How Is Agilent Technologies' Stock Performance Compared to Other Healthcare Stocks?

With a market cap of $42.3 billion, Agilent Technologies, Inc. (A) delivers application-focused solutions for the life sciences, diagnostics, and applied chemical markets worldwide. The company operates through three segments: Life Sciences and Applied Markets; Diagnostics and Genomics; and Agilent CrossLab, offering a broad portfolio of instruments, consumables, software, and laboratory services.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Agilent Technologies fits this criterion perfectly. Agilent distributes its products primarily through a direct sales model, complemented by distributors, resellers, representatives, and e-commerce channels.

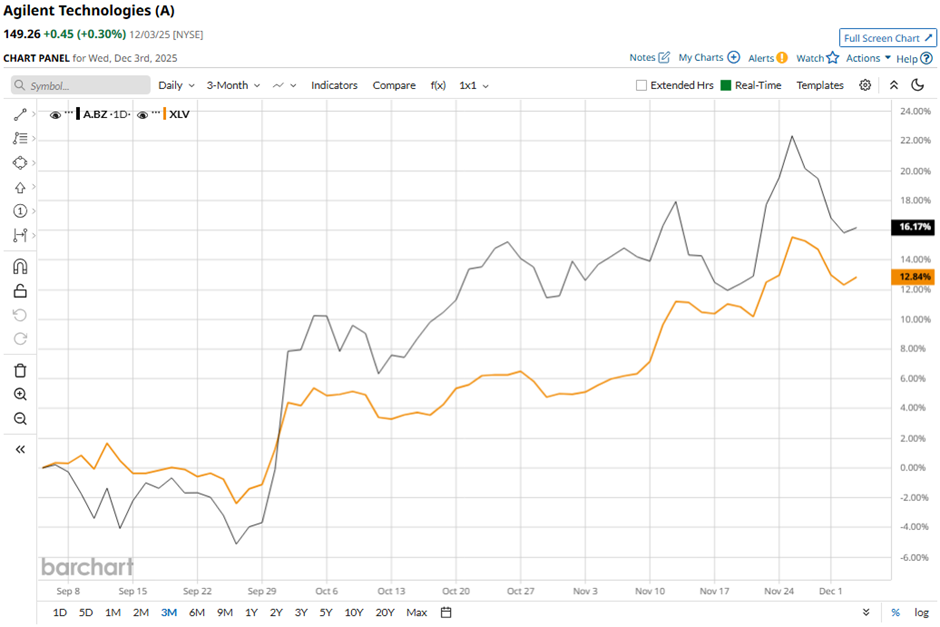

Shares of the Santa Clara, California-based company have fallen 6.9% from its 52-week high of $160.27. Shares of Agilent Technologies have increased 19.2% over the past three months, outperforming The Health Care Select Sector SPDR Fund’s (XLV) 13.3% gain over the same time frame.

Longer term, shares of the scientific instrument maker have risen 7.2% over the past 52 weeks, outpacing XLV’s 5.6% return over the same time frame. However, Agilent stock is up 11.1% on a YTD basis, lagging behind XLV’s 12.7% return.

The stock has been trading above its 50-day moving average since early May. Also, it has moved above its 200-day moving average since late August.

Agilent’s shares rose 2.3% following its Q4 2025 results on Nov. 24, with revenue of $1.86 billion beating estimates and adjusted EPS of $1.59, matching expectations. Investors were encouraged by outperformance in key segments, including Life Sciences and Diagnostics revenue of $755 million and a 7% increase in CrossLab revenue to $775 million. Sentiment was further boosted by Agilent’s confident fiscal 2026 outlook, projecting $7.3 billion - $7.4 billion in revenue and $5.86 - $6 in adjusted EPS.

Nevertheless, rival Eli Lilly and Company (LLY) has outpaced Agilent stock. LLY stock has surged 33.9% on a YTD basis and 27.1% over the past 52 weeks.

Despite Agilent Technologies’ weak performance relative to its industry peers, analysts are moderately optimistic about its prospects. The stock has a consensus rating of “Moderate Buy” from the 17 analysts in coverage, and the mean price target of $169.62 represents a premium of 13.6% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Nasdaq

Nasdaq 华尔街日报

华尔街日报