Has Intel’s 100% 2025 Rally Fully Reflected Its AI and Foundry Ambitions?

- Wondering if Intel at around $40.50 is still a bargain or if most of the upside has already been priced in? You are not the only one trying to figure out whether now is the moment to buy or wait.

- Over the last week Intel is up about 10.0%, adding to a 9.4% gain over the past month and a striking 100.3% return year to date. This has quickly changed how investors are thinking about both its upside and its risks.

- Much of this move has been driven by renewed optimism around Intel's foundry ambitions and its role in the broader AI and data center build out, as investors reassess whether it can close the gap with rivals in advanced manufacturing. At the same time, regulatory and geopolitical headlines around US chip policy and supply chain resilience have kept sentiment volatile. This underscores that this is not a low drama turnaround story.

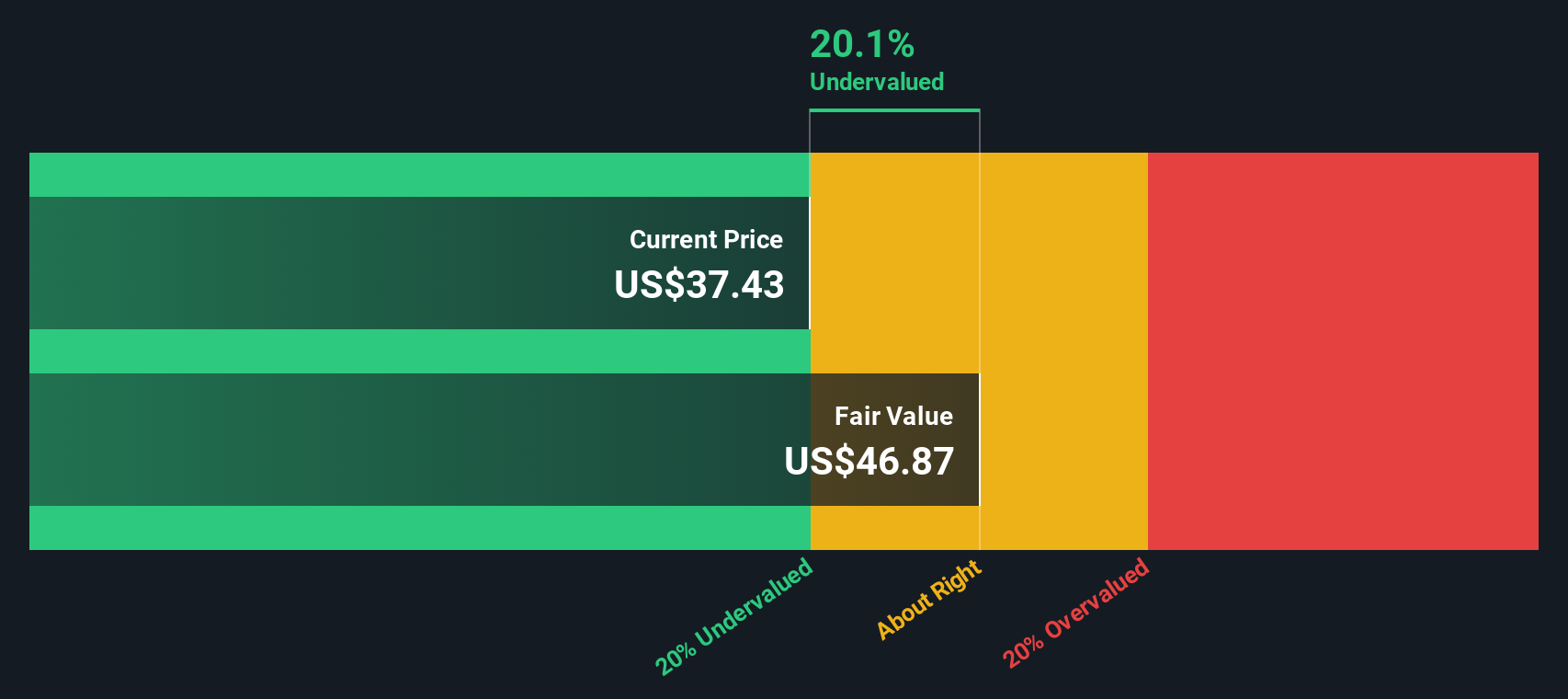

- Right now Intel scores a 3 out of 6 on our valuation checks, suggesting the stock looks undervalued on several measures but not across the board. In the sections that follow we will unpack those traditional valuation approaches before circling back to a more powerful way to think about Intel's true worth.

