Veritone (VERI): Reassessing Valuation After AI-Driven Growth, Debt Reduction and Renewed Analyst Optimism

Veritone (VERI) has been drawing fresh attention after pairing accelerating AI driven revenue growth with a sizable 77.5 million dollar debt reduction, a combination that meaningfully reshapes both its risk profile and long term upside.

See our latest analysis for Veritone.

That combination of rapid AI driven growth and a cleaner balance sheet helps explain why Veritone’s share price return is up sharply this year. The 90 day share price return has roughly doubled and the 1 year total shareholder return now exceeds 100 percent, even though longer term total shareholder returns remain deeply negative, suggesting momentum is building from a still bruised base.

If Veritone’s turnaround has caught your eye and you want to see what else is gaining traction in AI, now is a good time to explore high growth tech and AI stocks.

Yet with Veritone still unprofitable but growing fast, trading around half of analyst targets and riding a powerful AI narrative, investors now face the key question: is this a genuine mispricing, or is future growth already baked in?

Most Popular Narrative: 51.2% Undervalued

With Veritone last closing at $5.46 against a narrative fair value of $11.20, the most popular view frames today’s price as a sizable gap to potential.

Veritone's infrastructure agnostic, model independent aiWARE platform is increasingly favored as organizations shift from legacy AI pilots to production scale, "agentic" AI use cases requiring secure, interoperable, and highly flexible data orchestration. This unique capability creates long term competitive differentiation, supporting both customer retention and the expansion of high margin SaaS revenue streams.

Want to see what kind of revenue ramp and margin reboot would justify that upside, and what future earnings multiple ties it all together? The full narrative lays out a bold roadmap of accelerating top line growth, rising profitability and a valuation framework more often reserved for established software leaders. Curious which specific assumptions have to hold for this price gap to close, and how ambitious they really are? Dive in to see the numbers behind the story.

Result: Fair Value of $11.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained net losses and heavy customer concentration mean that any contract hiccup or slower margin recovery could quickly challenge today’s optimistic valuation gap.

Find out about the key risks to this Veritone narrative.

Another View: Rich Multiples Signal Caution

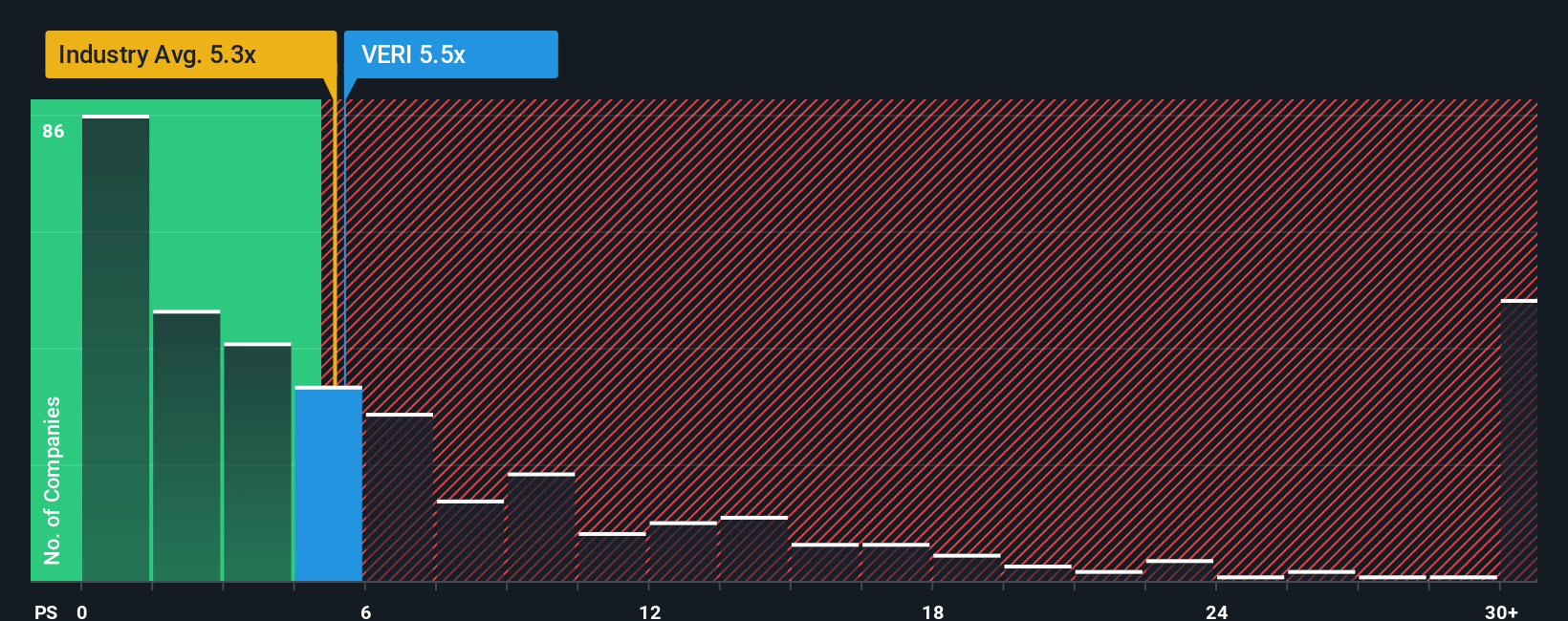

While the narrative fair value points to upside, Veritone’s current price to sales ratio of 5.1 times looks demanding versus the US software industry at 4.9 times and peers at 1.7 times, and is above its own 4.2 times fair ratio. This raises the risk that expectations have already run hot.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Veritone Narrative

If these perspectives do not quite match your view or you would rather dig into the numbers yourself, you can build a full narrative in just a few minutes: Do it your way.

A great starting point for your Veritone research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more high conviction investment ideas?

Before you move on, lock in your next opportunity by scanning focused stock ideas that match clear strategies, instead of chasing the latest headline move.

- Capitalize on mispriced quality by scanning these 915 undervalued stocks based on cash flows that pair solid fundamentals with attractive discounts to intrinsic value.

- Ride structural growth trends in intelligent automation through these 25 AI penny stocks targeting companies building real businesses around AI, not just buzzwords.

- Strengthen your income stream with these 14 dividend stocks with yields > 3% offering cash yields above 3 percent that can help cushion volatility and support long-term compounding.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报