What Axon Enterprise (AXON)'s Margin Pressure Amid Heavy R&D Spending Means For Shareholders

- In recent months, Axon Enterprise reported strong revenue growth driven by demand for TASER 10, Axon Body 4, and counter-drone systems, even as higher operating costs and margin pressure weighed on quarterly earnings.

- At the same time, Axon’s shift to a Connected Devices and Software & Services structure, combined with insider share sales and mixed analyst reactions, has sharpened investor focus on how its capital-intensive growth plans balance against a very high valuation and rising expenses.

- We’ll now examine how Axon’s margin pressure amid heavy R&D investment reshapes its previously growth-centric investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Axon Enterprise Investment Narrative Recap

To own Axon today, you have to believe its near-monopoly TASER franchise and expanding cloud ecosystem can offset rising costs, tariff pressure, and a very high share price multiple. Recent margin compression, insider selling, and a sharp stock pullback have not changed the key near term catalyst, which is execution on its Connected Devices and Software & Services growth plan. The biggest immediate risk remains that elevated spending and lower margins persist longer than investors are currently comfortable with.

The company’s raised 2025 revenue guidance to about US$2.74 billion, pointing to roughly 31% year on year growth, sits at the center of this tension. That outlook highlights how fast adoption of TASER 10, Axon Body 4, and counter drone tools can support top line expansion, but it also raises the stakes if costs, tariffs, and heavy R&D investment continue to weigh on earnings and keep the valuation under pressure.

Yet behind Axon’s growth story, investors also need to weigh the risk that rising tariffs and manufacturing costs could keep squeezing margins and...

Read the full narrative on Axon Enterprise (it's free!)

Axon Enterprise's narrative projects $4.6 billion revenue and $476.0 million earnings by 2028. This requires 24.3% yearly revenue growth and about a $149.7 million earnings increase from $326.3 million today.

Uncover how Axon Enterprise's forecasts yield a $822.50 fair value, a 49% upside to its current price.

Exploring Other Perspectives

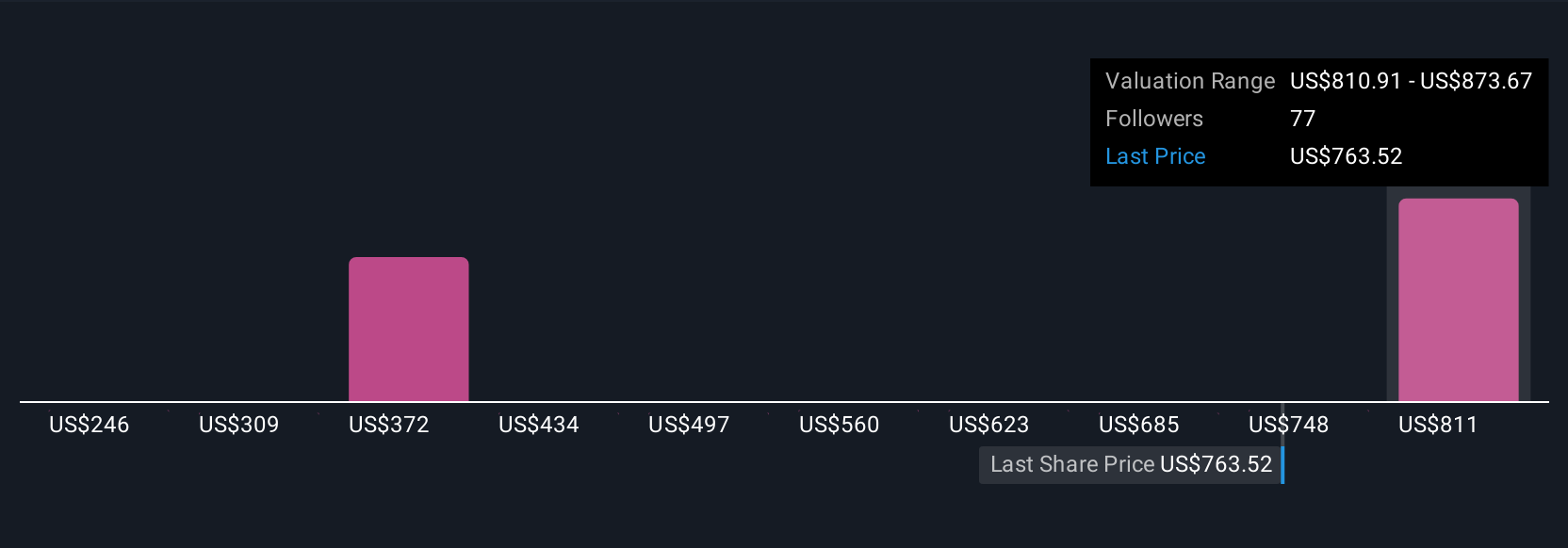

Nine Simply Wall St Community members see Axon’s fair value anywhere between about US$400 and US$835 per share, reflecting very different expectations. When you set that against Axon’s cost driven margin pressure and rich revenue multiple, it underlines why many investors are rethinking what they are willing to pay for this level of growth and risk.

Explore 9 other fair value estimates on Axon Enterprise - why the stock might be worth as much as 52% more than the current price!

Build Your Own Axon Enterprise Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Axon Enterprise research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Axon Enterprise research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Axon Enterprise's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报