UiPath (PATH) Q3 Profit Surge Tests Bearish Earnings-Decline Narrative

UiPath (PATH) just posted Q3 2026 results with revenue of about $411 million and basic EPS of $0.37, putting headline profitability firmly in the black for the quarter. The company has seen revenue move from roughly $355 million in Q3 2025 to $411 million in Q3 2026, while basic EPS swung from a loss of $0.02 to a solid positive print of $0.37, signaling a notable turnaround in quarterly profitability. With that kind of earnings lift on a growing top line, margins are starting to look more like a scaled software platform than an early stage growth story.

See our full analysis for UiPath.With the latest numbers on the table, the next step is to see how this profitability shift and revenue trajectory match up against the prevailing narratives investors have been leaning on, and where those stories might now need a rethink.

See what the community is saying about UiPath

Profitability Flips on TTM Basis

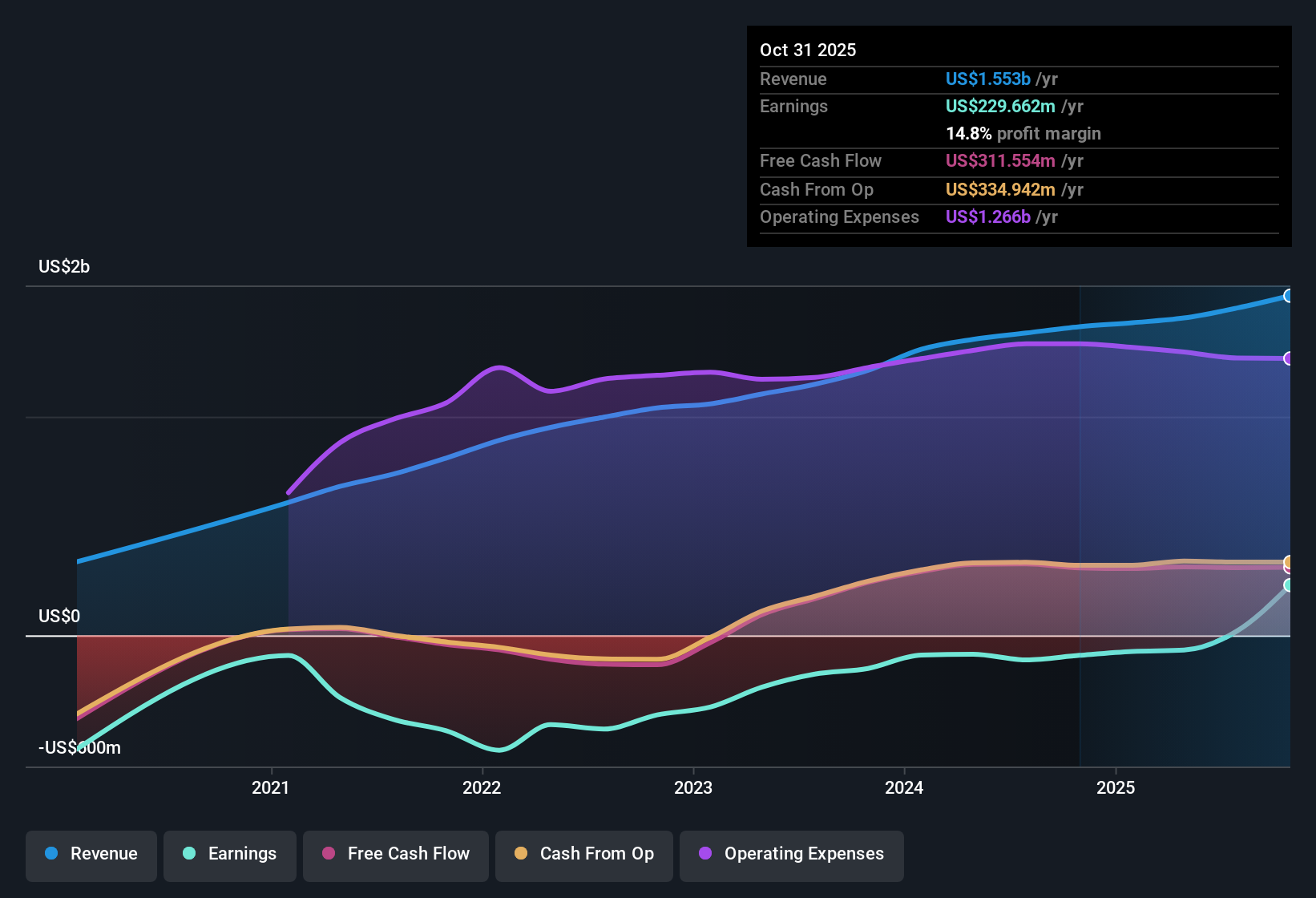

- On a trailing 12 month view, UiPath moved from a net loss of about $73.7 million in Q4 2025 to net income of roughly $229.7 million by Q3 2026, with Basic EPS rising from around negative $0.13 to positive $0.42 over the same window.

- Consensus narrative points to innovation and partnerships as growth drivers, and this new profitability gives bulls a concrete base to work from:

- Strategic moves such as agentic automation products and partnerships with firms such as Microsoft and Deloitte line up with the shift from negative trailing EPS of about negative $0.20 in mid 2025 to positive $0.42 by Q3 2026.

- The focus on cloud offerings, with more than $975 million in cloud annual recurring revenue mentioned in the narrative, sits alongside total trailing revenue of about $1.6 billion. This illustrates how a broader platform can help sustain these positive earnings.

UiPath’s sharp turn into the black has bulls asking whether this new profit base is just the start of a longer AI automation run or already priced in by the market. 🐂 UiPath Bull Case

Forecast Earnings Drop Versus 8.2% Growth

- Forward looking analysis flags that while revenue is forecast to grow about 8.2 percent per year, earnings are projected to decline by roughly 38.9 percent per year over the next three years.

- Critics highlight this gap between top line growth and falling profits as a key bearish theme:

