Is It Too Late to Consider Twilio After Recent Share Price Swings?

- Investors may be wondering if Twilio at around $125 a share is still a smart way to gain exposure to the communications API space, or if most of the upside has already been priced in.

- After a bumpy few weeks with the stock down 1.4% over 7 days and 3.7% over 30 days, Twilio is still up 14.8% year to date and 13.5% over the last year, while the 3 year gain of 173.5% contrasts sharply with a 62.6% drop over 5 years.

- Those swings sit against a backdrop of Twilio doubling down on customer engagement tools, pushing deeper into omnichannel communications, and sharpening its focus on profitability and operating efficiency. Investors have been reacting to management’s strategic shift away from pure top line growth toward more disciplined, higher quality revenue and margin expansion.

- On our scorecard, Twilio currently clocks a 2 out of 6 valuation checks, suggesting some pockets of value but also areas where the price looks full. Next, we will unpack what different valuation approaches say about that number, before circling back at the end to a more holistic way to think about what Twilio is really worth.

Twilio scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Twilio Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back to today in dollar terms. For Twilio, the model uses a 2 Stage Free Cash Flow to Equity approach, starting from last twelve month free cash flow of about $778 million and then applying analyst forecasts for the next few years.

Analysts expect Twilio's free cash flow to rise to roughly $1.19 billion by 2029, with further years extrapolated by Simply Wall St rather than based on direct analyst estimates. These projected cash flows are discounted back to today to arrive at an intrinsic value per share of about $119.

With the stock trading around $125, the DCF suggests Twilio is about 5.2% overvalued, which is a relatively small gap and well within the usual margin of error for valuation models.

Result: ABOUT RIGHT

Twilio is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Twilio Price vs Sales

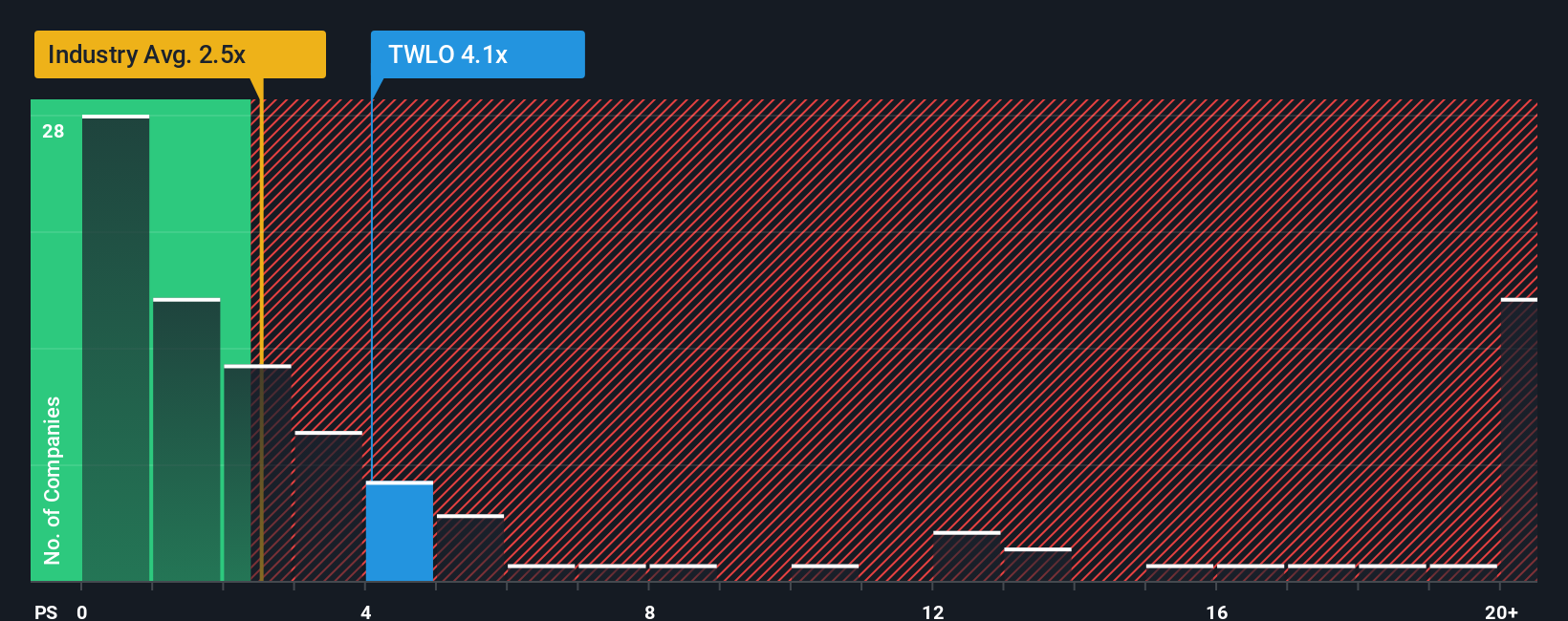

For a business like Twilio that is still prioritizing scaling its platform and has volatile earnings, the price to sales multiple is often a better gauge of market expectations than earnings-based metrics. Investors are effectively asking how many dollars they are willing to pay today for each dollar of Twilio's current annual revenue, knowing that growth and risk will drive whether that multiple ultimately proves justified.

