DocuSign (DOCU) Q3: Net Margin Drop to 9.6% Fuels Profitability Debate

DocuSign (DOCU) just posted Q3 2026 results with revenue of $818.4 million and basic EPS of $0.41, as the company continues to turn its profitability track record from headline to habit. Over the past few quarters, revenue has stepped up from $754.8 million in Q3 2025 to $776.3 million in Q4 2025, then to $763.7 million and $800.6 million in Q1 and Q2 2026, while EPS moved from $0.31 in Q3 2025 to a trailing twelve month figure of $1.49. With that backdrop, investors are watching how much of this growth is sticking in margins and what it signals about the durability of DocuSign’s profit profile.

See our full analysis for DocuSign.With the headline numbers on the table, the next step is to set them against the dominant narratives around DocuSign to see which storylines hold up and which ones the latest margin trends start to challenge.

See what the community is saying about DocuSign

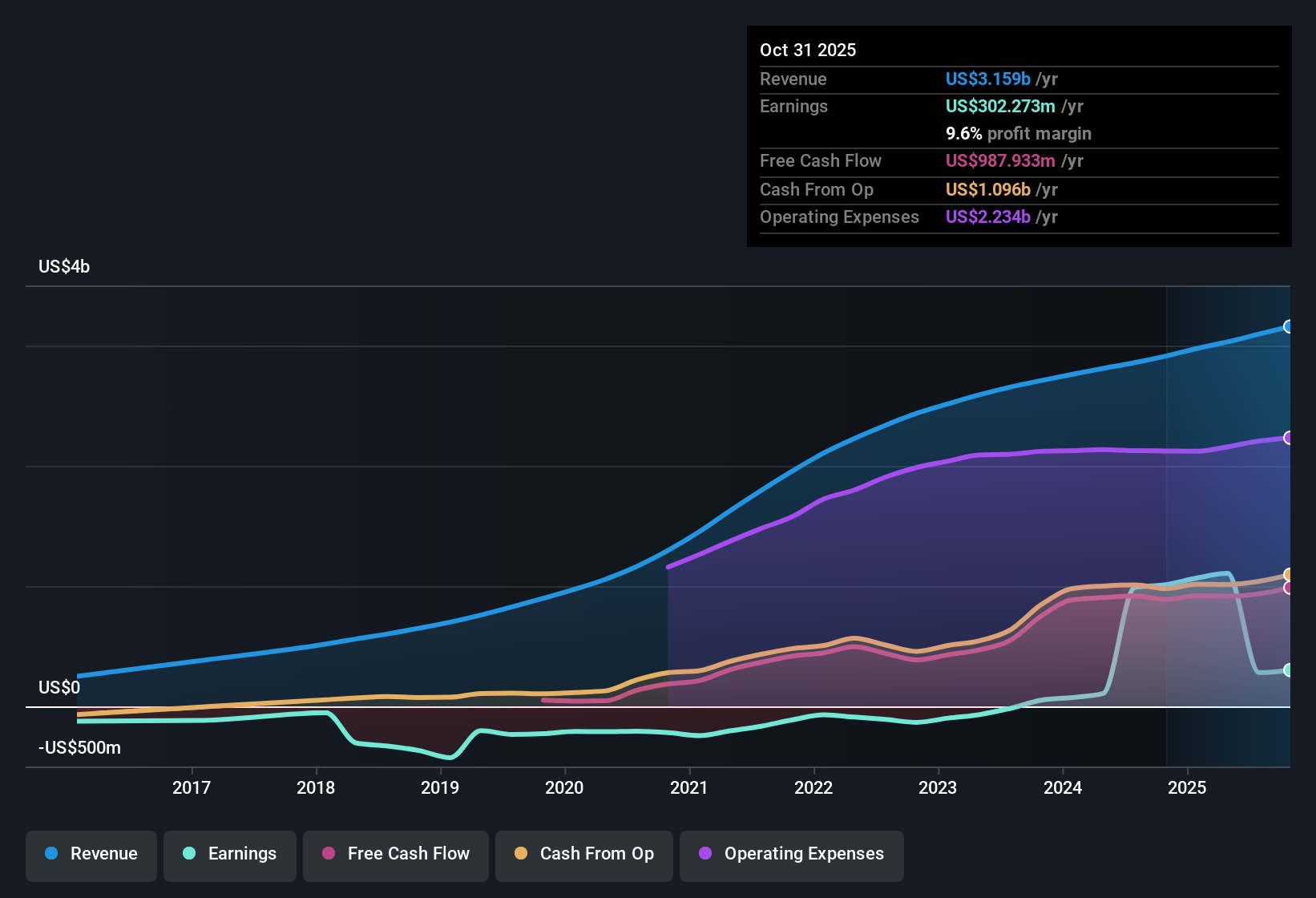

Trailing Net Margin Slips to 9.6%

- Over the last 12 months, net profit margin was 9.6 percent compared with 34.7 percent in the prior year, even though trailing twelve month revenue still reached about 3.2 billion dollars and net income was about 302 million dollars.

- Bears focus on this margin drop as a sign that profitability could stay pressured, which contrasts with how DocuSign has become steadily profitable over the past five years with earnings growing about 71.8 percent per year.

- That five year earnings growth rate and the move into consistent profitability show the business has generated real earnings power, even if the most recent year looks weaker on margins.

- The one year earnings softness that pushed margin down to 9.6 percent gives critics a concrete datapoint for arguing that costs like cloud migration and higher hosting expenses are still a real drag.

Earnings Forecasted to Grow 12.9% Annually

- Analysts expect earnings to grow about 12.9 percent per year from roughly 281 million dollars today to 359.8 million dollars by around 2028, while revenue is forecast to rise about 6.8 percent annually.

- Supporters argue this kind of earnings growth, on top of five year earnings growth of about 71.8 percent per year, backs a bullish view that DocuSign can keep compounding profits as more customers adopt AI powered agreement tools and broader agreement management platforms.

- Consensus narrative points to AI native agreement management and international expansion as key drivers that could help translate that 6.8 percent revenue growth into faster earnings growth.

- The expected lift in profit margin from roughly 9.1 percent to 9.4 percent over the next three years lines up with the idea that today’s cloud and hosting investments gradually become a tailwind for EPS.

Valuation Balances 43.7x P/E and 33.7% Discount

- The stock trades on a trailing P/E of 43.7 times, below the peer average of 46.3 times but above the US software industry at 31.5 times, and sits about 33.7 percent below an estimated DCF fair value of roughly 99.0 dollars per share versus the current price of about 65.67 dollars.

- What stands out in the consensus narrative is the tension between this apparent valuation discount and the need for DocuSign to keep delivering on those mid to high single digit revenue growth rates and mid teens earnings growth for the upside case to play out.

- The gap between the current share price around 65.67 dollars and the 98.99 dollar DCF fair value implies investors are not fully paying up for the 12.9 percent earnings growth outlook.

- At the same time, paying 43.7 times trailing earnings, above the broader software sector, means the market is still demanding that DocuSign make good on its margin improvement story, not just its top line growth.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for DocuSign on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers from another angle, and in just a few minutes you can turn that take into a full narrative of your own, Do it your way.

A great starting point for your DocuSign research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Explore Alternatives

Despite a solid track record of turning profitable, DocuSign’s sharply lower recent net margins and premium earnings multiple leave little room for execution missteps.

If that mix of compressed margins and valuation risk feels uncomfortable, use our these 906 undervalued stocks based on cash flows to quickly focus on companies where prices better reflect cash flow strength and downside protection.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报