How Macy’s Upgraded Sales Outlook And Buybacks At Macy’s (M) Has Changed Its Investment Story

- Macy’s, Inc. reported past third-quarter 2025 results showing revenue of US$4.91 billion and net income of US$11 million, while also updating investors on its year-to-date performance through November 1, 2025.

- Alongside modest year-on-year earnings pressure, Macy’s raised its full-year 2025 net sales guidance and continued shrinking its share count through buybacks, underscoring management’s confidence in its turnaround efforts.

- Next, we’ll examine how Macy’s upgraded full-year sales outlook reshapes the existing investment narrative built around modest earnings expectations.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Macy's Investment Narrative Recap

Macy’s investment case still rests on its ability to turn a shrinking store base into a leaner omni-channel business while protecting margins from tariffs and promotions. The latest quarter’s small profit and higher full-year sales guidance modestly support the near term catalyst around comp growth, but do little to ease the key risk that persistent cost pressures and store closures could cap earnings progress.

The most relevant update here is Macy’s decision to raise 2025 net sales guidance to US$21.475 billion to US$21.625 billion despite prior store closures that removed roughly US$700 million in annual sales. That helps frame the turnaround thesis around better productivity per store and digital growth, even as tariff-driven margin pressure and changing shopper behavior remain front of mind.

Yet while guidance has improved, investors should still be aware that heavier tariff and pricing pressure could...

Read the full narrative on Macy's (it's free!)

Macy's narrative projects $18.5 billion revenue and $663.0 million earnings by 2028.

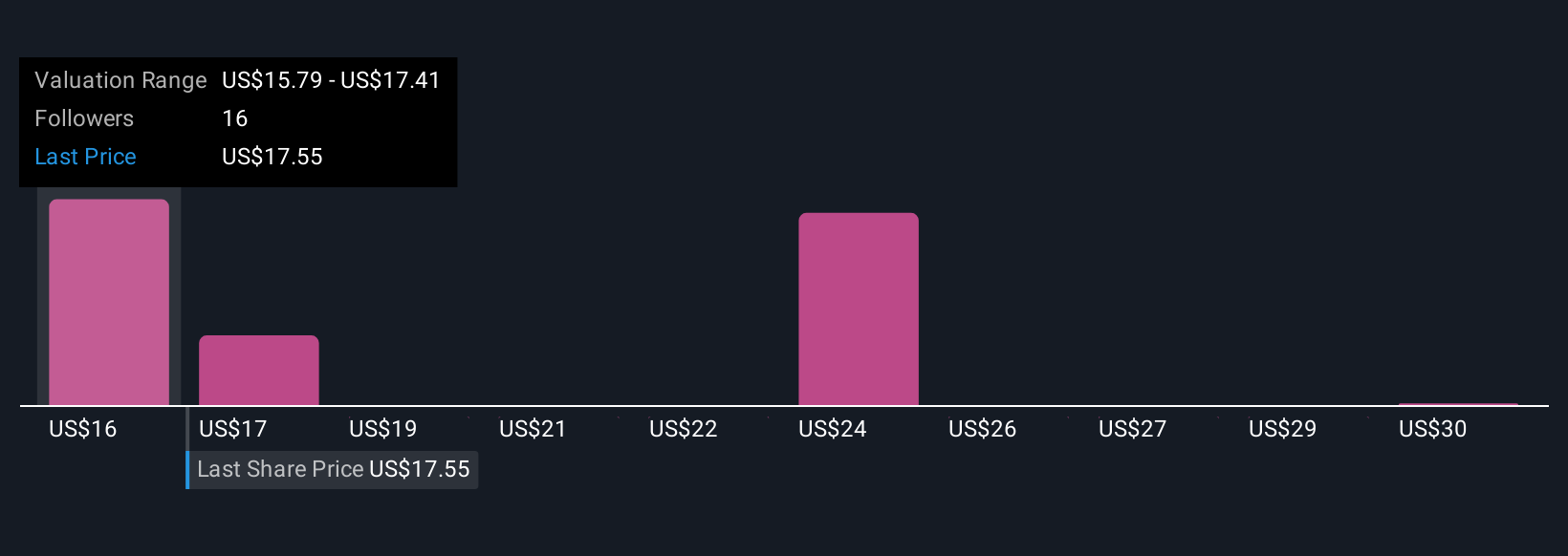

Uncover how Macy's forecasts yield a $17.32 fair value, a 22% downside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community span roughly US$17.32 to US$32 per share, showing how far apart individual views can be. As you weigh those opinions against Macy’s raised sales outlook and ongoing margin headwinds from tariffs, it is worth exploring several alternative viewpoints on what could matter most for future performance.

Explore 4 other fair value estimates on Macy's - why the stock might be worth 22% less than the current price!

Build Your Own Macy's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Macy's research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Macy's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Macy's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报