The Bull Case For Bet Shemesh Engines Holdings (1997) (TASE:BSEN) Could Change Following Mixed Q3 2025 Results And Stronger Nine-Month Profitability Trends

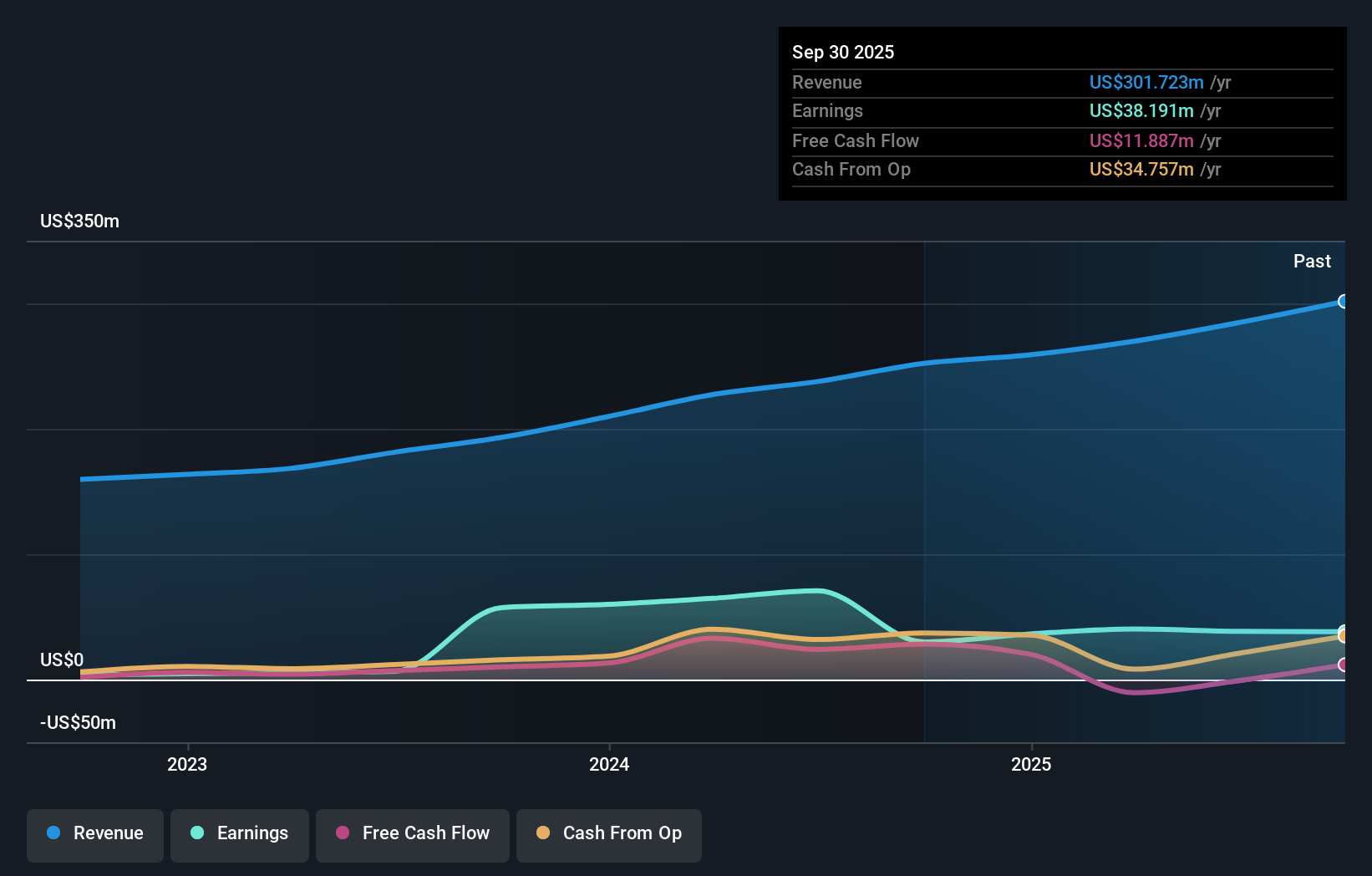

- Bet Shemesh Engines Holdings (1997) reported past third-quarter 2025 results with sales rising to US$84.67 million, while quarterly net income eased slightly to US$10.06 million and earnings per share ticked down year over year.

- Over the first nine months of 2025, the company grew sales to US$235.51 million and modestly increased net income and earnings per share, highlighting improving profitability on a year-to-date basis despite softer quarterly profit.

- We’ll now examine how the company’s stronger nine-month earnings progression shapes Bet Shemesh Engines’ investment narrative for investors.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Bet Shemesh Engines Holdings (1997)'s Investment Narrative?

To own Bet Shemesh Engines, you have to believe in its ability to turn solid aerospace demand into sustained, high quality earnings, despite some cost and margin pressure along the way. The latest Q3 2025 numbers support that broader thesis: sales continued to climb, nine‑month net income and EPS improved year on year, and profitability looks healthier on a year‑to‑date basis even though quarterly profit softened slightly. That mix suggests the immediate earnings story remains intact rather than materially altered by this release. Short term, the key catalysts still sit around order visibility, execution on existing programs and any decisions coming out of the January 2026 extraordinary shareholder meeting, while risks remain tied to rich valuation multiples, thinner dividend cover and any further squeeze on margins if costs rise faster than revenue.

However, one area in particular could catch investors off guard if conditions shift. Bet Shemesh Engines Holdings (1997)'s shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Bet Shemesh Engines Holdings (1997) - why the stock might be worth as much as 40% more than the current price!

Build Your Own Bet Shemesh Engines Holdings (1997) Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bet Shemesh Engines Holdings (1997) research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Bet Shemesh Engines Holdings (1997) research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bet Shemesh Engines Holdings (1997)'s overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报