Approach 1: Intel Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future cash flows and discounting them back to the present. For Intel, the 2 Stage Free Cash Flow to Equity model starts from last twelve month free cash flow of roughly negative $13.7 billion, highlighting how heavy investment is currently depressing cash generation.

Analysts and extrapolations used by Simply Wall St then project a recovery, with free cash flow expected to turn positive and reach about $4.3 billion by 2029 and continue rising through the early 2030s. These projected cash flows, all in dollars, are discounted back to today to estimate what the entire stream is worth on a per share basis.

On this basis, Intel’s intrinsic value is estimated at about $15.34 per share, while the current market price is around $40.50. That implies the stock is roughly 164.0% overvalued relative to this cash flow based model, indicating that today’s price already reflects a very optimistic turnaround scenario.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Intel may be overvalued by 164.0%. Discover 914 undervalued stocks or create your own screener to find better value opportunities.

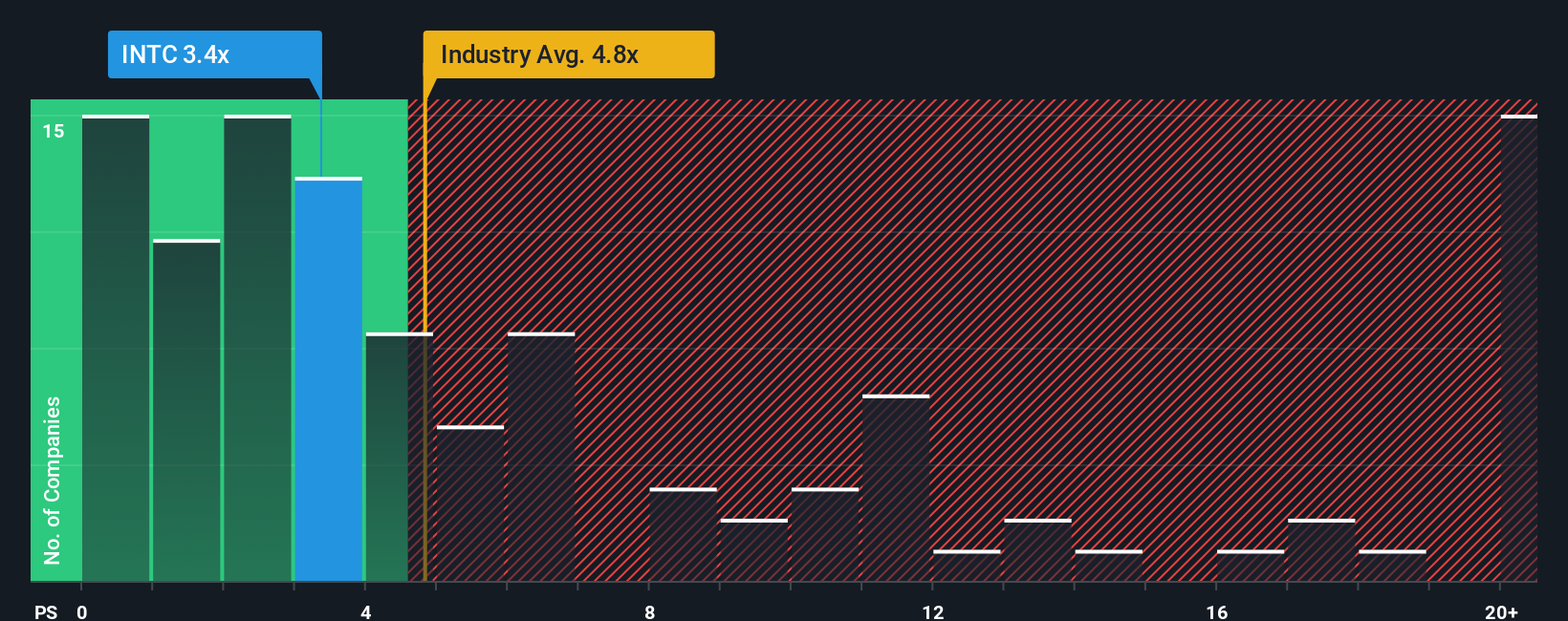

Approach 2: Intel Price vs Sales

For a company like Intel that is still rebuilding profitability but generates substantial revenue, the price to sales multiple is a practical way to gauge what investors are paying for each dollar of current business activity. In general, higher growth and lower perceived risk can justify a richer multiple, while slower growth or execution concerns should pull it down.

