MongoDB (MDB) Is Up 21.6% After Atlas-Led Beat, Buyback And 2026 Outlook Hike - Has The Bull Case Changed?

- MongoDB recently reported third-quarter 2025 results showing revenue of US$628.31 million with a much smaller net loss of US$2.01 million, raised its fiscal 2026 revenue outlook to US$2.434 billion–US$2.439 billion, and completed a US$351.69 million buyback covering 1.77% of its shares.

- The company’s Atlas cloud database, which grew 30% year over year and now contributes about three-quarters of revenue, is increasingly central to MongoDB’s push to become a core data platform for AI workloads across large enterprises and AI-native startups.

- Now, we’ll examine how this upgraded full-year 2026 revenue guidance and Atlas-led momentum shapes MongoDB’s pre-existing investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

MongoDB Investment Narrative Recap

To own MongoDB, I think you need to believe its Atlas cloud database can stay the preferred home for modern and AI-heavy applications despite intense hyperscaler and open source competition. The latest Q3 beat and higher fiscal 2026 revenue outlook reinforce Atlas as the near term growth engine, but do not fully settle concerns that growth could slow if large enterprise workloads mature faster than new AI use cases ramp.

The completion of the US$351.69 million buyback, covering 1.77% of shares, stands out here because it sits alongside strong Atlas-driven revenue momentum and raised guidance. While this capital return may help offset some dilution from stock-based compensation, the bigger question for investors remains whether Atlas can keep winning high value workloads fast enough to support both continued growth and progress toward sustained profitability.

Yet even with Atlas growing fast, investors should be aware that competition from lower cost cloud native databases could...

Read the full narrative on MongoDB (it's free!)

MongoDB's narrative projects $3.5 billion revenue and $5.0 million earnings by 2028. This requires 16.8% yearly revenue growth and an $83.6 million earnings increase from -$78.6 million today.

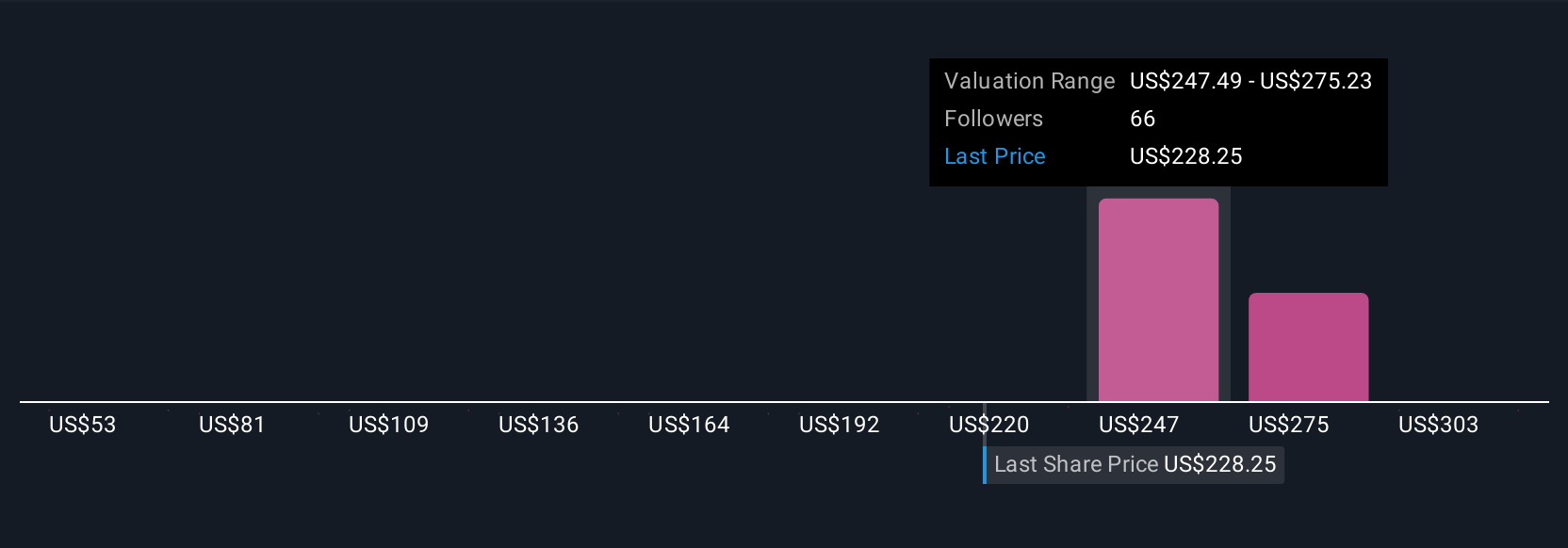

Uncover how MongoDB's forecasts yield a $427.93 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Eleven fair value estimates from the Simply Wall St Community range from US$130.20 to US$427.93, showing how far apart individual views can be. As you weigh those against Atlas driven growth and the raised US$2.434 billion to US$2.439 billion revenue outlook, it is worth considering how long hyperscaler competition might pressure MongoDB's margins and long term profitability.

Explore 11 other fair value estimates on MongoDB - why the stock might be worth as much as 8% more than the current price!

Build Your Own MongoDB Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MongoDB research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free MongoDB research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MongoDB's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报