Exploring Undiscovered Gems in Canada for December 2025

As the Canadian market continues to demonstrate resilience amidst policy shifts and global uncertainties, the TSX is on track for its strongest calendar-year return since 2009. This positive momentum provides an opportune backdrop for investors to explore lesser-known stocks that exhibit strong fundamentals and growth potential, particularly in sectors poised to benefit from evolving economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 13.62% | 30.86% | ★★★★★★ |

| Itafos | 20.68% | 9.86% | 37.00% | ★★★★★★ |

| Orogen Royalties | NA | 50.65% | 42.51% | ★★★★★★ |

| Mako Mining | 5.29% | 37.41% | 60.51% | ★★★★★★ |

| Soma Gold | 37.84% | 26.84% | 22.13% | ★★★★★★ |

| Melcor Developments | 47.67% | 8.75% | 12.05% | ★★★★☆☆ |

| Corby Spirit and Wine | 54.56% | 11.67% | -4.04% | ★★★★☆☆ |

| Queen's Road Capital Investment | 7.68% | -3.30% | -0.82% | ★★★★☆☆ |

| Dundee | 1.46% | -35.04% | 52.59% | ★★★★☆☆ |

| Goldmoney | 48.12% | -46.91% | 0.88% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Birchcliff Energy (TSX:BIR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Birchcliff Energy Ltd. is an intermediate oil and natural gas company focused on the exploration, development, and production of natural gas, light oil, condensate, and other natural gas liquids in Western Canada with a market cap of CA$2.14 billion.

Operations: Birchcliff Energy generates revenue primarily from its oil and gas exploration and production segment, amounting to CA$666.41 million. The company's financial performance is reflected in its net profit margin, which provides insight into profitability after accounting for all expenses.

