Ouster (OUST): Evaluating Valuation After Surging on LiDAR Growth Hopes in Autonomous and Industrial Markets

Ouster (OUST) has suddenly landed on many investors radar after a 350% share price jump over the past six months, powered by enthusiasm for LiDAR demand in autonomous vehicles and industrial automation.

See our latest analysis for Ouster.

That surge sits on top of a 100.65% year to date share price return and a 138.50% one year total shareholder return, suggesting momentum has been rebuilding as investors reassess Ouster’s growth prospects and risk profile following recent LiDAR contract wins and product milestones.

If Ouster’s run has you looking for the next wave of innovation, now is a good moment to scan the market for high growth tech and AI stocks that could fit a similar high growth theme.

But after such a powerful rerating, especially with shares still trading at a steep discount to analyst targets, is Ouster an overlooked value in a booming niche, or is the market already baking in years of future growth?

Most Popular Narrative: 37.3% Undervalued

With Ouster last closing at $24.78 versus a narrative fair value near $39.50, the gap hinges on aggressive growth, margin expansion, and scaling assumptions.

Significant advancements in Ouster's digital lidar hardware, such as the next-generation L4 sensors and Chronos custom silicon, are expected to double the addressable market and improve gross margins through enhanced performance and reliability.

Curious how a still unprofitable LiDAR player earns such a rich future multiple? The story leans on rapid revenue compounding, margin uplift, and a bold earnings ramp. Want to see exactly how those projections stack up over time and justify that premium valuation path?

Result: Fair Value of $39.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated execution risk and fierce LiDAR competition mean that any slowdown in adoption or pricing pressure could quickly undermine today’s bullish narrative.

Find out about the key risks to this Ouster narrative.

Another Angle on Valuation

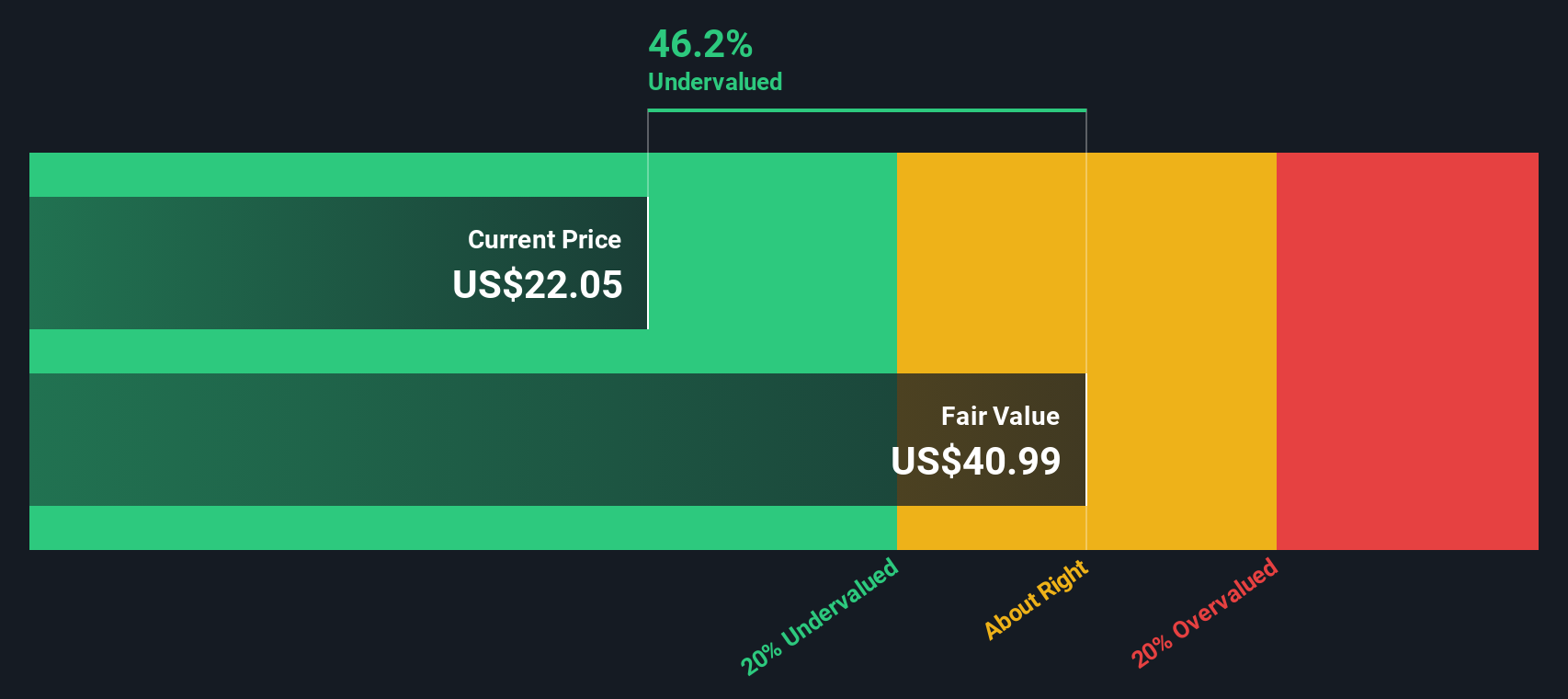

Our DCF model also flags Ouster as undervalued, with the shares trading around 39.6 percent below an estimated fair value of roughly $41. That supports the bullish narrative, but it also raises a question: how comfortable are you with the growth and margin assumptions baked into both views?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Ouster Narrative

If this perspective does not fully align with your own, or you would rather dig into the numbers yourself, you can build a custom view in just a few minutes, Do it your way

A great starting point for your Ouster research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you log off, put your momentum to work by scouting fresh opportunities on the Simply Wall St Screener so you never leave potential returns on the table.

- Capture income potential by scanning these 15 dividend stocks with yields > 3% that may strengthen your portfolio with reliable cash flows when markets turn volatile.

- Tap into cutting edge innovation through these 28 quantum computing stocks that could benefit as real world applications accelerate beyond today’s expectations.

- Supercharge your growth hunt with these 26 AI penny stocks riding powerful trends in automation, data, and next generation software platforms.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报