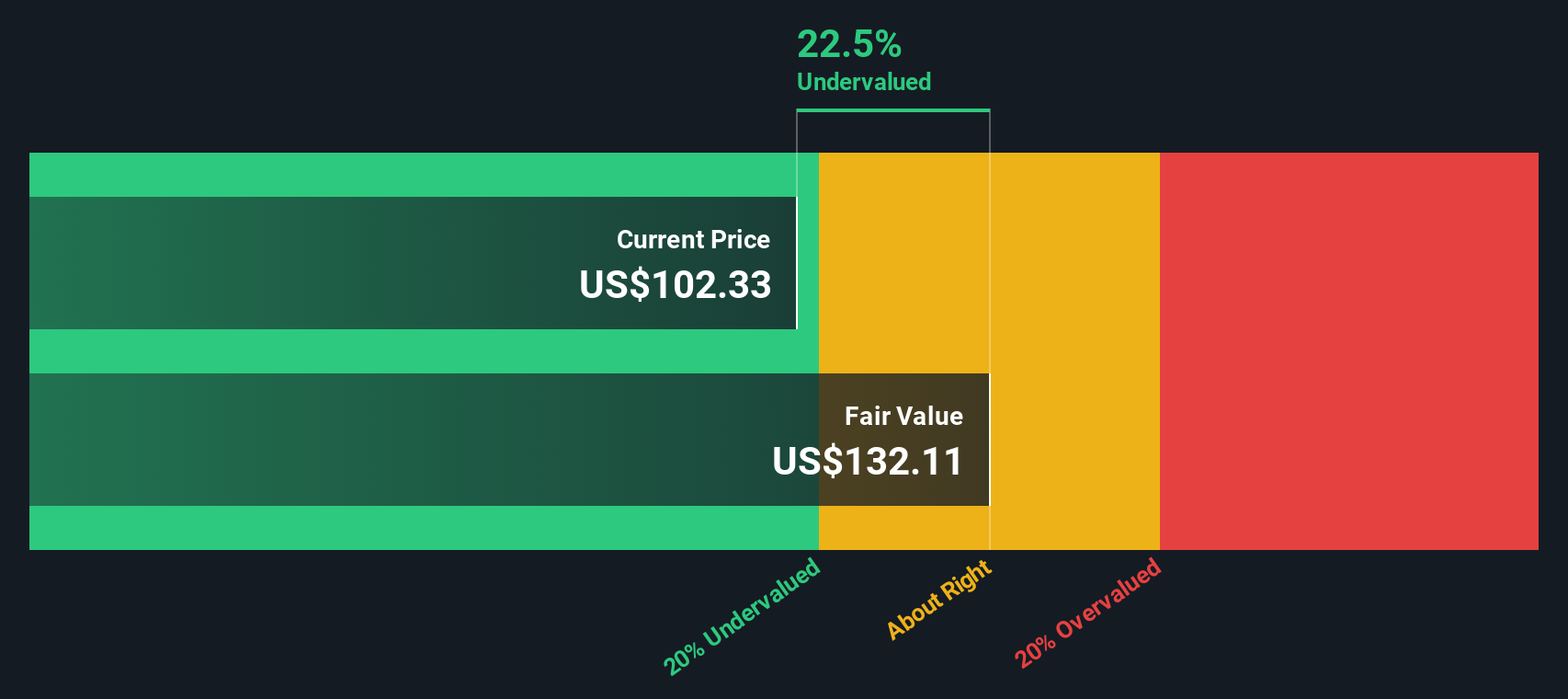

Twilio currently trades on a price to sales ratio of about 3.88x. That sits above the broader IT industry average of roughly 2.52x, but below the peer group average of around 6.54x, suggesting the market assigns Twilio a premium to the typical software name, but not as much as faster growing or more profitable communications peers. Simply Wall St's Fair Ratio for Twilio is 4.68x, which is an estimate of a reasonable price to sales multiple once the company’s growth outlook, profitability profile, risk, industry positioning and size are factored in.

