How Lincoln’s New Chief AI, Data and Analytics Officer Could Shape Lincoln National (LNC) Investors

- Lincoln Financial recently announced that Nilanjan (Neel) Adhya will become Executive Vice President and Chief AI, Data and Analytics Officer in January 2026, reporting directly to CEO Ellen Cooper and joining the Senior Management Committee.

- By recruiting a veteran of BlackRock and IBM to build AI and data into core capabilities, Lincoln is signaling a deeper push to modernize customer experience and operations across its insurance and retirement businesses.

- We’ll now explore how appointing a seasoned AI and data leader to a newly created C-suite role could reshape Lincoln’s long-term investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Lincoln National Investment Narrative Recap

To be a shareholder in Lincoln National, you need to believe that its shift toward more capital efficient products and digital modernization can offset legacy variable annuity and Retirement Plan Services headwinds. The appointment of Nilanjan Adhya as Chief AI, Data and Analytics Officer supports the technology modernization catalyst, but does not directly change the near term risks tied to legacy guarantees and structural outflows.

Among recent developments, Lincoln’s consistent US$0.45 per share quarterly common dividend stands out, given that it is not well covered by free cash flow. For investors, this highlights the tension between returning capital to shareholders and preserving balance sheet flexibility while the company is still working through legacy product exposure and technology upgrades.

Yet even as Lincoln leans into AI and digital tools, investors should be aware that its legacy variable annuity guarantees still have the potential to...

Read the full narrative on Lincoln National (it's free!)

Lincoln National’s narrative projects $21.0 billion revenue and $1.6 billion earnings by 2028. This requires 5.2% yearly revenue growth and about a $0.6 billion earnings increase from $1.0 billion today.

Uncover how Lincoln National's forecasts yield a $44.00 fair value, a 3% upside to its current price.

Exploring Other Perspectives

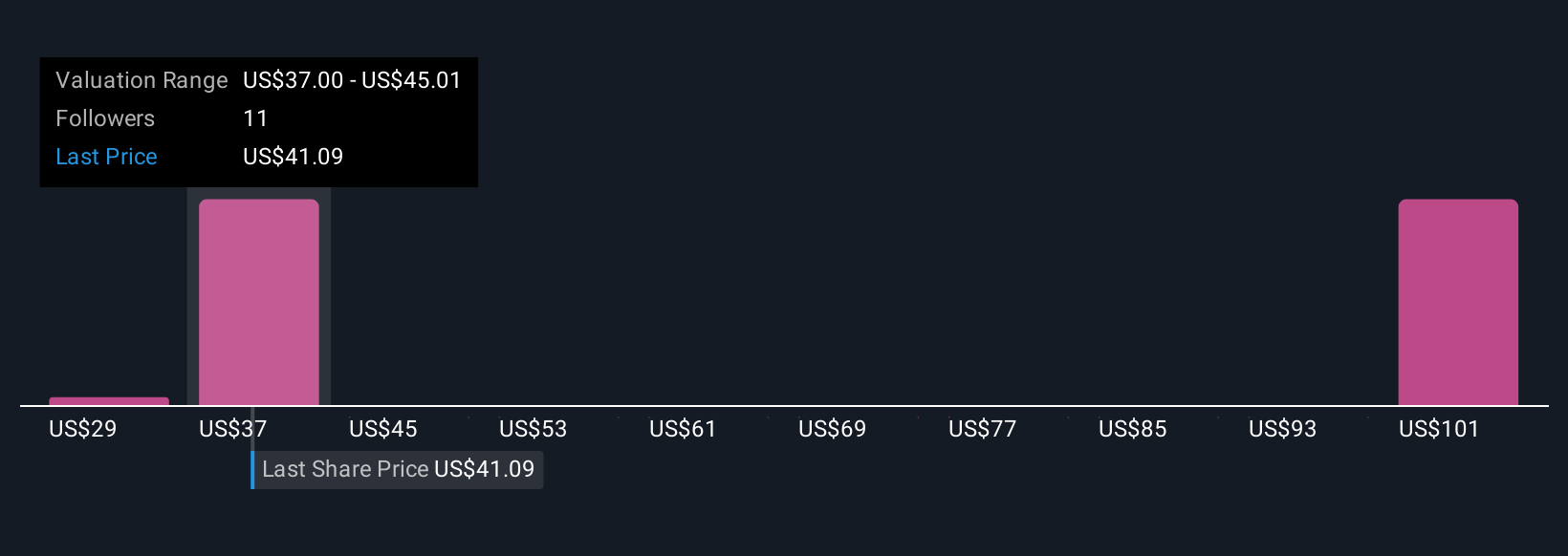

Three members of the Simply Wall St Community currently value Lincoln National between US$28.99 and about US$112.76 per share, reflecting a wide spread of expectations. When you weigh those views against the company’s push to embed AI and data into its operations, it underlines how differently people assess the long term payoff from Lincoln’s modernization efforts and why it can help to consider several viewpoints before making your own judgement.

Explore 3 other fair value estimates on Lincoln National - why the stock might be worth 32% less than the current price!

Build Your Own Lincoln National Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lincoln National research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lincoln National research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lincoln National's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报