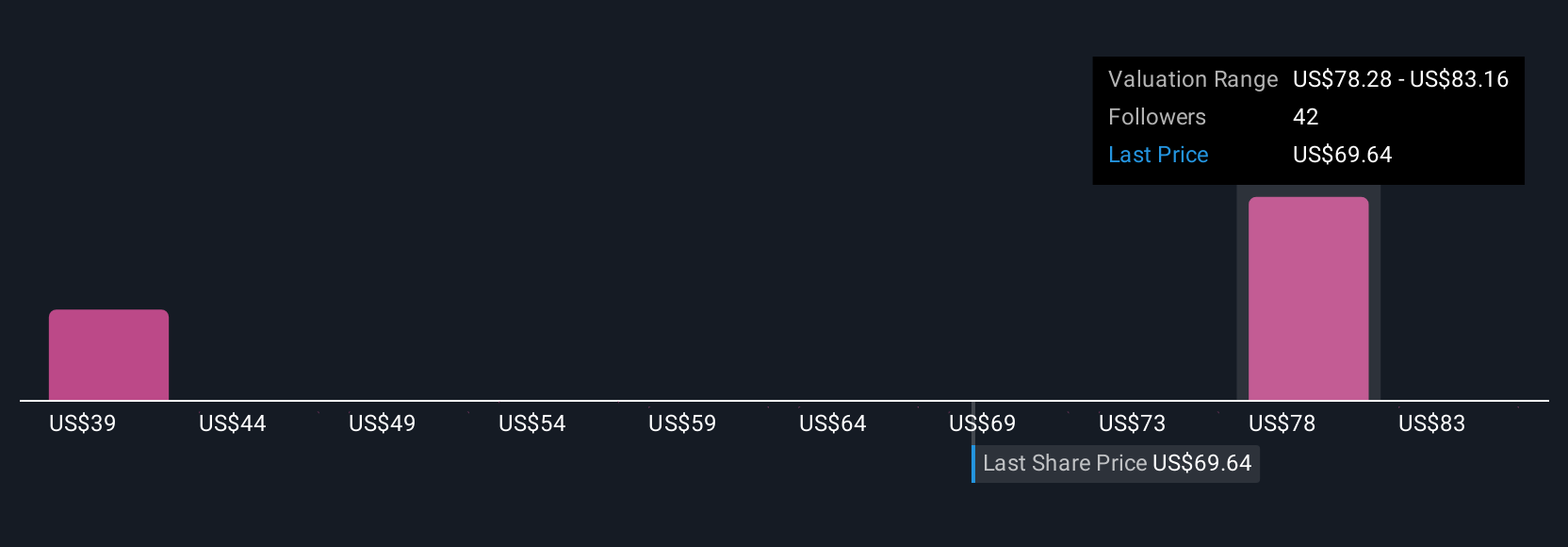

Nine Simply Wall St Community valuations span roughly US$46.8 to US$85 per share, underscoring how far apart individual views can be. Against that backdrop, Dutch Bros’ rapid shop expansion and reliance on sustained same-store sales growth give you several different scenarios for how future performance might unfold.

Explore 9 other fair value estimates on Dutch Bros - why the stock might be worth 20% less than the current price!

Build Your Own Dutch Bros Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dutch Bros research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dutch Bros research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dutch Bros' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报