Could Nikon’s Yamaha Tie-Up Quietly Reframe Its Healthcare Ambitions for Investors in (TSE:7731)?

- Nikon Instruments Inc. recently announced a partnership with Yamaha Motor Co., Ltd. in the United States, combining Nikon’s advanced imaging platforms with Yamaha’s CELL HANDLER 2 system at the Nikon BioImaging Lab near Boston to support pharmaceutical drug discovery workflows.

- This collaboration expands Nikon’s presence in life sciences by offering integrated, workflow-focused services for cell-based research, deepening its role in early-stage drug development support.

- Next, we’ll examine how this life sciences partnership with Yamaha could influence Nikon’s broader investment narrative and healthcare ambitions.

Find companies with promising cash flow potential yet trading below their fair value.

Nikon Investment Narrative Recap

To own Nikon, you need to believe its shift from traditional imaging into higher value industrial and healthcare solutions can offset near term pressure in semiconductor and digital manufacturing. The Yamaha partnership adds credibility to Nikon’s healthcare push, but it does not materially change the most immediate catalyst, which remains execution in Precision Equipment, or the key risk of delayed semiconductor recovery and its impact on already reduced earnings guidance.

The announcement that Nikon is developing digital lithography systems for advanced packaging in the AI market is the clearest recent catalyst connected to this story. If Nikon can pair cutting edge lithography with growing healthcare services such as the Yamaha collaboration, investors may see a more balanced business mix that is less reliant on cyclical semiconductor orders over time.

Yet, despite these growth efforts, investors still need to be aware of...

Read the full narrative on Nikon (it's free!)

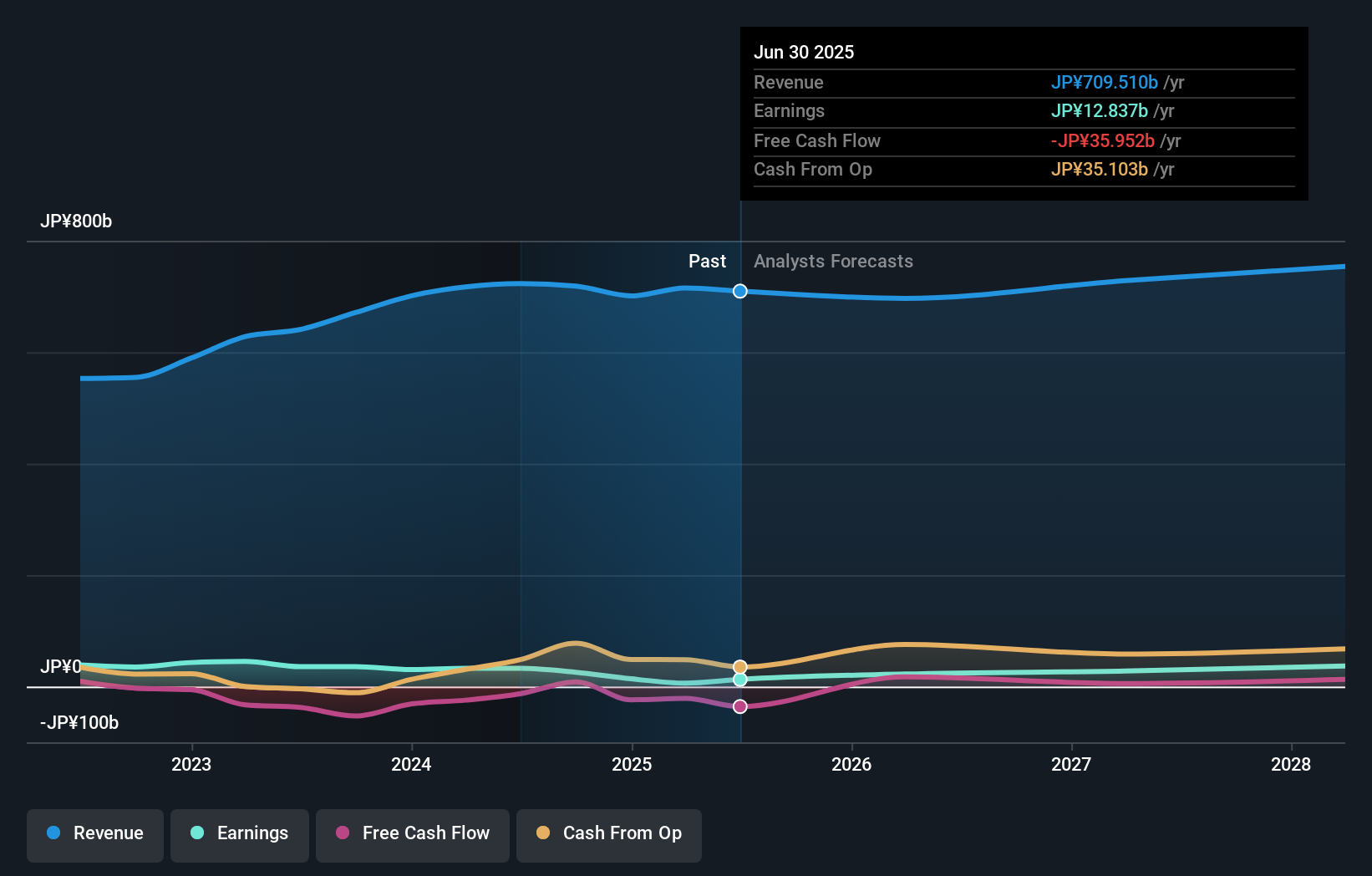

Nikon’s narrative projects ¥753.2 billion revenue and ¥41.0 billion earnings by 2028. This requires 2.0% yearly revenue growth and a ¥28.2 billion earnings increase from ¥12.8 billion today.

Uncover how Nikon's forecasts yield a ¥1546 fair value, a 16% downside to its current price.

Exploring Other Perspectives

One Simply Wall St Community member estimates Nikon’s fair value at ¥1,545.91, highlighting how a single view can differ from market pricing. You can weigh that against the risk of delayed semiconductor related recovery and decide how it fits into your own expectations for Nikon’s future performance.

Explore another fair value estimate on Nikon - why the stock might be worth as much as ¥1546!

Build Your Own Nikon Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nikon research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Nikon research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nikon's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报