Methode Electronics (MEI) Q2: Ongoing Net Losses Challenge Value-Focused Bullish Narratives

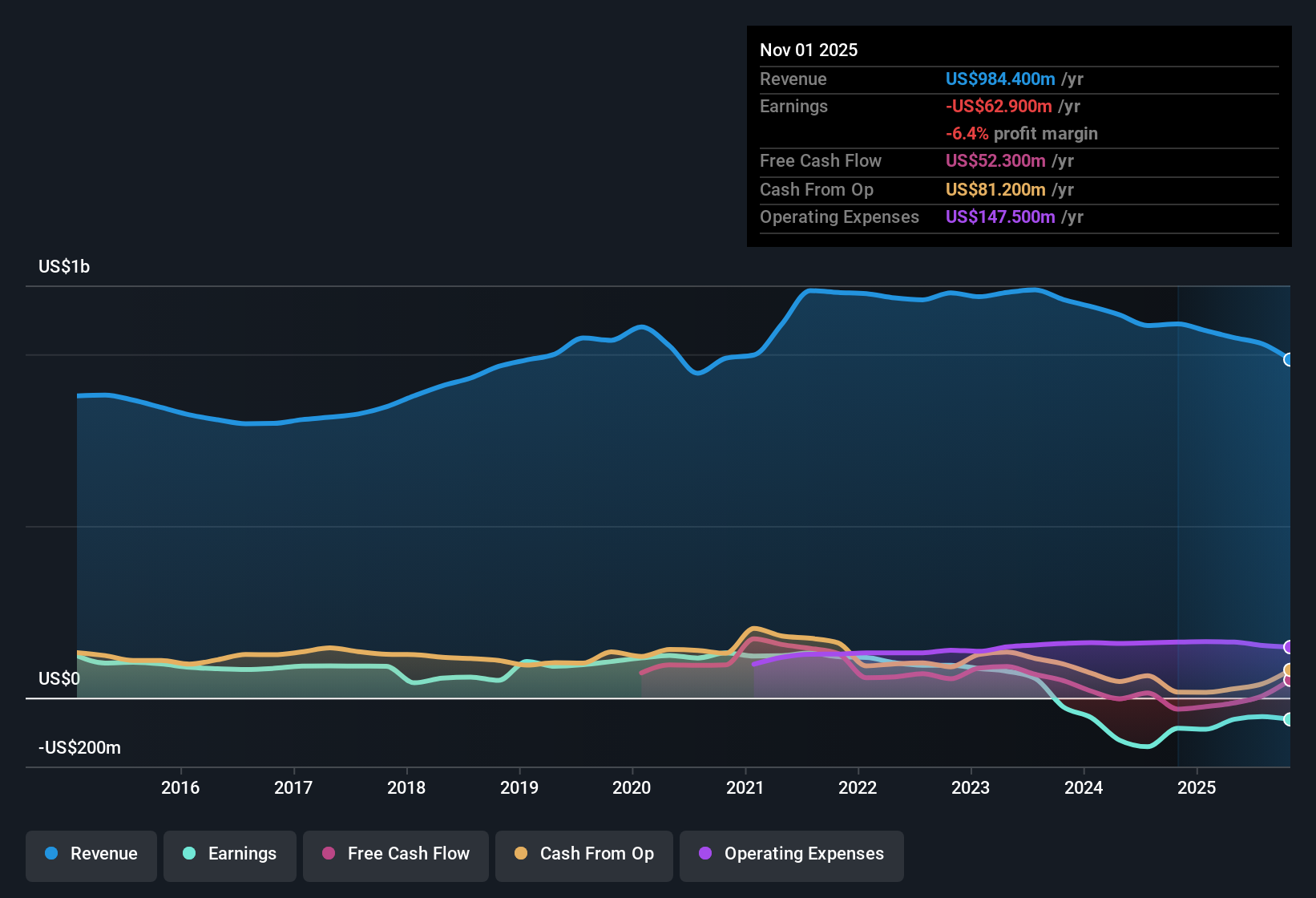

Methode Electronics (MEI) just posted Q2 2026 results with revenue of $246.9 million and a basic EPS loss of $0.28, as the trailing twelve months show revenue of $984.4 million alongside a basic EPS loss of $1.78. The company has seen quarterly revenue move in a relatively tight band from $292.6 million in Q2 2025 to $246.9 million in Q2 2026, while EPS has stayed in negative territory across the same stretch. This is setting the stage for investors to focus on how long current margin pressure might persist and what could eventually lift profitability.

