Boeing (BA) Is Up 8.0% After New Apache Deal, Higher Jet Targets And 2026 FCF Outlook - Has The Bull Case Changed?

- In recent days, Boeing has secured a nearly US$4.70 billion Foreign Military Sales contract to build AH-64E Apache helicopters for international customers, outlined plans for higher 737 and 787 deliveries and a return to positive free cash flow in 2026, and added former Alaska Air Group CEO Bradley Tilden to its board.

- Taken together, these moves point to a company aiming to buttress long-term cash generation and governance while expanding a growing defense backlog.

- We’ll now examine how the CFO’s outlook for a return to positive free cash flow in 2026 may reshape Boeing’s investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Boeing Investment Narrative Recap

To own Boeing, you need to believe it can turn a large backlog and stabilizing production of 737 and 787 jets into sustained free cash flow while managing debt and execution risk. The CFO’s guidance for a return to positive free cash flow in 2026 directly affects the key near term catalyst of a financial turnaround, but it does not remove the overarching risk from high leverage and any renewed production or certification setbacks.

Among the recent announcements, the CFO’s forecast of low single digit billions in positive free cash flow in 2026 is the most relevant, because it ties rising 737 and 787 deliveries, 737-10 certification timing, and the growing defense backlog together into a clearer cash generation story, which many investors are watching as the primary test of Boeing’s recovery.

But investors should also be aware that Boeing’s high debt load could quickly magnify any new production delays or certification problems...

Read the full narrative on Boeing (it's free!)

Boeing's narrative projects $114.4 billion revenue and $7.1 billion earnings by 2028. This requires 14.9% yearly revenue growth and an $18.0 billion earnings increase from -$10.9 billion today.

Uncover how Boeing's forecasts yield a $245.00 fair value, a 21% upside to its current price.

Exploring Other Perspectives

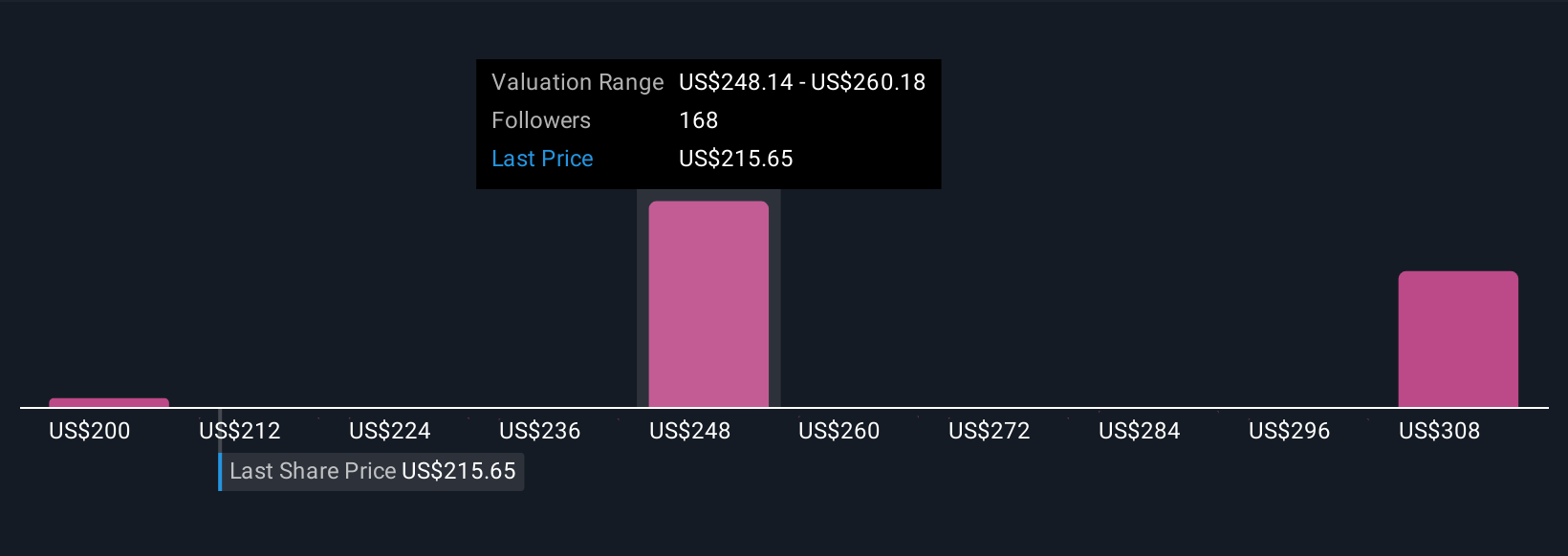

Seventeen members of the Simply Wall St Community currently estimate Boeing’s fair value between US$206.79 and US$326.80, highlighting how far opinions can spread. Against that backdrop, Boeing’s plan to restore positive free cash flow in 2026 puts execution on aircraft deliveries and margins at the center of the company’s performance story, so it can be worth comparing several of these viewpoints before forming your own.

Explore 17 other fair value estimates on Boeing - why the stock might be worth just $206.79!

Build Your Own Boeing Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boeing research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Boeing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boeing's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报