Why Steven Madden (SHOO) Is Up 5.0% After Q3 Beat, Softer Sales And Upbeat Q4 Outlook

- In early December 2025, Steven Madden reported third-quarter results with earnings per share slightly above forecasts but revenue below expectations, while also highlighting stronger revenue prospects for the fourth quarter helped by its Kurt Geiger acquisition and easing tariff pressures.

- At the same time, insider filings showed President Amelia Varela selling 15,000 shares and the CFO adjusting his holdings, against a backdrop of generally positive forward guidance and analyst optimism about improving revenue trends.

- Now we’ll examine how this upbeat fourth-quarter guidance amid tariff relief could influence Steven Madden’s existing investment narrative and assumptions.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Steven Madden Investment Narrative Recap

To own Steven Madden, you have to believe it can turn solid brands, growing digital channels, and the Kurt Geiger acquisition into healthier margins despite recent earnings pressure. The latest quarter’s mixed results and upbeat fourth quarter guidance do not materially change the near term catalyst, which is whether tariff relief and stronger holiday demand actually translate into the earnings recovery management is pointing to, while persistent tariff and wholesale channel risks remain the key overhang.

The most relevant development here is management’s fourth quarter 2025 guidance, which calls for a sharp year on year revenue increase supported by Kurt Geiger and some easing in tariff pressures. That outlook sits alongside insider selling, a steady dividend and a paused buyback, and it will likely frame how investors weigh the potential of digital and international growth against ongoing concerns around margins, inventory, and exposure to value focused wholesale customers.

But investors should also be aware that if tariffs re-accelerate or sourcing shifts prove slower than expected, the pressure on margins and earnings could...

Read the full narrative on Steven Madden (it's free!)

Steven Madden's narrative projects $3.1 billion revenue and $266.9 million earnings by 2028. This requires 10.5% yearly revenue growth and a $175.9 million earnings increase from $91.0 million today.

Uncover how Steven Madden's forecasts yield a $43.75 fair value, in line with its current price.

Exploring Other Perspectives

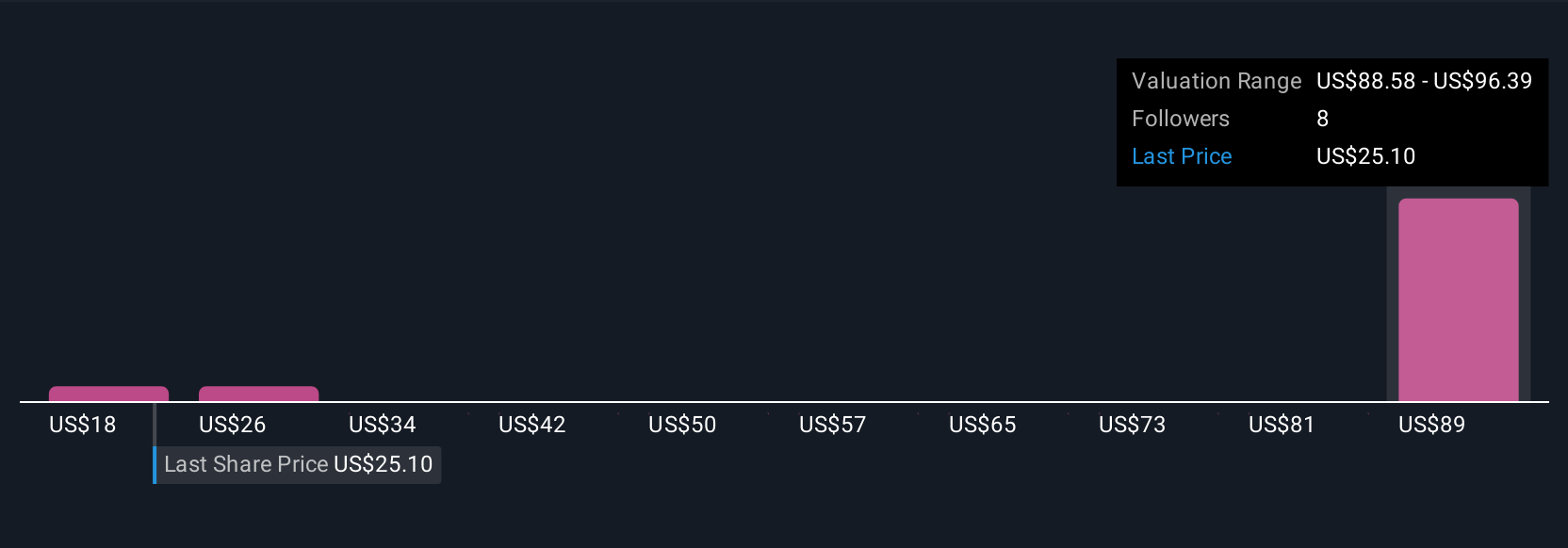

Three Simply Wall St Community fair value estimates range from US$18.29 to US$111.86, showing how far apart individual views can be. Against that backdrop, the company’s reliance on value focused wholesale channels, where past order cancellations have already hit revenue, gives readers a clear reason to compare several different scenarios for Steven Madden’s future performance.

Explore 3 other fair value estimates on Steven Madden - why the stock might be worth less than half the current price!

Build Your Own Steven Madden Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Steven Madden research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Steven Madden research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Steven Madden's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报