Is Airbnb Now an Opportunity After Regulatory Uncertainty and a Recent Share Price Slide?

- If you have ever looked at Airbnb and wondered whether the stock is quietly becoming a bargain or still pricing in perfection, you are exactly who this breakdown is for.

- Despite a bumpy ride this year with the share price down 8.1% year to date and 11.4% over the last year, the stock is still up 27.4% over three years, hinting that long term holders have been rewarded even as short term sentiment wobbles.

- Recent headlines have focused on regulatory shifts in key cities and ongoing debates around short term rental rules, which can change how investors think about Airbnb's long term growth runway. At the same time, coverage of travel demand normalizing after the post pandemic surge has added a new layer of uncertainty to how sustainable its growth story really is.

- Right now, Airbnb scores a 4/6 valuation check, suggesting the market may be underestimating its value in several areas. We will walk through what different valuation approaches say about that, before finishing with a more powerful way to tie all those numbers into a clearer long term picture.

Find out why Airbnb's -11.4% return over the last year is lagging behind its peers.

Approach 1: Airbnb Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and discounting them back to today using a required return. For Airbnb, the model uses a 2 stage Free Cash Flow to Equity approach, starting from its last twelve months Free Cash Flow of about $4.6 billion.

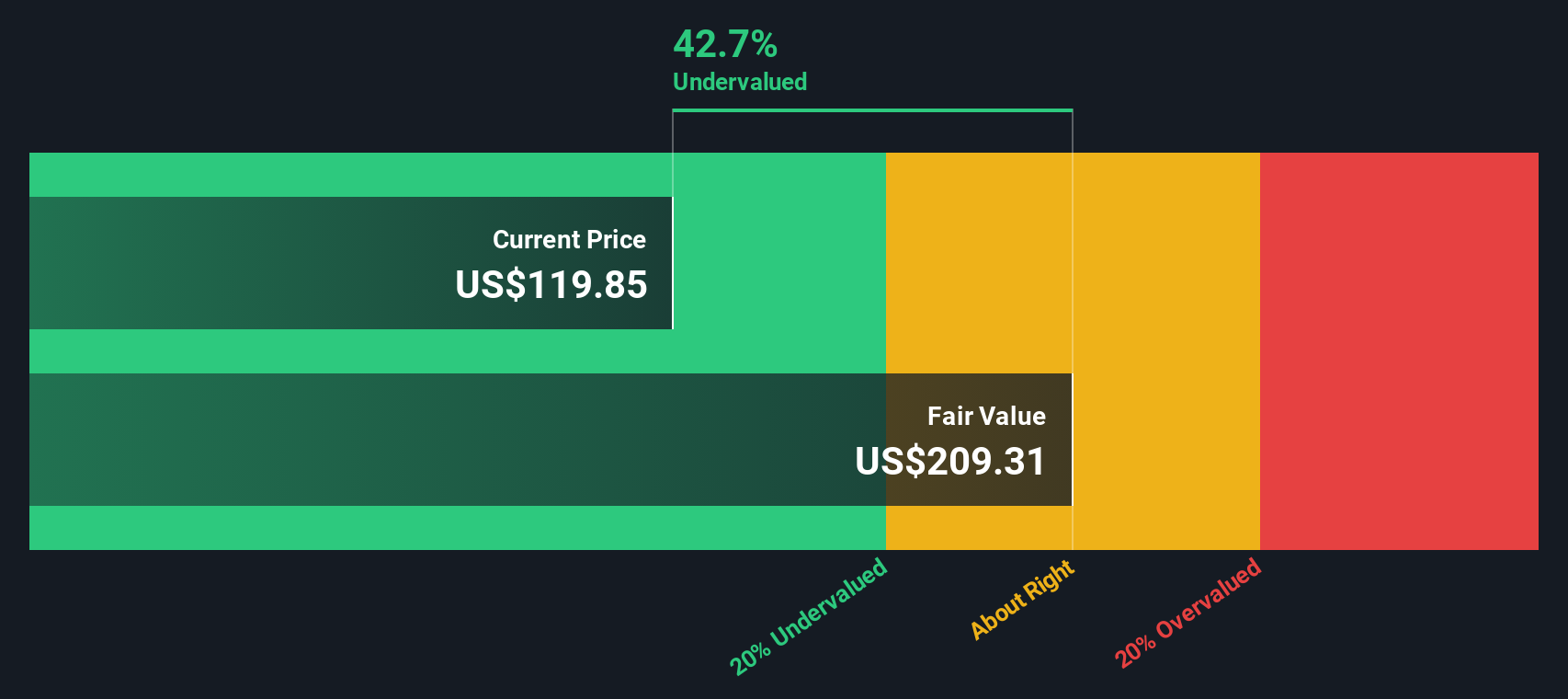

Analysts provide detailed forecasts for the next few years, with Simply Wall St extending these to build a longer runway. Under this framework, Airbnb’s Free Cash Flow is projected to rise to around $10.1 billion by 2035, implying solid but gradually slowing growth as the business matures. All these future cash flows, expressed in $, are then discounted to today’s value to arrive at an estimated intrinsic value per share of roughly $233.92.

That DCF value implies the stock is trading at about a 48.3% discount to its calculated worth, indicating a meaningful gap between market expectations and the cash flow outlook.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Airbnb is undervalued by 48.3%. Track this in your watchlist or portfolio, or discover 912 more undervalued stocks based on cash flows.

Approach 2: Airbnb Price vs Earnings

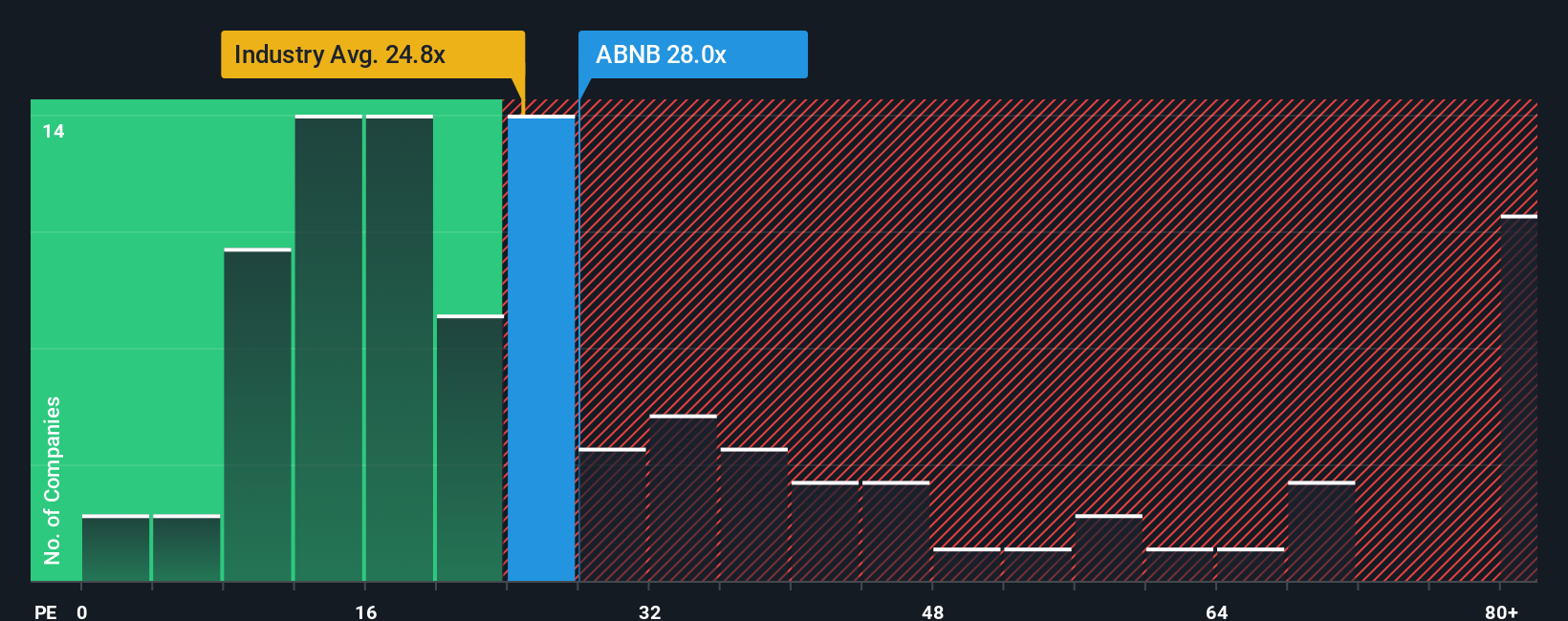

For profitable companies like Airbnb, the Price to Earnings, or PE, ratio is a useful yardstick because it links what investors are paying directly to the profits the business is already generating. The higher the expected growth and the lower the perceived risk, the more investors are usually willing to pay in terms of a higher PE multiple.

