DeFi Technologies (NEOE:DEFI): Revisiting Valuation After a Sharp Share Price Pullback

DeFi Technologies (NEOE:DEFI) has been sliding recently, with the stock down sharply over the past month and past 3 months. That pullback is prompting investors to revisit the company’s fundamentals.

See our latest analysis for DeFi Technologies.

That recent selloff sits on top of a much bigger swing. The latest share price of CA$1.80 comes after a steep year to date share price decline, but still leaves long term total shareholder returns extremely strong. However, momentum is clearly fading as investors reassess risk and the sustainability of prior gains.

If DeFi’s volatility has you rethinking where to hunt for upside, it could be worth exploring fast growing stocks with high insider ownership as a fresh source of high conviction ideas.

With revenue and profits still growing fast, yet the share price languishing near recent lows despite a sizeable gap to analyst targets, investors now face a key question: is this a contrarian buy, or is future growth already priced in?

Most Popular Narrative: 67.9% Undervalued

With DeFi Technologies last closing at CA$1.80 versus a narrative fair value of CA$5.60, the narrative implies substantial upside if its growth thesis plays out.

The rapid launch and scaling of new digital asset ETPs, especially first-mover and niche products, enable the company to monetize rising demand for diversified and innovative exposure to altcoins and tokenized assets, supporting growth in both transaction-based revenues and management/staking fee yields. The company's active pipeline of DeFi Alpha trades, which are expected to accelerate in value due to increasing altcoin prices and an expanding opportunity set, adds a significant and growing contribution to revenues and net income as markets broaden and mature.

Curious how aggressive revenue expansion, surging earnings, and richer margins could all converge into that fair value estimate? Unpack the full narrative and see which bold assumptions carry the valuation.

Result: Fair Value of $5.6 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on stable crypto markets and timely DeFi Alpha execution, while regulatory setbacks or prolonged delays could quickly undermine the growth story.

Find out about the key risks to this DeFi Technologies narrative.

Another View: Pricing Signals Are Less Generous

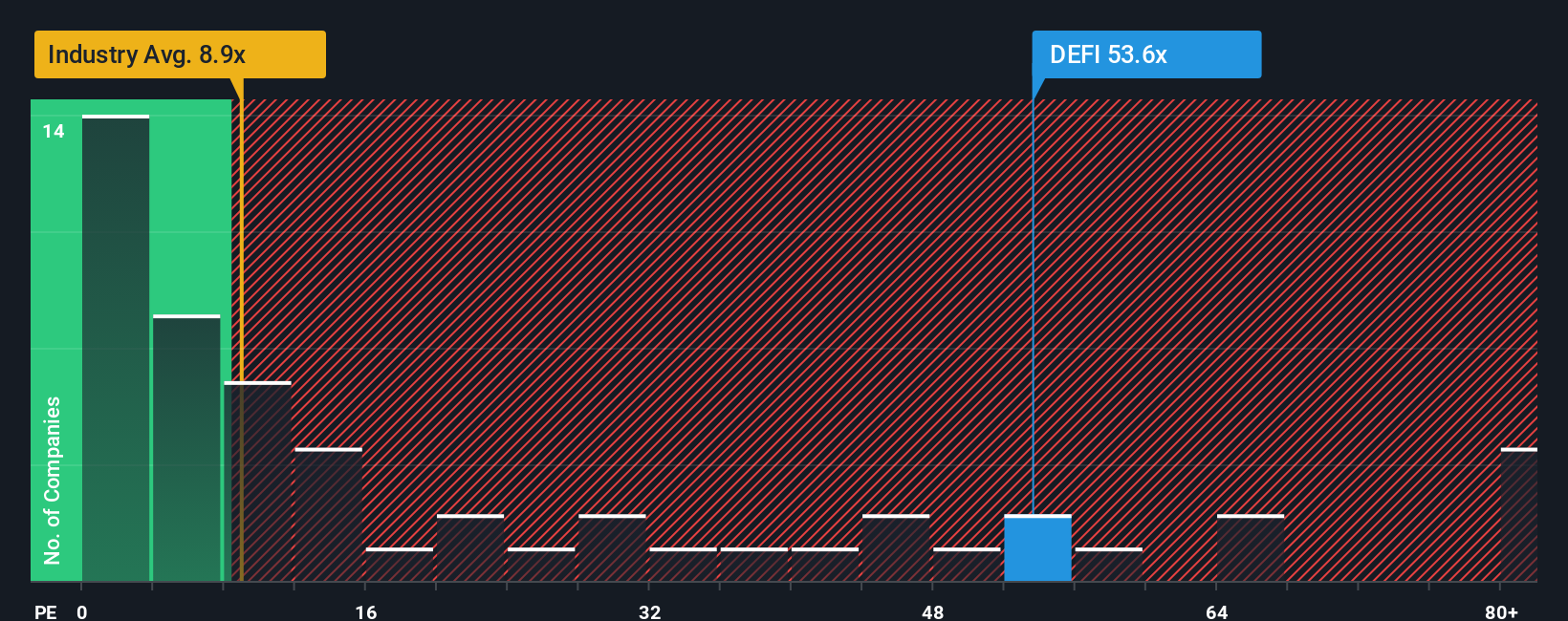

While the narrative fair value paints DeFi Technologies as deeply undervalued, the price to earnings lens sounds a warning. Shares trade on about 57.8 times earnings, far richer than the Canadian Capital Markets industry at 8.8 times and peers at 20 times, and only slightly below a fair ratio of 61.4 times. This suggests limited margin of safety if growth wobbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DeFi Technologies Narrative

If you are unconvinced by this framing or would rather interrogate the numbers firsthand, you can build a custom view in minutes: Do it your way.

A great starting point for your DeFi Technologies research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for your next investing edge?

Do not stop at a single stock when you can quickly scan the market for strong, data backed ideas tailored to your strategy using the Simply Wall St Screener.

- Capitalize on mispriced opportunities by targeting companies trading below their intrinsic value through these 908 undervalued stocks based on cash flows, where strong cash flows meet attractive entry points.

- Position yourself early in the next wave of innovation by zeroing in on companies powering artificial intelligence with these 26 AI penny stocks before the crowd fully catches on.

- Strengthen your income stream by focusing on reliable payers via these 15 dividend stocks with yields > 3%, with yields above 3% from businesses with solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报