Palo Alto Networks (PANW): Assessing Valuation After Big CyberArk, Chronosphere Deal Plans and Cooling Growth Sentiment

Palo Alto Networks (PANW) is back in the spotlight after management used the UBS Global Technology and AI Conference to double down on its ambitious Chronosphere and planned CyberArk deals, just as growth and sentiment cool.

See our latest analysis for Palo Alto Networks.

Those bold AI and cybersecurity bets have come as the stock has cooled a little, with a 1 month share price return of negative 8.78 percent and a slightly positive 90 day share price return of 0.63 percent. Long term holders still enjoy a 3 year total shareholder return of 143.41 percent and 5 year total shareholder return of 281.36 percent, suggesting momentum has paused rather than broken.

If these moves have you thinking more broadly about where the next winners might come from, it could be worth exploring other high growth tech and AI names via high growth tech and AI stocks.

With revenue still growing double digits and the share price now trading at a low double digit discount to analyst targets and intrinsic value, is Palo Alto Networks a rare mispriced leader, or is the market already discounting future growth?

Most Popular Narrative: 12.9% Undervalued

With Palo Alto Networks last closing at $195.68 against a narrative fair value of $224.53, the valuation story leans in favor of patient optimists.

Strategic investments in AI-driven security, automation, and differentiated product innovation (e.g., AI firewalls, SASE, secure browser, Cortex Cloud, XSIAM) are driving rapid ARR growth in high-value segments (>32% NGS ARR growth and over 2.5x AI ARR YoY), supporting a move towards higher-margin, recurring revenue streams and improved long-term net margins.

Want to see the math behind that upside case? The growth runway, margin lift, and punchy future earnings multiple that underpin this fair value are anything but conservative.

Result: Fair Value of $224.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy integration demands from acquisitions and intensifying competition from cloud providers could pressure margins and test Palo Alto Networks’ long term growth narrative.

Find out about the key risks to this Palo Alto Networks narrative.

Another Way of Looking at Value

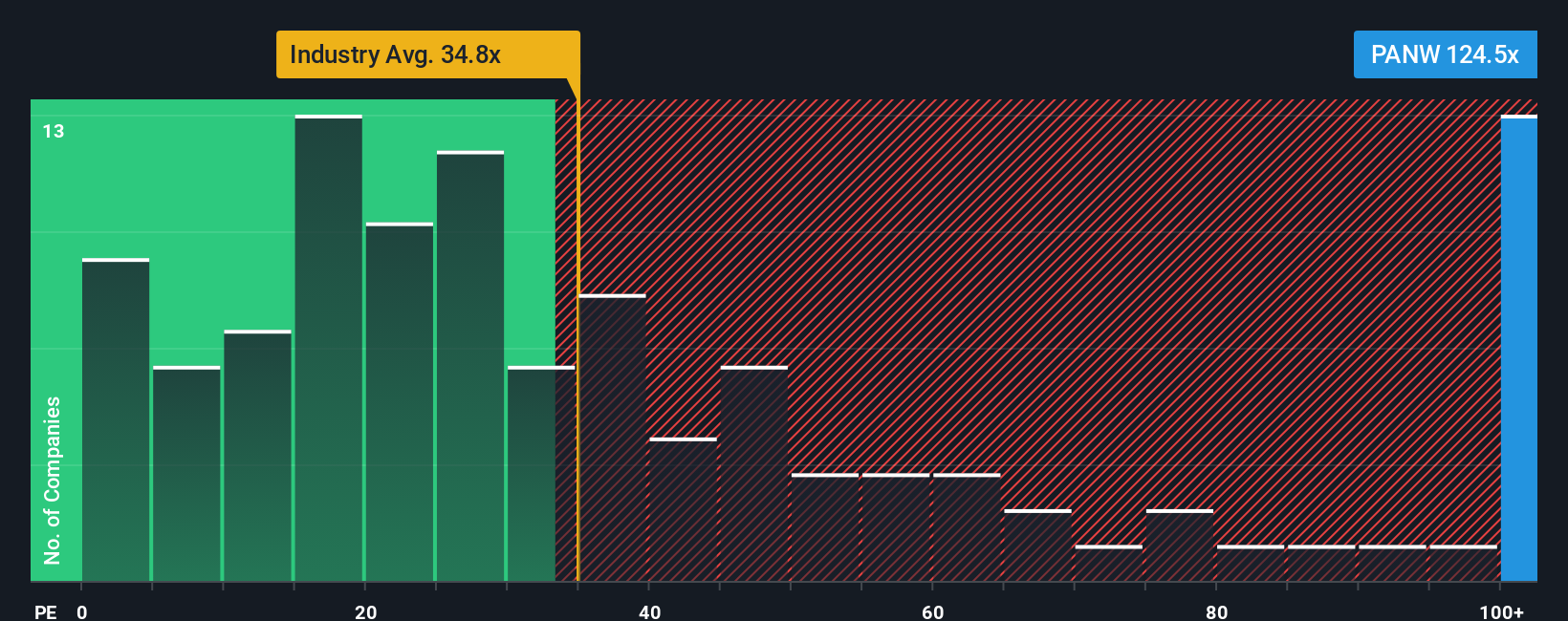

On earnings, Palo Alto Networks looks far less forgiving. The stock trades on a steep 122.1 times earnings versus about 31.4 times for the wider US software sector and 51.1 times for peers, while our fair ratio sits nearer 43.3 times. That gap signals meaningful valuation risk if sentiment cools again, even if growth delivers.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Palo Alto Networks Narrative

If you see the story differently, or want to stress test the numbers yourself, you can build a fresh perspective in minutes: Do it your way.

A great starting point for your Palo Alto Networks research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by using the Simply Wall Street screener to uncover stocks that fit your strategy with precision and confidence.

- Capture potential multibaggers early by zeroing in on these 3575 penny stocks with strong financials that already show balance sheet strength and credible growth momentum.

- Ride structural megatrends by targeting these 30 healthcare AI stocks harnessing data, automation, and diagnostics to reshape patient outcomes and long term earnings power.

- Strengthen your portfolio’s income engine by focusing on these 15 dividend stocks with yields > 3% that combine robust cash generation with reliable, above market yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报