Airbnb currently trades on a PE of about 27.84x. That sits above the broader Hospitality industry average of roughly 21.23x, but slightly below the peer group average of around 29.53x. To move beyond simple comparisons, Simply Wall St estimates a proprietary Fair Ratio of about 30.08x, which reflects Airbnb’s specific mix of earnings growth, margins, scale, industry, and risk profile.

This Fair Ratio is more tailored than broad industry or peer benchmarks because it adjusts for how quickly Airbnb is growing and how risky that growth might be. With the Fair Ratio modestly above today’s 27.84x, the multiple suggests the shares are trading at a discount to what would be expected for a business of its quality and prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

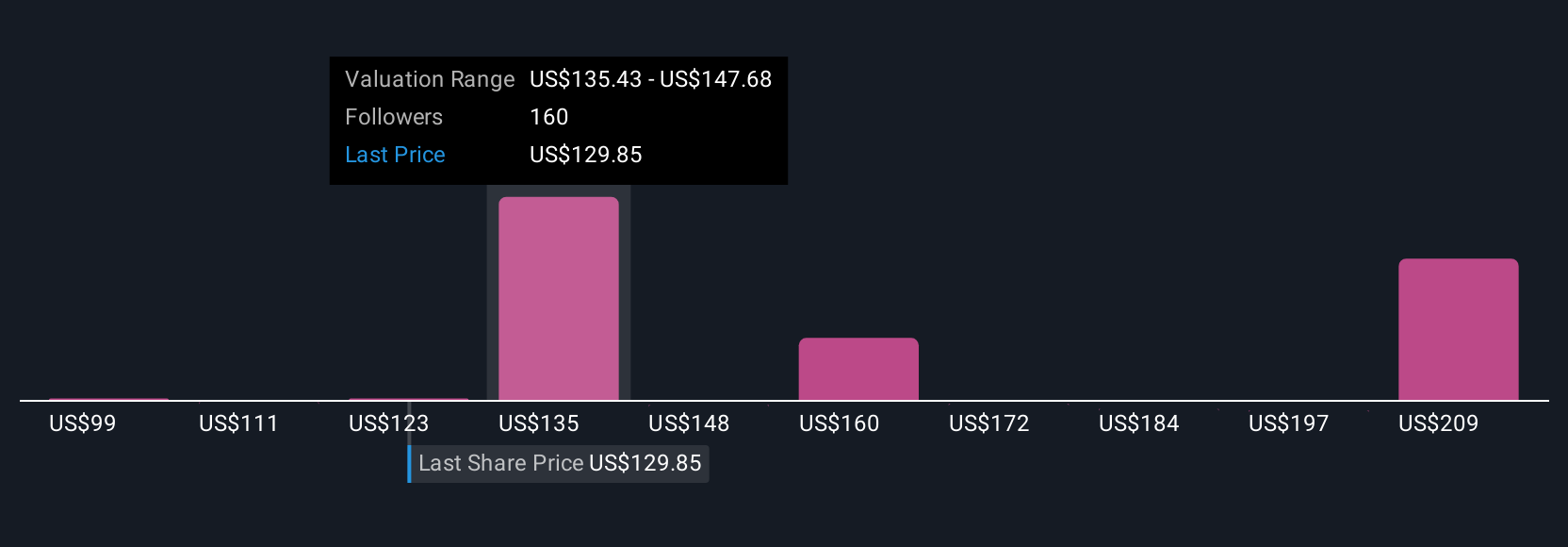

Upgrade Your Decision Making: Choose your Airbnb Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Airbnb’s future with the numbers behind it. A Narrative is your story about a company written in financial form, where your expectations for revenue growth, profit margins, and risk come together into a clear fair value estimate. Instead of treating forecasts and price targets as abstract numbers, a Narrative links what you believe about Airbnb’s business to a forecast, and then to what you think the shares are actually worth. On Simply Wall St, Narratives live inside the Community page, where millions of investors use them as an easy, accessible tool to decide whether to buy, hold, or sell by comparing Fair Value with today’s Price. They also update dynamically as new information, like earnings or news on regulations, is released so your view never goes stale. For example, one Airbnb Narrative might see a Fair Value around $98 because regulation and slowing growth dominate the story, while another might land near $181 because it leans into faster international expansion, stronger margins, and a higher future PE.

Do you think there's more to the story for Airbnb? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报