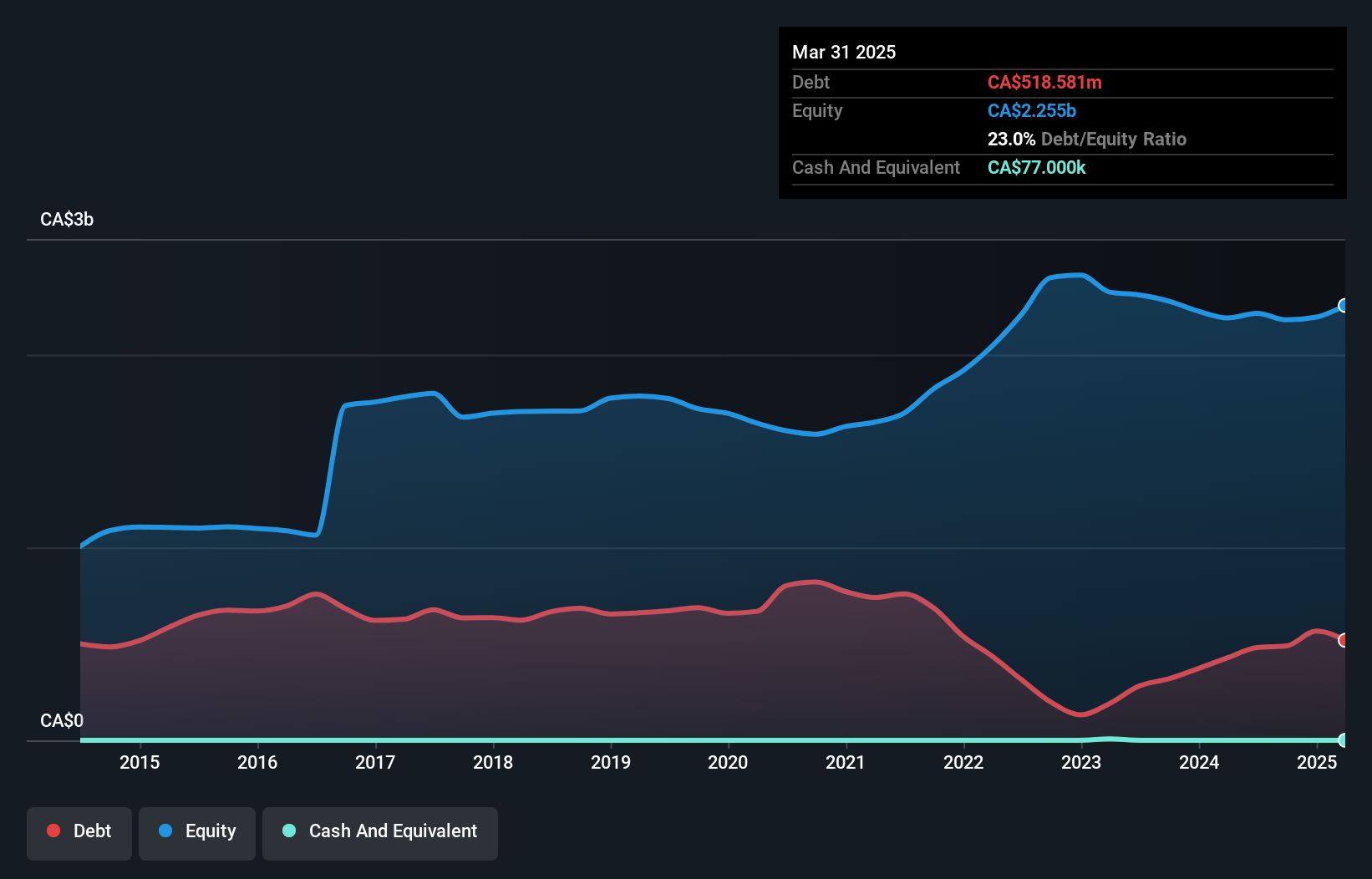

Birchcliff Energy, a notable player in the Canadian energy sector, has demonstrated impressive financial health with its debt to equity ratio dropping from 51.7% to 23.6% over five years and maintaining a satisfactory net debt to equity ratio of 23.6%. The company's earnings grew by an astounding 375%, outpacing the industry average of -0.8%, highlighting its robust performance despite market challenges. Recently, Birchcliff announced a share repurchase program for up to 26.77 million shares, signaling confidence in its valuation as it trades at about half of its estimated fair value (51.4% below).

- Navigate through the intricacies of Birchcliff Energy with our comprehensive health report here.

Gain insights into Birchcliff Energy's past trends and performance with our Past report.

Kiwetinohk Energy (TSX:KEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kiwetinohk Energy Corp. is engaged in the production of natural gas, natural gas liquids, oil, and condensate in Canada with a market capitalization of approximately CA$1.10 billion.

Operations: Kiwetinohk Energy derives its revenue primarily from the exploration and development of petroleum and natural gas, generating CA$586.66 million in this segment. The company has a market capitalization of approximately CA$1.10 billion.

