BlackBerry (TSX:BB) Valuation Check After QNX Sound Win With Leading Chinese Luxury EV Maker

BlackBerry (TSX:BB) just landed a meaningful design win for its QNX Sound platform with a leading Chinese automaker, securing a spot in next generation luxury EVs and pushing its automotive software story forward.

See our latest analysis for BlackBerry.

That backdrop helps explain why BlackBerry’s share price, now at $5.93, shows a solid 90 day share price return of 10.43% and a standout 1 year total shareholder return of 62.02%. This suggests momentum is rebuilding after recent volatility.

If this QNX win has you thinking more broadly about software and connected car plays, it could be a good moment to scout auto manufacturers for other interesting ideas in the space.

Yet with BlackBerry trading slightly above analyst targets but screens still flagging deep intrinsic value, investors face a key question: is this renewed momentum an underappreciated turnaround, or has the market already priced in the next leg of growth?

Price-to-Earnings of 127.3x: Is it justified?

On a headline basis, BlackBerry’s CA$5.93 share price translates into a steep price-to-earnings ratio of 127.3 times, well above peers and industry benchmarks.

The price-to-earnings ratio compares what investors pay today for each dollar of current earnings, a common yardstick for mature and emerging software names. With BlackBerry only recently returning to profitability, this elevated multiple hints that the market is pricing in a powerful earnings recovery rather than paying for today’s modest profit base.

Against the Canadian software industry average of 54.5 times earnings, BlackBerry’s 127.3 times looks aggressively priced, and it also exceeds the peer group’s 73.7 times benchmark. Our estimated fair price-to-earnings ratio of 36.8 times suggests a much lower level the market could eventually gravitate toward if expectations moderate or execution disappoints.

Explore the SWS fair ratio for BlackBerry

Result: Price-to-Earnings of 127.3x (OVERVALUED)

However, investors must still weigh modest 5.4% revenue growth and a history of weak long term returns. These factors could quickly challenge today’s upbeat expectations.

Find out about the key risks to this BlackBerry narrative.

Another View: Our DCF Model Says the Opposite

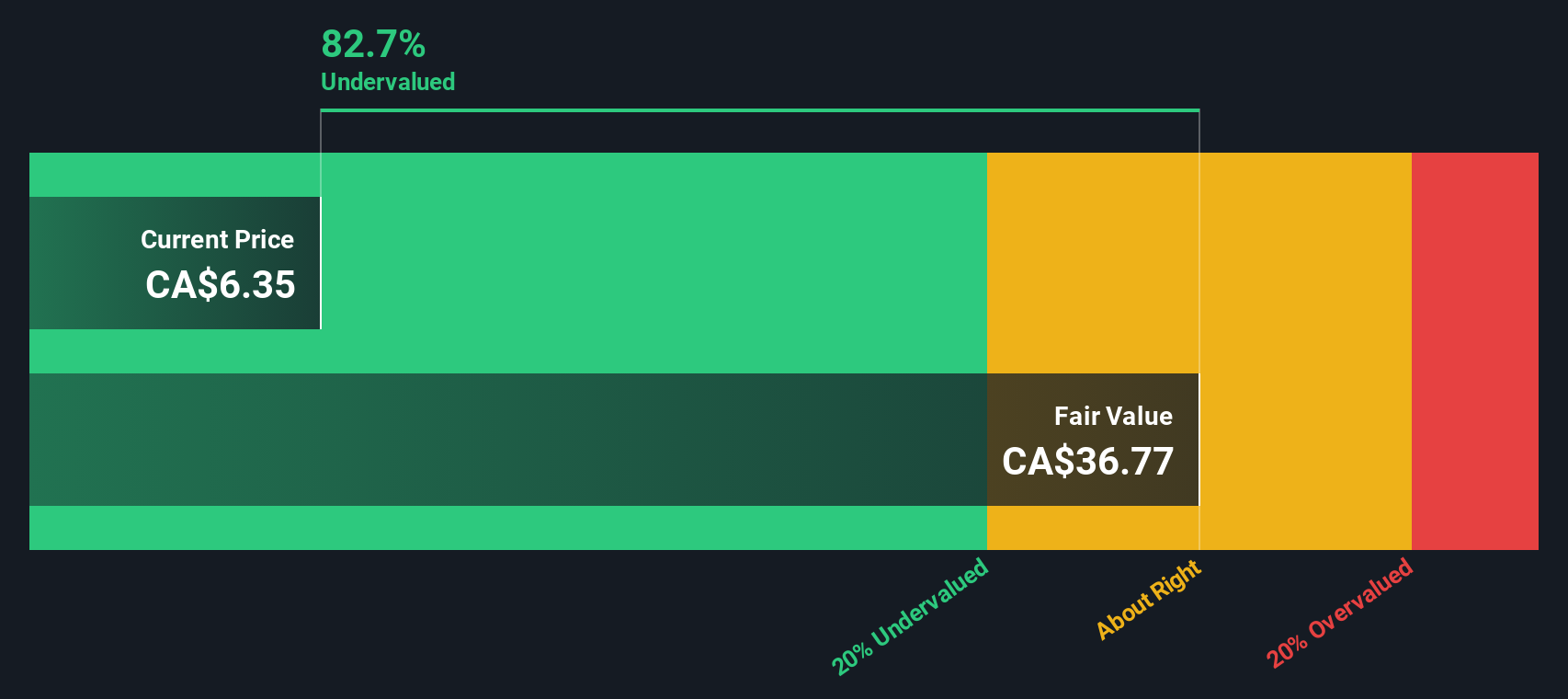

While earnings multiples make BlackBerry look expensive, our DCF model tells a different story. It suggests the shares are trading about 84% below a fair value of roughly CA$37.41, which implies the market may be heavily discounting BlackBerry’s long term cash flow potential. Which signal deserves more weight?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BlackBerry for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 911 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own BlackBerry Narrative

If you want to dig into the numbers yourself or challenge these conclusions, you can quickly build a custom view of BlackBerry in just a few minutes: Do it your way.

A great starting point for your BlackBerry research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at one opportunity when you can systematically hunt for three. Use the Simply Wall Street Screener to surface data driven candidates across the market.

- Capture potential multibaggers early by scanning these 3572 penny stocks with strong financials that already back their promise with stronger balance sheets and improving fundamentals.

- Ride the next wave of intelligent automation by targeting these 26 AI penny stocks positioned at the crossroads of software, data, and exponential computing power.

- Lock in income while rates shift by focusing on these 15 dividend stocks with yields > 3% that balance attractive yields with sustainable payout ratios and resilient cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报