Why Kaspi.kz (KSPI) Is Up 5.5% After Q3 Revenue Beat And Rabobank Deal Progress – And What's Next

- Kaspi.kz recently reported its fiscal Q3 2025 results, posting 20% year-over-year consolidated revenue growth across its Payments, Marketplace, and Fintech segments, while also updating investors that its planned acquisition of Rabobank A.Ş. remains on track for expected completion in mid-2026, subject to regulatory approvals.

- Management also highlighted that a supply shortage of smartphones temporarily constrained growth in Q3, yet the broad-based strength across Kaspi.kz’s ecosystem suggests its multi-segment model is helping to offset pressure in individual product categories.

- We’ll now examine how Kaspi.kz’s broad-based Q3 revenue growth, despite smartphone supply constraints, may reshape its existing investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Kaspi.kz Investment Narrative Recap

To own Kaspi.kz, you need to believe its super app can keep deepening engagement across payments, marketplace, and fintech while managing regulatory and competitive pressures at home and abroad. The Q3 2025 update, with 20% revenue growth despite smartphone shortages and confirmation that the Rabobank A.Ş. deal remains on track, does not materially change the near term focus on Turkey execution risk as the key swing factor for the story.

Among recent announcements, Kaspi.kz’s 2025 guidance for around 20% consolidated net income growth (excluding Türkiye) is especially relevant, because it underlines how management still frames the core Kazakhstan-led ecosystem as the main earnings engine while larger international moves like Rabobank A.Ş. sit in the background as longer term, higher risk catalysts that could change the company’s profile if they are successfully integrated.

Yet investors should be aware that regulatory shifts affecting phones and banking licenses could still...

Read the full narrative on Kaspi.kz (it's free!)

Kaspi.kz’s narrative projects KZT 5,094.9 billion revenue and KZT 1,669.2 billion earnings by 2028. This requires 17.0% yearly revenue growth and a KZT 578.2 billion earnings increase from KZT 1,091.0 billion today.

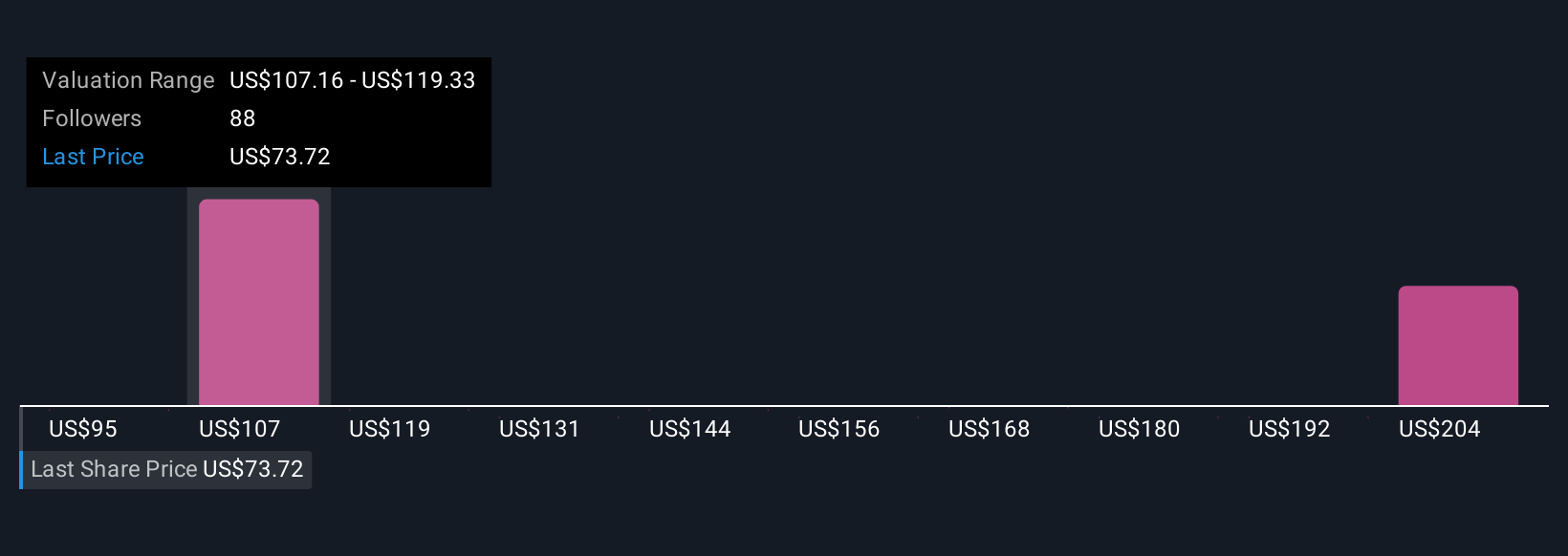

Uncover how Kaspi.kz's forecasts yield a $108.32 fair value, a 39% upside to its current price.

Exploring Other Perspectives

Eighteen fair value estimates from the Simply Wall St Community span roughly KZT92 to KZT319 per share, showing how far views can stretch. Against that backdrop, Kaspi.kz’s broad based Q3 revenue growth, alongside regulatory and Turkey execution risks, gives you several angles on how its performance could evolve.

Explore 18 other fair value estimates on Kaspi.kz - why the stock might be worth just $92.05!

Build Your Own Kaspi.kz Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kaspi.kz research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Kaspi.kz research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kaspi.kz's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报