- Geopolitical and macro pressures, along with FX headwinds and a roughly 2 percent drag from the SaaS transition on full year revenue growth, are cited as reasons the current $1.6 billion trailing revenue base may not translate into stable profitability.

- Guidance framed as more cautious for fiscal 2026 fits with the forecast that profits retreat despite recent positive EPS, challenging any view that the current level of earnings can be extrapolated forward.

The clash between mid single digit revenue growth and a steep earnings pullback is what skeptics point to when they question how durable UiPath’s new profitability really is. 🐻 UiPath Bear Case

Valuation Sits Between Peers And DCF

- At a share price of $18.48, UiPath trades at about 42.7 times trailing earnings, below peer multiples of 60.6 times but above the broader US software average of 31.7 times, and modestly above a DCF fair value estimate of roughly $17.89.

- Analysts’ consensus style narrative balances growth potential against this valuation setup:

- Revenue expected to grow around 8.2 percent per year is slower than the US market’s 10.6 percent forecast, so the premium to the industry P E relies on the automation and AI roadmap continuing to deepen customer relationships.

- At the same time, the share price sitting only slightly above DCF fair value suggests the market is already factoring in both the recent move to about $229.7 million in trailing net income and the projected 38.9 percent annual earnings decline, rather than assuming a straight line growth story.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for UiPath on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? In just a few minutes, you can turn that viewpoint into a shareable story that reflects your outlook: Do it your way.

A great starting point for your UiPath research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Explore Alternatives

Despite UiPath’s recent swing to profitability, forecasts for a steep earnings decline alongside only modest revenue growth raise questions about the durability of its current momentum.

If that slowdown risk feels uncomfortable, use our stable growth stocks screener (2081 results) to quickly focus on businesses with steadier revenue and earnings trends that may offer more dependable compounding.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报