Does New Dravet Data for Zorevunersen Strengthen the Bull Case for Stoke Therapeutics (STOK)?

- Stoke Therapeutics and Biogen recently reported long-term Phase 1/2a and open-label extension data at the 2025 American Epilepsy Society meeting, showing durable seizure reductions and better cognition, behavior, and quality of life in Dravet syndrome patients treated with investigational antisense oligonucleotide zorevunersen alongside standard anti-seizure medicines.

- A propensity score weighted comparison with the ONTERFLY natural history cohort, along with EEG evidence of dose-dependent reductions in abnormal brain activity, strengthens the case that zorevunersen may act as a disease-modifying therapy targeting NaV1.1 protein production via the SCN1A gene.

- Next, we’ll examine how this emerging disease-modifying profile for zorevunersen shapes Stoke Therapeutics’ investment narrative and long-term opportunity set.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Stoke Therapeutics' Investment Narrative?

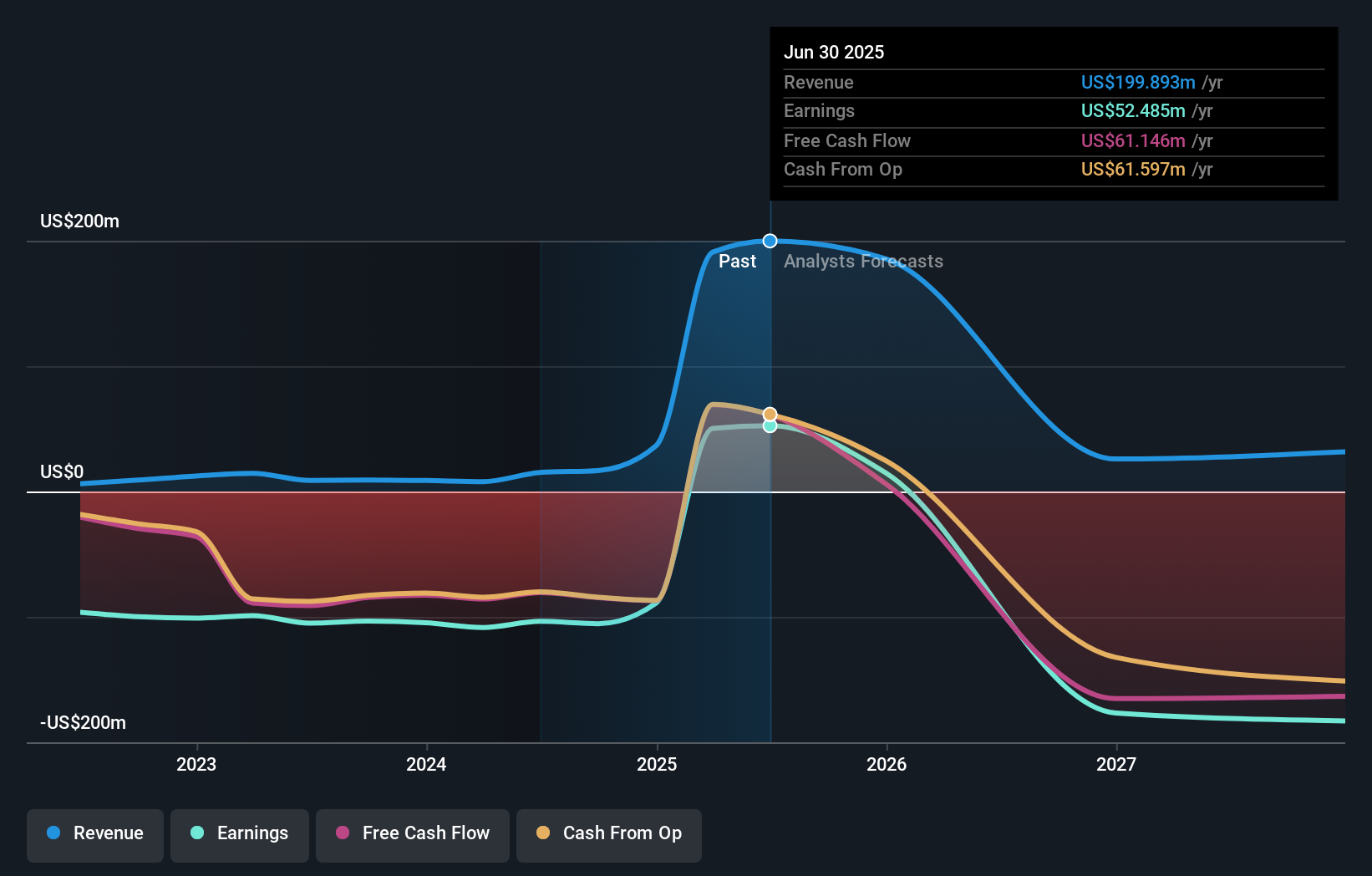

To own Stoke Therapeutics, you need to believe that zorevunersen can mature from promising data into a first-in-class, disease-modifying treatment for Dravet syndrome, and that this franchise can support a premium valuation despite forecasts for declining revenue and earnings. The AES data meaningfully reinforce the near term catalyst path by tightening the link between early-stage results and the ongoing Phase 3 EMPEROR design, which could help justify Stoke’s high multiple and recent very large share price run if later data align. At the same time, the stock already trades above some fair value estimates, with profitability still fragile, a relatively new management team, and a business that could look stretched if the EMPEROR readout, safety profile, or Biogen collaboration do not evolve as hoped.

However, investors should pay close attention to how much optimism is already priced in. Stoke Therapeutics' share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Three Simply Wall St Community fair values cluster between US$4.77 and US$12.45, well below the current share price. That wide gap sits alongside a story now heavily anchored to one late stage trial, so readers may want to weigh multiple viewpoints on how much clinical success is already reflected in today’s expectations.

Explore 3 other fair value estimates on Stoke Therapeutics - why the stock might be worth as much as $12.45!

Build Your Own Stoke Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Stoke Therapeutics research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Stoke Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Stoke Therapeutics' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报