Flex’s AI Data Center Pivot and NVIDIA, LG Deals Might Change The Case For Investing In Flex (FLEX)

- In recent months, Flex introduced a new AI-focused data center infrastructure platform and disclosed collaborations with NVIDIA and LG Electronics to build modular, energy-efficient data center solutions, aiming to speed up deployments and lower implementation risks for customers.

- This push deeper into AI-driven data center hardware and integrated systems is reshaping Flex’s role from a traditional contract manufacturer to a higher-value, solution-oriented partner across global cloud and AI infrastructure buildouts.

- We’ll now examine how Flex’s AI-centric data center platform and partnerships could influence its investment narrative and future risk-reward balance.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Flex Investment Narrative Recap

To own Flex, you need to believe its shift toward higher value, AI-centric data center solutions can offset thin margins and concentration in a handful of large cloud customers. The new AI data center platform and NVIDIA and LG collaborations may strengthen the most important short term catalyst, which is continued data center segment growth, but they do little to change the key near term risk around potential insourcing or spend shifts by major hyperscaler clients.

Among Flex’s recent developments, the deployment of its advanced liquid cooling and integrated rack solutions at Equinix’s Ashburn facility stands out as most relevant. It shows how Flex is moving beyond basic manufacturing into integrated, high density power and cooling systems that directly serve AI workloads, which aligns closely with the current data center growth catalyst while still leaving the company exposed if large customers decide to bring more of this capability in house.

Yet even as Flex deepens ties with AI data center clients, investors should be aware that customer insourcing and vertical integration could still...

Read the full narrative on Flex (it's free!)

Flex's narrative projects $29.1 billion revenue and $1.3 billion earnings by 2028. This requires 3.7% yearly revenue growth and about a $0.4 billion earnings increase from $0.9 billion today.

Uncover how Flex's forecasts yield a $73.51 fair value, a 20% upside to its current price.

Exploring Other Perspectives

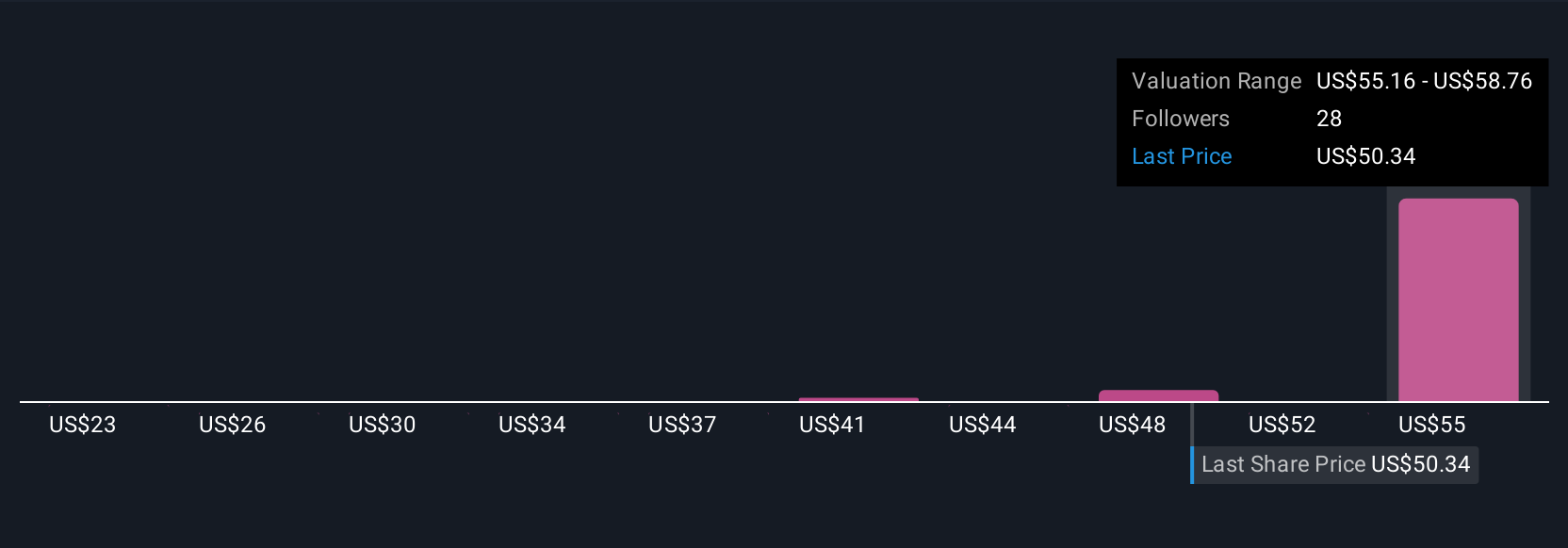

Five Simply Wall St Community valuations for Flex span from US$45 to about US$73.51, underlining how widely opinions can diverge. Against that backdrop, the company’s growing dependence on a small group of hyperscaler and colo customers raises important questions about how resilient those bullish forecasts for its data center driven performance really are.

Explore 5 other fair value estimates on Flex - why the stock might be worth as much as 20% more than the current price!

Build Your Own Flex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Flex research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Flex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Flex's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报