Intel currently trades on a price to sales ratio of about 3.6x, which is below the broader Semiconductor industry average of roughly 5.5x and well under the peer group average of around 14.9x. Simply Wall St’s proprietary Fair Ratio for Intel is estimated at about 5.5x, reflecting what investors might reasonably pay given its growth outlook, margins, industry positioning and risk profile.

This Fair Ratio is more informative than a simple comparison with peers or the sector, because it explicitly bakes in Intel’s specific characteristics instead of assuming it should trade like a typical chip stock. With the market valuing Intel at 3.6x sales versus a Fair Ratio near 5.5x, the multiple suggests the shares are currently trading at a discount to their fundamentals.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

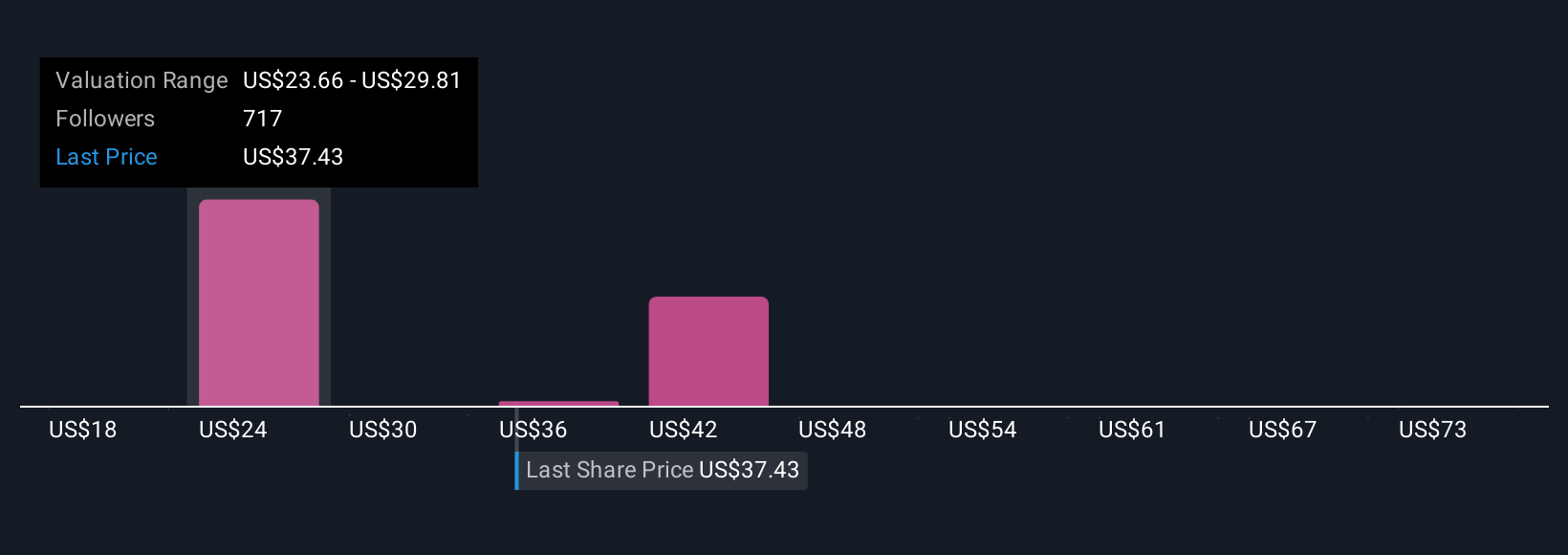

Upgrade Your Decision Making: Choose your Intel Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Intel’s future with the numbers behind it. A Narrative is the story you believe about a company, translated into concrete assumptions for revenue growth, profit margins, future multiples and a fair value estimate. On Simply Wall St, Narratives live inside the Community page, where millions of investors turn their views into structured forecasts so you can see exactly how a story maps into a model. Each Narrative links three things: what you think will happen in Intel’s business, what that implies for future financials, and the fair value that falls out of those numbers. Narratives then help you assess your own decisions by comparing that fair value to Intel’s current share price, giving you a clear signal instead of a vague hunch. They also update dynamically as new earnings, news, and guidance arrive so your story and valuation stay in sync with reality. For example, some Intel Narratives see fair value near $16, while others are closer to $37, reflecting very different expectations about AI, foundry execution and margins.

Do you think there's more to the story for Intel? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报