Are Genius Sports’ (GENI) New AI Deals Enough To Reframe Its Cash Flow Narrative?

- In recent weeks, Genius Sports announced multiple AI-driven partnerships, including a nationwide Intelligent Content Platform with FanDuel Sports Network and new deals with Brazil’s football confederation and Publicis Sports to power semi-automated officiating and data-led fan engagement.

- These agreements highlight how GeniusIQ, the company’s proprietary AI and data platform, is increasingly central to both broadcast innovation and global football officiating.

- We’ll now explore how these AI-powered advertising and officiating deals intersect with concerns over Genius Sports’ revised cash flow outlook to shape its investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Genius Sports Investment Narrative Recap

To own Genius Sports, you need to believe its GeniusIQ platform can turn exclusive data rights into profitable, scalable products across betting, media and advertising, while the path to sustainable free cash flow remains the key near term catalyst. Recent AI-driven advertising and officiating wins reinforce that product story, but do not directly resolve concerns around the company’s revised cash flow outlook and the questions raised by UBS’s lower price target and the upcoming auditor change.

Among the latest announcements, the nationwide Intelligent Content Platform with FanDuel Sports Network is most relevant, because it directly speaks to Genius’s ability to deepen higher margin media and advertising revenues. If this AI-powered ad inventory across 300 plus NBA and WNBA games per season gains traction with brands, it could support the core thesis that GeniusIQ can unlock more lucrative, recurring monetization beyond traditional betting data partnerships.

But beneath the headline growth in AI partnerships, investors should still be aware of...

Read the full narrative on Genius Sports (it's free!)

Genius Sports' narrative projects $930.2 million revenue and $120.7 million earnings by 2028. This requires 18.5% yearly revenue growth and a $198.6 million earnings increase from -$77.9 million today.

Uncover how Genius Sports' forecasts yield a $14.76 fair value, a 30% upside to its current price.

Exploring Other Perspectives

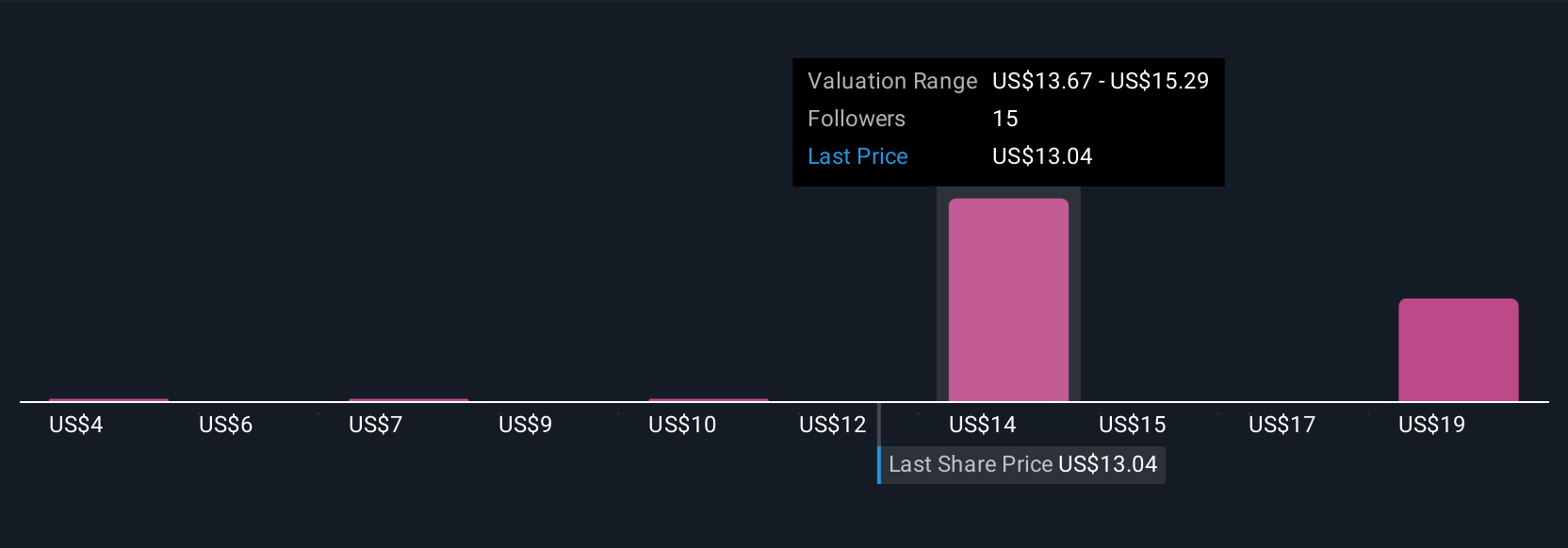

Six fair value estimates from the Simply Wall St Community span roughly US$4 to US$26 per share, reflecting sharply different return expectations. Set against this wide range, the company’s increased earnings guidance and expanding AI driven media deals highlight how views on future monetization of GeniusIQ and timing of sustainable cash generation can diverge, so it is worth weighing several independent perspectives before making any decision.

Explore 6 other fair value estimates on Genius Sports - why the stock might be worth less than half the current price!

Build Your Own Genius Sports Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Genius Sports research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Genius Sports research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Genius Sports' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报