Endeavour Mining (TSX:EDV): Valuation Check After Bold Five-Year Gold Exploration Roadmap to 2030

Endeavour Mining (TSX:EDV) just laid out a punchy five year exploration roadmap, targeting 12 to 15 million ounces of new gold resources by 2030, and the timing is stirring fresh debate around the stock.

See our latest analysis for Endeavour Mining.

That roadmap comes after a powerful rerating, with a roughly 137% year to date share price return and a 148% one year total shareholder return signalling that momentum has been building rather than fading.

If this kind of gold story has your attention, it could be worth scanning other materials names and discovering fast growing stocks with high insider ownership for fresh, high conviction ideas.

With the shares already up sharply and the market cheering a 12 to 15 million ounce exploration target, is Endeavour still trading at a discount to its long term potential, or has the market already priced in that growth?

Most Popular Narrative Narrative: 14.7% Undervalued

With Endeavour Mining last closing at CA$63.55 against a narrative fair value of CA$74.53, the story frames the recent rally as only part way through.

The analysts have a consensus price target of CA$53.683 for Endeavour Mining based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$63.0, and the most bearish reporting a price target of just CA$37.5.

Want to see how falling headline growth, rising margins, and a richer future earnings multiple still add up to upside from here? The narrative lays out the full equation.

Result: Fair Value of $74.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on navigating West African political risk and managing rising royalty and environmental costs, which could squeeze cash flow.

Find out about the key risks to this Endeavour Mining narrative.

Another View: Multiples Tell a Richer Story

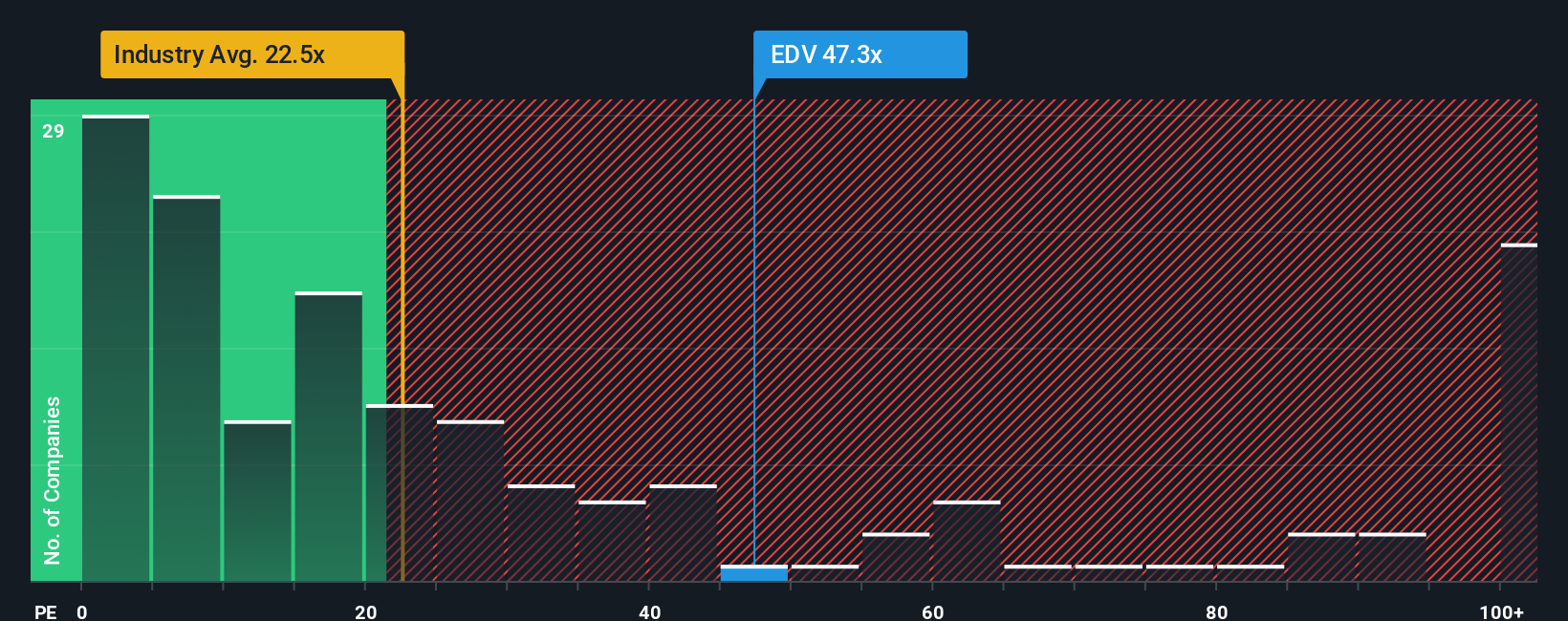

On earnings, Endeavour trades at 22.3 times, slightly richer than the Canadian metals and mining average of 21.2 times, but below a fair ratio of 24.4 times and far cheaper than peers at 64.8 times. Is that a safety margin, or a signal expectations are already lofty?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Endeavour Mining Narrative

If you see the story differently or want to dig into the numbers yourself, you can shape a personalized view in minutes: Do it your way.

A great starting point for your Endeavour Mining research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at a single opportunity. Use the Simply Wall St Screener to surface focused stock ideas that could sharpen and strengthen your portfolio positioning.

- Capture potential mispricings by running through these 908 undervalued stocks based on cash flows that combine solid fundamentals with attractive cash flow based valuations.

- Ride powerful structural trends by scanning these 26 AI penny stocks that are pushing the boundaries of intelligent automation and data driven business models.

- Lock in reliable income streams by targeting these 15 dividend stocks with yields > 3% that balance yield, payout sustainability, and long term dividend growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报