Did PennyMac’s Big Earnings Beat Amid Long-Term Declines Just Shift PMT’s Investment Narrative?

- PennyMac Mortgage Investment Trust recently reported past-quarter revenues of US$99.23 million, a 22.7% year-on-year increase that exceeded analyst estimates, alongside better-than-expected EPS and net interest income.

- This strong quarterly surprise stands in contrast to the trust’s multi-year declines in sales, earnings per share, and tangible book value per share, raising questions about how durable the improvement might be.

- Next, we’ll examine how this earnings beat, despite longer-term credit and growth pressures, reshapes the investment narrative for PennyMac.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

PennyMac Mortgage Investment Trust Investment Narrative Recap

To own PennyMac Mortgage Investment Trust, you need to believe its mortgage credit and securitization platform can translate cyclical housing and rate trends into steady income, despite past book value erosion. The latest revenue and EPS beat helps near term by easing concerns around earnings momentum, but it does not materially reduce the core risks around credit quality, leverage, and the sustainability of the current dividend.

The recent affirmation of the US$0.40 per share quarterly common dividend is especially relevant in light of the earnings surprise, since dividends remain only partially supported by current run rate profits. For investors, the combination of an income focused payout and uneven earnings across recent quarters keeps the dividend policy itself a key catalyst to watch, alongside any signs that improved credit performance can slow tangible book value declines.

Yet despite the stronger quarter, investors should be aware that sustained pressure on book value and dividend coverage could still...

Read the full narrative on PennyMac Mortgage Investment Trust (it's free!)

PennyMac Mortgage Investment Trust's narrative projects $354.4 million revenue and $194.9 million earnings by 2028. This assumes revenue will decline by 16.8% per year and earnings will increase by about $132 million from $62.9 million today.

Uncover how PennyMac Mortgage Investment Trust's forecasts yield a $13.43 fair value, a 4% upside to its current price.

Exploring Other Perspectives

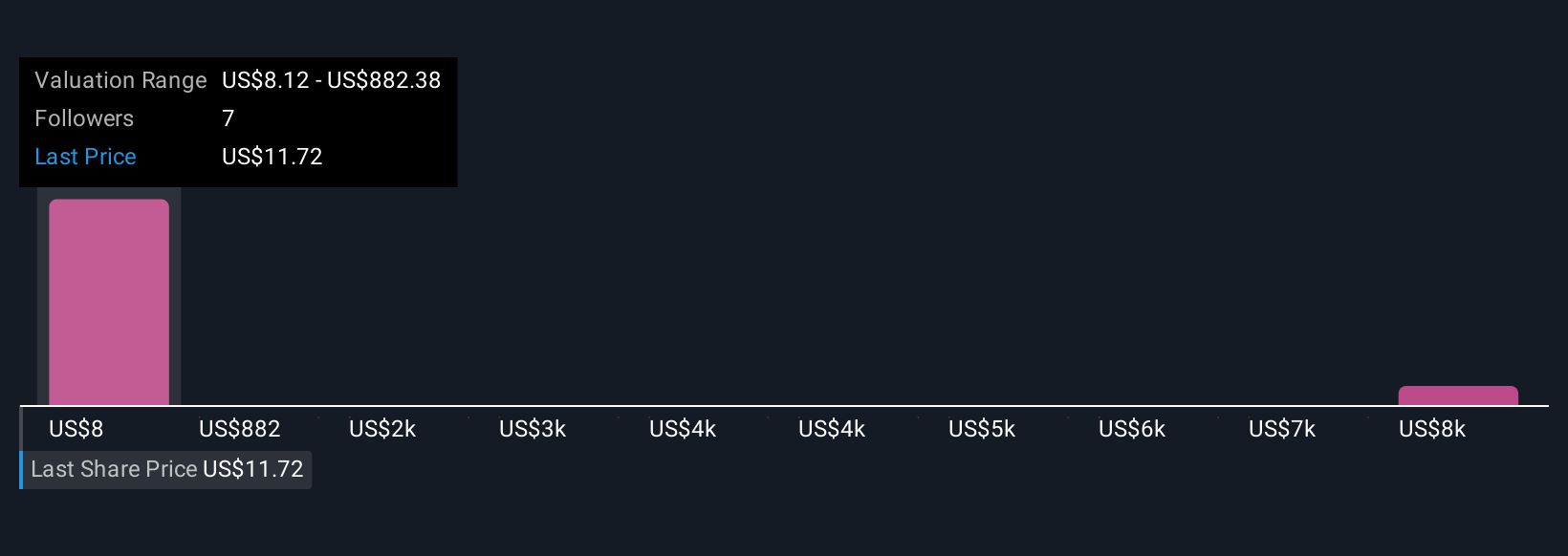

Four fair value estimates from the Simply Wall St Community span from about US$8 to over US$8,700 per share, underlining how far views can diverge. When you set that against PMT’s recent earnings beat alongside ongoing concerns about credit quality and dividend coverage, it becomes even more important to weigh several different perspectives on the trust’s future performance.

Explore 4 other fair value estimates on PennyMac Mortgage Investment Trust - why the stock might be a potential multi-bagger!

Build Your Own PennyMac Mortgage Investment Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PennyMac Mortgage Investment Trust research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free PennyMac Mortgage Investment Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PennyMac Mortgage Investment Trust's overall financial health at a glance.

No Opportunity In PennyMac Mortgage Investment Trust?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报