Did Tariff-Driven Demand Allegations and Loan Risks Just Shift CarMax's (KMX) Investment Narrative?

- In recent months, CarMax has faced multiple securities class action lawsuits and a CEO termination after investors alleged the company misled the market about the sustainability of its growth and the risks in its auto finance loan portfolio. These cases center on claims that earlier demand was temporarily inflated by customer reactions to potential tariffs, raising questions about how well investors understood the true health of the business.

- We’ll now examine how these allegations about temporary tariff-driven demand and undisclosed loan portfolio risks may reshape CarMax’s investment narrative.

- We’ll now examine how alleged misstatements about temporary tariff-driven demand could alter CarMax’s longer-term growth and risk profile.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

CarMax Investment Narrative Recap

To own CarMax today, you need to believe its used car platform and omnichannel model can convert recent volatility into sustainable, profitable volumes despite softer unit trends and financing headwinds. The wave of securities lawsuits and the CEO termination intensify near term uncertainty around the quality of CarMax’s auto finance book, which now looks like the most important catalyst and the biggest risk, as any further loan loss surprises or demand resets could weigh on confidence in the story.

Among recent announcements, the November 6 guidance cut, calling for an 8% to 12% decline in comparable store used unit sales for Q3 2026, ties most directly to the lawsuits’ core claims about temporary, tariff driven demand. That revision, coupled with weaker Q2 2026 results and higher loan loss provisions, provides the key reference point for assessing whether CarMax’s earlier growth was a one off pull forward or a sustainable base for any future recovery in sales and earnings.

But just as important for investors is how expanding full credit spectrum lending interacts with these newly alleged risks in CarMax’s auto finance loan portfolio...

Read the full narrative on CarMax (it's free!)

CarMax's narrative projects $29.8 billion revenue and $919.9 million earnings by 2028. This requires 1.3% yearly revenue growth and about a $361 million earnings increase from $558.5 million today.

Uncover how CarMax's forecasts yield a $39.77 fair value, in line with its current price.

Exploring Other Perspectives

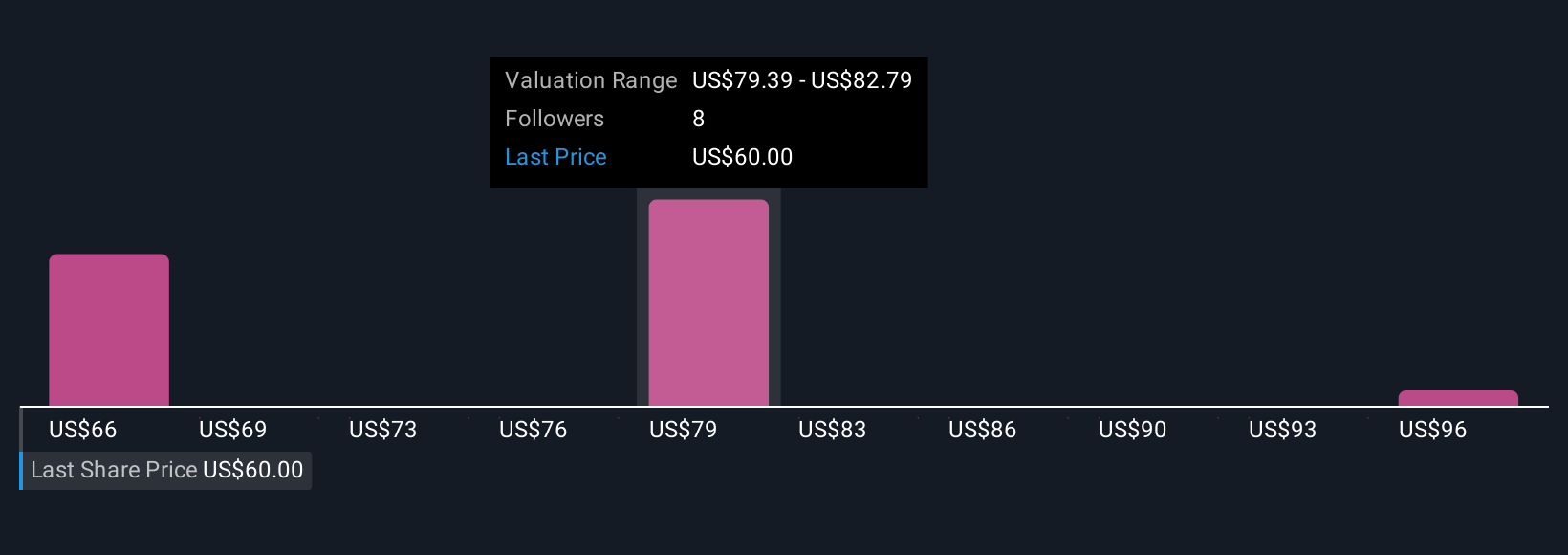

Five members of the Simply Wall St Community currently see CarMax’s fair value between US$39.77 and US$99.80, reflecting very different expectations. You can weigh those views against the emerging risk that previously strong demand was a temporary tariff driven surge, with potential implications for future loan losses and earnings resilience.

Explore 5 other fair value estimates on CarMax - why the stock might be worth over 2x more than the current price!

Build Your Own CarMax Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CarMax research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CarMax research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CarMax's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报