Should Strathcona’s Higher 2026 Output on Unchanged Budget Require Action From Strathcona Resources (TSX:SCR) Investors?

- Strathcona Resources has completed its acquisition of the Vawn thermal project and adjacent undeveloped lands, increased its 2026 production guidance to 120–130 Mbbls/d, and kept its CA$1.00 billion capital budget intact while slightly rebalancing sustaining capital.

- The integration of Vawn with the nearby Edam project and added thermal growth inventory is expected to enhance long-term production capacity and operating efficiencies across Strathcona’s Lloydminster portfolio.

- We’ll now examine how the higher 2026 production guidance at an unchanged capital budget could reshape Strathcona’s existing investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Strathcona Resources Investment Narrative Recap

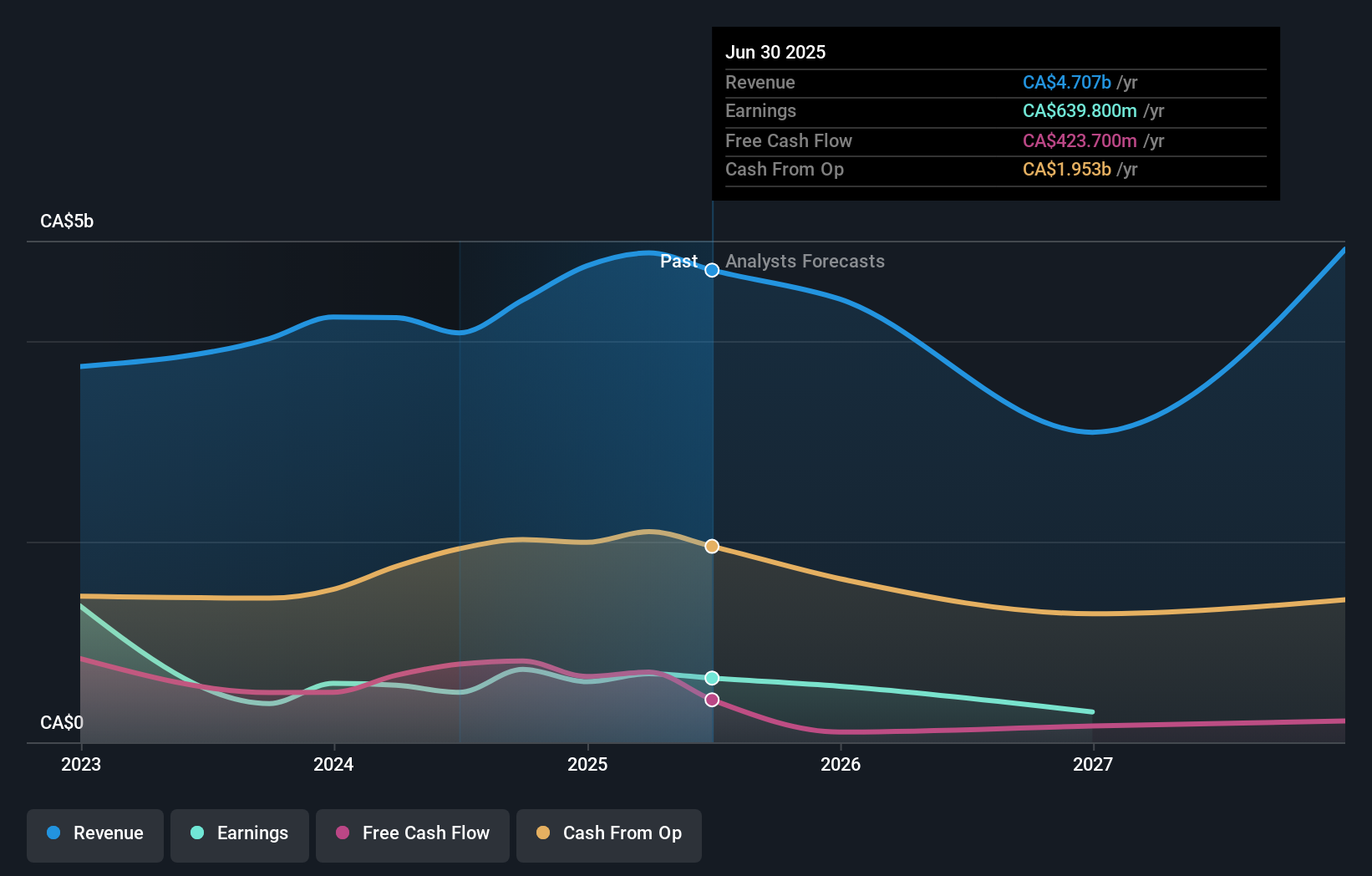

To own Strathcona, you need to believe in its ability to grow heavy oil production efficiently while returning significant cash to shareholders. The higher 2026 production guidance at an unchanged CA$1.00 billion capital budget reinforces that growth story, but near term the key catalyst remains execution on its multi‑year thermal buildout, while the biggest risk is that forecast earnings are expected to decline over the next three years, which this update does not materially change.

The recently approved CA$10.00 per share special distribution is the clearest near term event that could influence how investors view Strathcona’s balance between growth and cash returns. Set against a share price trading above some estimated fair values and with consensus pointing to falling earnings, this one‑time payout highlights both the appeal and the potential tension in Strathcona’s current investment case.

However, investors should also be aware that forecast earnings are expected to decline even as production grows, which could...

Read the full narrative on Strathcona Resources (it's free!)

Strathcona Resources’ narrative projects CA$5.1 billion revenue and CA$126.6 million earnings by 2028.

Uncover how Strathcona Resources' forecasts yield a CA$38.78 fair value, a 11% downside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span a wide range, from about CA$1.69 to CA$65.15, underscoring how far opinions can differ. Set against guidance for rising production but falling consensus earnings, this spread invites you to compare multiple viewpoints before forming your own expectations about Strathcona’s performance.

Explore 3 other fair value estimates on Strathcona Resources - why the stock might be worth as much as 50% more than the current price!

Build Your Own Strathcona Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Strathcona Resources research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Strathcona Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Strathcona Resources' overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报