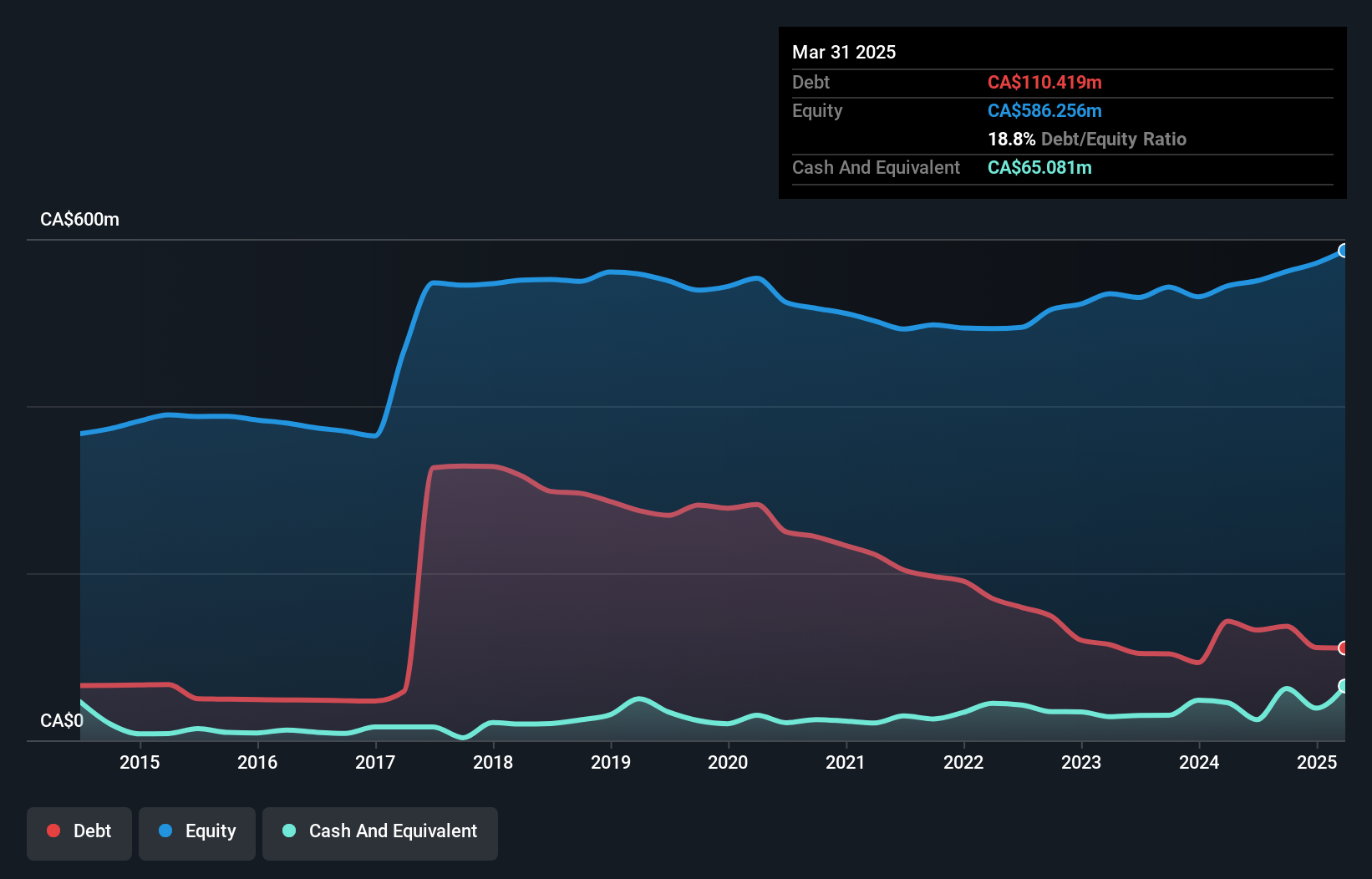

Kiwetinohk Energy, a Canadian energy player, shows promising yet mixed signals. Its earnings growth of 77.9% over the past year surpasses the Oil and Gas industry's -0.8%. Despite this, recent quarterly net income dropped to CAD 18 million from CAD 32 million last year. The company's EBIT covers interest payments 8 times over, indicating strong financial health in this area. With a net debt to equity ratio at a satisfactory 23%, it remains financially stable despite increased debt levels over five years. A potential acquisition by Cygnet Energy for CAD 1.1 billion could reshape its future landscape significantly if approved later this month.

- Unlock comprehensive insights into our analysis of Kiwetinohk Energy stock in this health report.

Examine Kiwetinohk Energy's past performance report to understand how it has performed in the past.

Total Energy Services (TSX:TOT)

Simply Wall St Value Rating: ★★★★★★

Overview: Total Energy Services Inc. is an energy services company operating in Canada, the United States, Australia, and internationally with a market capitalization of approximately CA$547.38 million.

Operations: Total Energy Services generates revenue through four key segments: Well Servicing (CA$120.41 million), Contract Drilling Services (CA$328.56 million), Compression and Process Services (CA$481.65 million), and Rentals and Transportation Services (CA$79.22 million).

Total Energy Services, a player in the energy sector, is trading at a significant discount, approximately 89.1% below its estimated fair value. Over the past five years, it has improved its debt profile with a reduction in the net debt to equity ratio from 47.1% to 15.1%. The company reported earnings growth of 41.7% last year, surpassing industry averages by a wide margin. Recent activities include repurchasing shares worth CAD 23.21 million and extending CAD 170 million credit facilities until January 2029, which underscores its strategic financial management and pursuit of growth opportunities in North America and Australia.

- Get an in-depth perspective on Total Energy Services' performance by reading our health report here.

Explore historical data to track Total Energy Services' performance over time in our Past section.

Summing It All Up

- Unlock our comprehensive list of 46 TSX Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报