Is Oculis Holding’s New Equity Shelf Shaping a More Flexible Capital Strategy for OCS Investors?

- Oculis Holding AG has closed its previously filed shelf registration dated 10 November 2025, covering US$9.39 million of ordinary shares totaling 494,259 securities.

- This completed shelf registration, alongside the vesting of restricted stock units for a company director, highlights both Oculis’s evolving capital structure and its approach to equity-based compensation.

- We’ll now explore how the completion of this US$9.39 million shelf registration shapes Oculis’s investment narrative and capital-raising flexibility.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

What Is Oculis Holding's Investment Narrative?

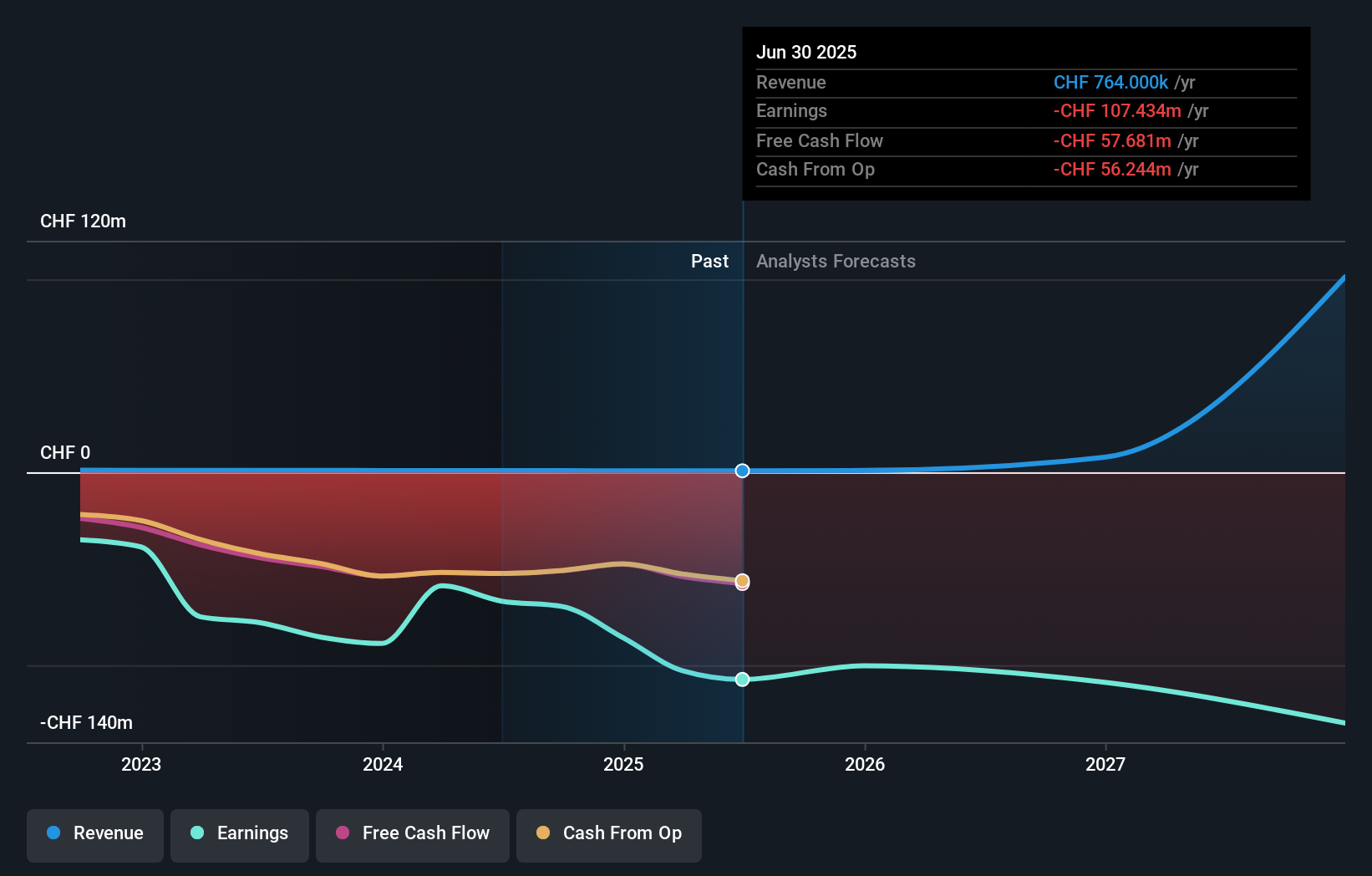

For Oculis, the core belief is that its ophthalmology pipeline, especially Privosegtor and OCS-01, can eventually justify heavy current losses and limited revenue, even at a rich price-to-book multiple. The recent closure of the US$9.39 million shelf registration, following the withdrawn US$100 million ATM and recent loan facilities, reinforces that the near-term story is still about securing flexible funding rather than changing the clinical or commercial timetable. This latest equity capacity looks small next to existing financing options, so it is unlikely to move the dial on key short term catalysts such as upcoming Privosegtor and OCS-01 milestones. It does, however, underline dilution and execution risk in a business that remains unprofitable and reliant on capital markets for runway extension. Yet there is one funding-related risk here that investors should not overlook.

In light of our recent valuation report, it seems possible that Oculis Holding is trading beyond its estimated value.Exploring Other Perspectives

The single fair value estimate from the Simply Wall St Community sits at US$44.69, suggesting a concentrated, optimistic view. Set this against Oculis’s ongoing losses and reliance on external funding, and it becomes clear why you may want to compare multiple viewpoints before deciding how its clinical and financing progress might influence future performance.

Explore another fair value estimate on Oculis Holding - why the stock might be worth just $44.69!

Build Your Own Oculis Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oculis Holding research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Oculis Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oculis Holding's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报