See our full analysis for Methode Electronics.With the headline numbers on the table, the next step is to compare these results with the dominant narratives around Methode, highlighting where the latest margin profile supports the story and where it pushes back.

See what the community is saying about Methode Electronics

Losses Narrow but Remain Persistent

- Net income excluding extra items came in at a loss of $9.9 million in Q2 2026 versus a $28.3 million loss in Q4 2025, while trailing twelve month net losses sit at $62.9 million on $984.4 million of revenue.

- Consensus narrative points to cost discipline and operational changes as future margin drivers. However, the data still shows negative profit margins over the last year and losses that have grown at about 59.6% per year over five years, so the path from current losses to stronger EBITDA and net margins is not yet visible in the reported numbers.

- The narrative highlights plant consolidations and supply chain optimization as margin tailwinds, but trailing EPS is still a loss of $1.78 over the last twelve months.

- Analysts assume profit margins could eventually move from about negative 6.0% to 9.0%. However, current results only show that the company remains unprofitable today rather than clearly progressing toward that industry level.

Revenue Stabilizes While Growth Outlook Softens

- Quarterly revenue has held in a relatively tight band between $239.9 million and $292.6 million since Q1 2025, landing at $246.9 million this period, while trailing twelve month revenue slipped from $1,087.9 million in Q2 2025 to $984.4 million in Q2 2026.

- Consensus narrative leans on data center power and EV programs as future growth engines. However, forecasts now point to revenue changing at about negative 6.8% per year over the next three years compared with prior trailing context of 0.7% per year, which shows that expected top line momentum is modest relative to the broader US market and sits beside the story of high growth sectors in a less supportive way.

- While the narrative notes nearly doubled data center power revenues, the consolidated line still trends down on a trailing basis from just over $1.08 billion to $984.4 million.

- Customer concentration and program risk, such as the Stellantis program impact, helps explain why these newer segments have not yet offset declines elsewhere in the reported totals.

Cheap Valuation Versus Deep Profitability Challenges

- At a share price of $7.74, Methode trades at about 0.3 times trailing sales compared with a peer average of 8.4 times and an industry average of 2.5 times. It also sits well below a DCF fair value of about $21.73 and an analyst price target of $10.25.

- Bears highlight that losses have increased at about 59.6% per year over five years and that the 3.62 percent dividend yield is not covered by earnings. The current trailing net loss of $62.9 million alongside forecasts for continued unprofitability over the next three years aligns with those concerns, even as the low multiples and large gap to DCF fair value offer a clear value argument.

- The stock’s roughly 64 percent discount to DCF fair value may attract value focused investors, but ongoing negative EPS of $1.78 over the last twelve months underscores why skeptics focus on execution risk.

- The uncovered dividend and expectation of continued losses mean any re rating toward either the $10.25 analyst target or DCF fair value likely depends on a visible turn in profitability that is not yet present in the trailing figures.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Methode Electronics on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers in a different light? Use that angle to shape your own narrative in just a few minutes, starting with Do it your way.

A great starting point for your Methode Electronics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Explore Alternatives

Methode’s widening multi year losses, weakening revenue trend, and uncovered dividend show that profitability and cash support remain uncertain despite the apparent valuation discount.

If you want steadier results than this unpredictable margin and earnings profile, use our stable growth stocks screener (2078 results) to focus on companies delivering consistent revenue and profit growth through different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报