Is Public Service Enterprise Stock Underperforming the S&P 500?

With a market cap of $40.3 billion, Public Service Enterprise Group Incorporated (PEG) operates through its PSE&G and PSEG Power segments. The company provides electric and gas transmission and distribution services, invests in solar and energy-efficiency projects, and operates nuclear generation facilities across the United States.

Companies valued over $10 billion are generally described as “large-cap” stocks, and Public Service Enterprise fits right into that category. As of December 31, 2024, PSEG managed extensive electric, gas, and solar infrastructure, including 25,000 circuit miles of transmission and distribution lines and 158 MW of installed solar capacity.

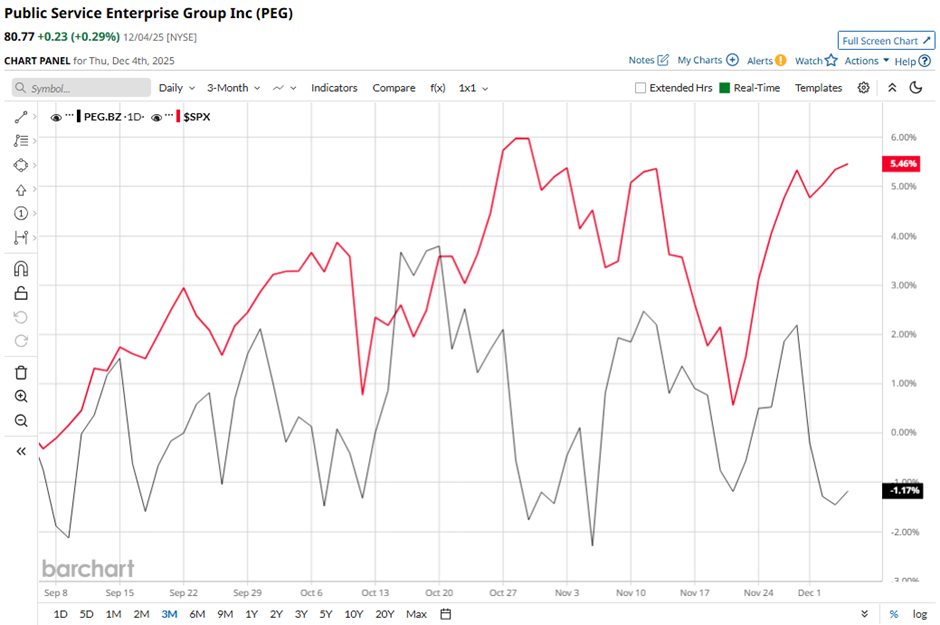

Shares of the Newark, New Jersey-based company have fallen 12.5% from its 52-week high of $92.25. Public Service Enterprise’s shares have decreased 1.2% over the past three months, lagging behind the broader S&P 500 Index’s ($SPX) 5.5% gain over the same time frame.

In the longer term, PEG stock is down 4.4% on a YTD basis, underperforming SPX’s 16.6% increase. Moreover, shares of the company have dropped over 12% over the past 52 weeks, compared to the 12.7% return of the SPX over the same time frame.

Despite recent fluctuations, the stock has been trading below its 50-day and 200-day moving averages since late August.

Despite reporting weaker-than-expected Q3 2025 revenue of $2.37 billion, shares of PEG recovered marginally on Nov. 3 as adjusted EPS of $1.13 topped the consensus and rose from $0.90 a year earlier. Investors also responded positively to strong operating results, with Q3 adjusted operating earnings reaching $565 million, driven by $515 million from PSE&G, and to management’s decision to narrow full-year EPS guidance to the upper half of $4 - $4.06.

Moreover, rival NextEra Energy, Inc. (NEE) has outpaced pronounced PEG stock. NEE stock has soared 16.3% on a YTD basis and 10.1% over the past 52 weeks.

Despite the stock’s weak performance over the past year, analysts remain moderately optimistic on PEG. It has a consensus rating of “Moderate Buy” from the 20 analysts in coverage, and the mean price target of $92.09 is a premium of 14% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Nasdaq

Nasdaq 华尔街日报

华尔街日报