Alexandria Real Estate Equities (ARE) Is Down 15.3% After Sharp Dividend Cut And Impairment Charge - What's Changed

- Alexandria Real Estate Equities, Inc. previously cut its quarterly dividend for the fourth quarter of 2025 to US$0.72 per share, a 45% reduction from the prior quarter, payable on January 15, 2026 to shareholders of record on December 31, 2025, alongside weaker guidance and an impairment charge tied to its Long Island City property.

- These actions, combined with multiple securities class action filings alleging misleading disclosures about leasing, occupancy and Long Island City asset values, have intensified focus on the REIT’s balance sheet resilience, disclosure practices and long-term cash flow capacity.

- We’ll now examine how the sharp dividend reduction and related balance sheet priorities may reshape Alexandria Real Estate Equities’ investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Alexandria Real Estate Equities Investment Narrative Recap

To stay invested in Alexandria Real Estate Equities right now, you have to believe its specialized life science campuses can support sustainable occupancy and cash flows despite recent setbacks. The sharp dividend cut, weaker guidance and Long Island City impairment have pushed the near term focus firmly onto balance sheet repair as the key catalyst, while the biggest current risk is that slower leasing and lower occupancy further pressure earnings and asset values.

The 45% dividend reduction to US$0.72 per share for Q4 2025 is central to this shift, as it is explicitly tied to preserving liquidity after disappointing Q3 results and the LIC write down. This announcement connects directly to concerns about leverage, same property NOI declines and planned US$3.9 billion of dispositions, all of which now sit at the heart of the ARE story in the coming quarters.

Yet investors also need to be aware that the leasing and occupancy questions raised by the LIC impairment and lawsuits could...

Read the full narrative on Alexandria Real Estate Equities (it's free!)

Alexandria Real Estate Equities' narrative projects $3.2 billion revenue and $288.1 million earnings by 2028. This implies a 0.7% yearly revenue decline and a $309.6 million earnings increase from -$21.5 million today.

Uncover how Alexandria Real Estate Equities' forecasts yield a $68.50 fair value, a 51% upside to its current price.

Exploring Other Perspectives

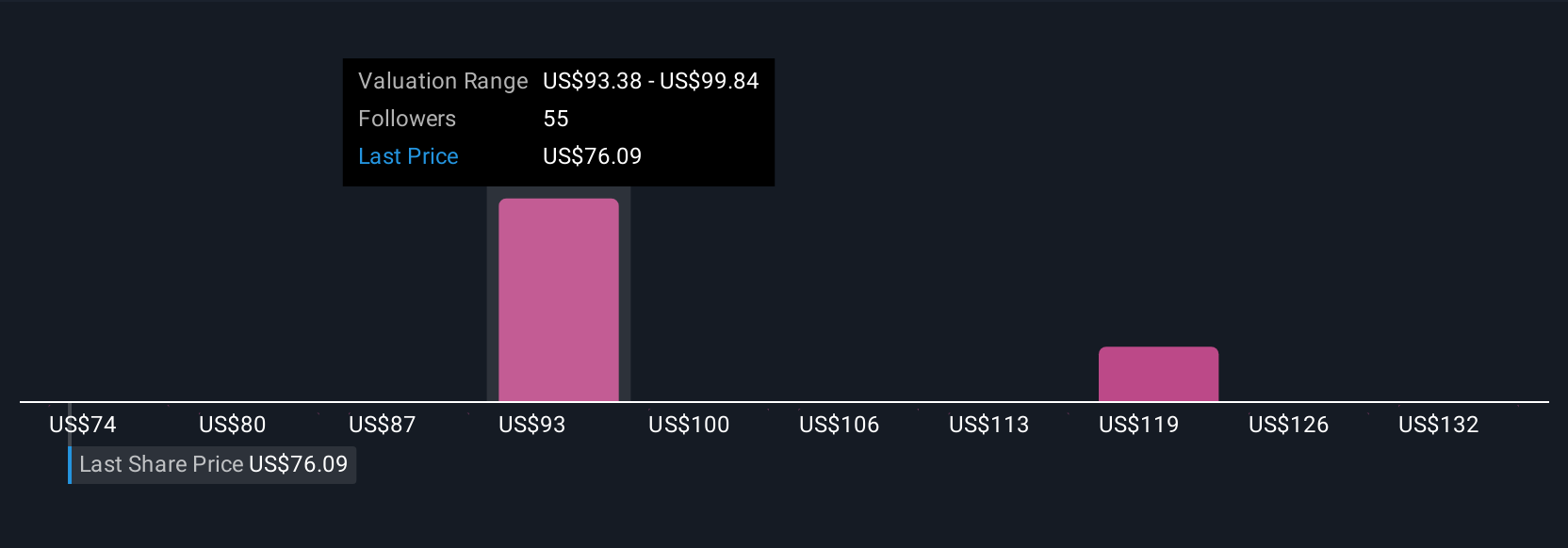

Nine Simply Wall St Community fair value estimates span roughly US$68.50 to US$136.20 per share, underscoring how far apart individual views can be. You should weigh those opinions against the risk that slower leasing and weaker occupancy could further pressure NOI and reshape expectations for Alexandria’s future performance.

Explore 9 other fair value estimates on Alexandria Real Estate Equities - why the stock might be worth just $68.50!

Build Your Own Alexandria Real Estate Equities Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alexandria Real Estate Equities research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alexandria Real Estate Equities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alexandria Real Estate Equities' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报