Taking Stock Of Penguin Solutions (PENG) Valuation After Its Latest AI-Focused Quarterly Results

Penguin Solutions (PENG) just delivered quarterly results that grew revenue year on year and beat earnings expectations, even though sales landed slightly below forecasts and highlighted its ongoing shift into enterprise AI infrastructure.

See our latest analysis for Penguin Solutions.

Even with the latest results and renewed attention from tech focused funds, Penguin Solutions’ recent 1 day and 7 day share price gains contrast with a softer 90 day share price return. At the same time, multi year total shareholder returns suggest the longer term AI infrastructure story is still intact.

If you are watching how AI infrastructure names are being repriced, it could be a good moment to explore high growth tech and AI stocks for other potential ideas in the space.

With shares still trading below analyst targets despite double digit revenue growth and improving AI credentials, is the recent pullback a window to buy Penguin Solutions at a discount, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 24% Undervalued

With the narrative fair value set around the high twenties against a last close of $21.48, Penguin Solutions is being framed as a discounted way into enterprise AI infrastructure.

Increasing demand for scalable and energy efficient data center solutions, driven by edge computing and new AI workloads, aligns with Penguin's differentiated, customizable hardware and software offerings, supporting higher margin solution sales and long term improvement in net margins.

Curious how a maturing hardware player gets a premium growth storyline? The narrative leans on rising margins, expanding earnings power, and a surprisingly low implied future multiple. Want to see the full playbook behind that upside case?

Result: Fair Value of $28.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained revenue lumpiness from large, unpredictable Advanced Computing deals or tariff driven margin pressure could quickly challenge this upbeat AI infrastructure thesis.

Find out about the key risks to this Penguin Solutions narrative.

Another Angle on Valuation

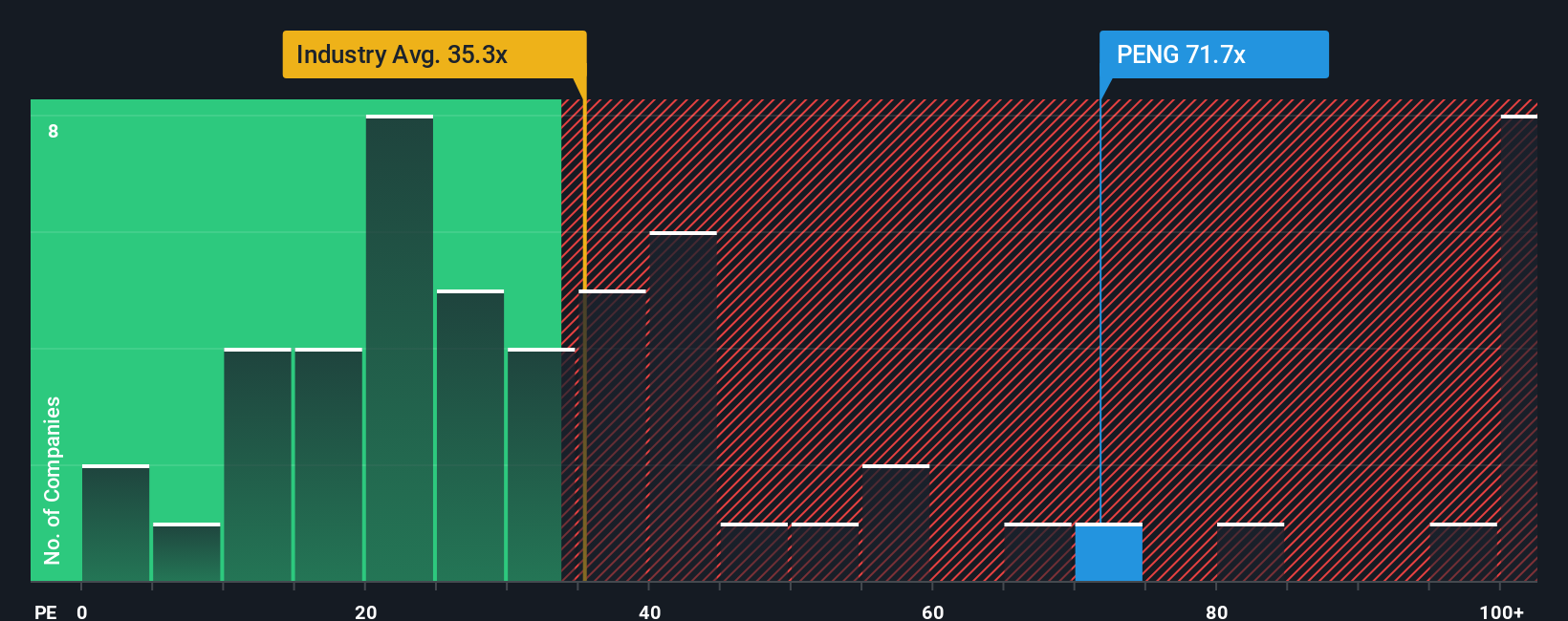

Price based models paint a tougher picture. Penguin Solutions trades on a price to earnings ratio of about 73 times, meaningfully richer than both peer averages near 60 times and the broader US semiconductor group around 36 times. Is the AI upside really enough to justify that premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Penguin Solutions Narrative

If this perspective does not quite fit your view, or you prefer to dig into the numbers yourself, you can build a custom narrative in minutes, Do it your way.

A great starting point for your Penguin Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Ready for your next move? Use the Simply Wall St Screener to track fresh opportunities before the crowd, and keep your watchlist brimming with high potential ideas.

- Tap into powerful long term compounding potential by targeting dependable income opportunities through these 14 dividend stocks with yields > 3%.

- Capitalize on market mispricing by zeroing in on companies trading below intrinsic value using these 912 undervalued stocks based on cash flows.

- Ride the wave of intelligent automation by focusing on innovators shaping the future of machine learning and data driven solutions via these 25 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报