This Fair Ratio framework is more tailored than a straight industry or peer comparison because it adjusts for Twilio-specific characteristics rather than assuming all software names deserve the same multiple. With the stock at 3.88x compared to a Fair Ratio of 4.68x, Twilio appears modestly undervalued on this measure.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

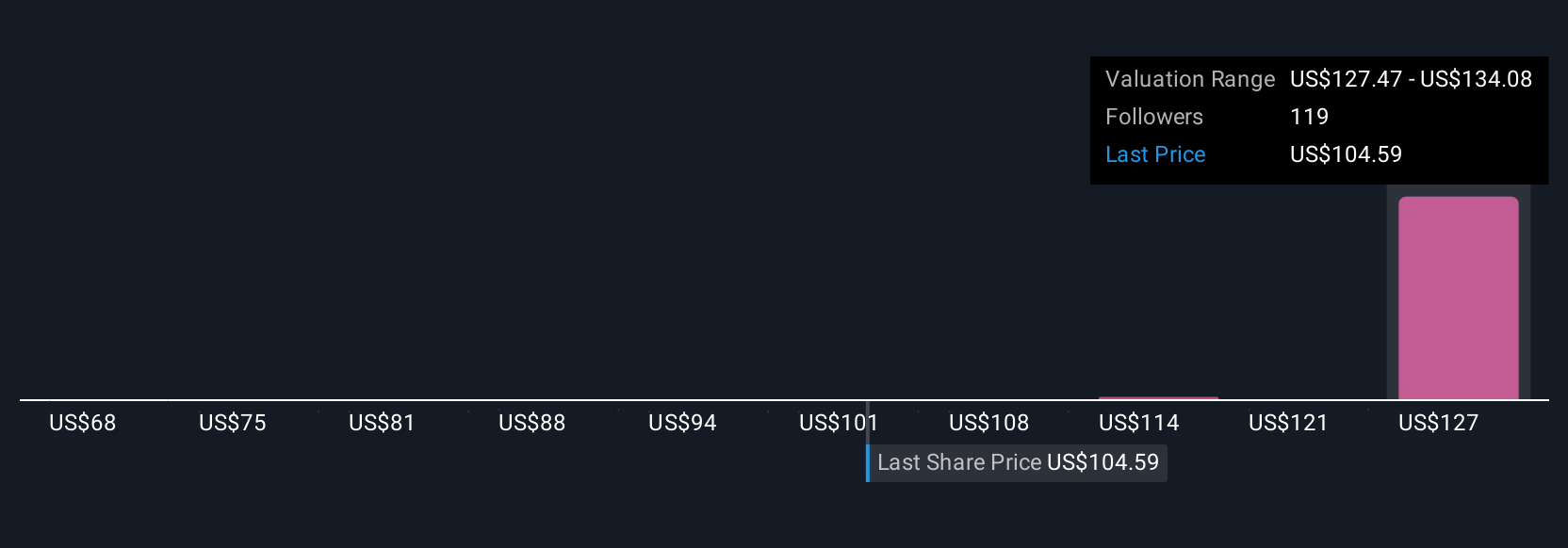

Upgrade Your Decision Making: Choose your Twilio Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Twilio’s business with the numbers behind its future. A Narrative is your story about the company, translated into concrete expectations for revenue growth, profit margins and risk, which then flow through to a financial forecast and an explicit fair value estimate. On Simply Wall St, Narratives live inside the Community page, where millions of investors can build and compare these story driven models without needing to code spreadsheets or valuation templates. Once you set up a Narrative, the platform continuously compares your Fair Value to Twilio’s current share price to flag when it looks meaningfully undervalued or overvalued, and it updates dynamically as new earnings, news and guidance are released. For Twilio, one Narrative might see fair value closer to $68 with more modest growth and thin margins, while another might justify about $138 based on stronger AI driven adoption and margin expansion, giving you a clear, side by side view of how different assumptions translate into different decisions.

For Twilio however we'll make it really easy for you with previews of two leading Twilio Narratives:

Fair value: $138.04

Implied undervaluation vs current price: -13.30%

Revenue growth assumption: 7.93%

- Views Twilio as a key long term beneficiary of rising demand for AI powered, omnichannel customer engagement tools, particularly voice AI and advanced messaging.

- Expects product innovation, deeper platform integration, and international expansion to lift margins, free cash flow, and overall earnings quality.

- Anchors on analyst forecasts that justify a higher fair value if Twilio can deliver mid to high single digit revenue growth, margin expansion toward mid single digits, and a premium future P/E multiple.

Fair value: $68.00

Implied overvaluation vs current price: 84.15%

Revenue growth assumption: 24.14%

- Argues Twilio would not meet the strict profitability, predictability, and margin of safety standards favored by conservative, value oriented investors like Warren Buffett.

- Highlights competitive and technological risks in a fast moving communications and AI landscape, along with a business model that still lacks durable, proven economics.

- Concludes that at current levels the stock does not offer a sufficient margin of safety, making it more appropriate for growth focused investors willing to accept higher uncertainty.

Do you think there's more to the story for Twilio? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报