Rising Focus On Ultra‑Pure Materials Could Be A Game Changer For 5N Plus (TSX:VNP)

- In recent days, attention around 5N Plus has increased as investors refocus on specialty materials, highlighting the company’s role in supplying ultra‑pure compounds for advanced semiconductor and industrial applications.

- The renewed interest underscores how 5N Plus’s positioning in high‑accuracy, high‑purity materials could make it an important beneficiary of broader specialty semiconductor trends.

- We’ll now examine how rising industry focus on ultra‑pure specialty materials could influence 5N Plus’s existing investment narrative and future prospects.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

5N Plus Investment Narrative Recap

To own 5N Plus, you need to believe that demand for ultra pure specialty materials in semiconductors and advanced industrial uses will stay robust, and that the company can keep converting this into profitable, high return growth. The latest attention on Canadian specialty materials reinforces that thesis but does not materially change the near term picture, where execution on expanded First Solar volumes remains a key catalyst and customer concentration and potential policy shifts remain central risks.

In this context, the expanded supply agreement with First Solar, including higher cadmium telluride volumes for 2025 to 2028 and the planned introduction of cadmium selenide from 2026, looks especially relevant to the renewed focus on advanced materials. It ties 5N Plus’s ultra pure compounds directly to a leading U.S. solar manufacturer, linking the current industry interest in specialty semiconductors to a tangible, contracted source of demand that could influence earnings visibility and capital allocation decisions over the next few years.

Yet, despite this optimism, investors should be aware that reliance on a small number of large customers could...

Read the full narrative on 5N Plus (it's free!)

5N Plus' narrative projects $509.7 million revenue and $59.2 million earnings by 2028.

Uncover how 5N Plus' forecasts yield a CA$25.88 fair value, a 34% upside to its current price.

Exploring Other Perspectives

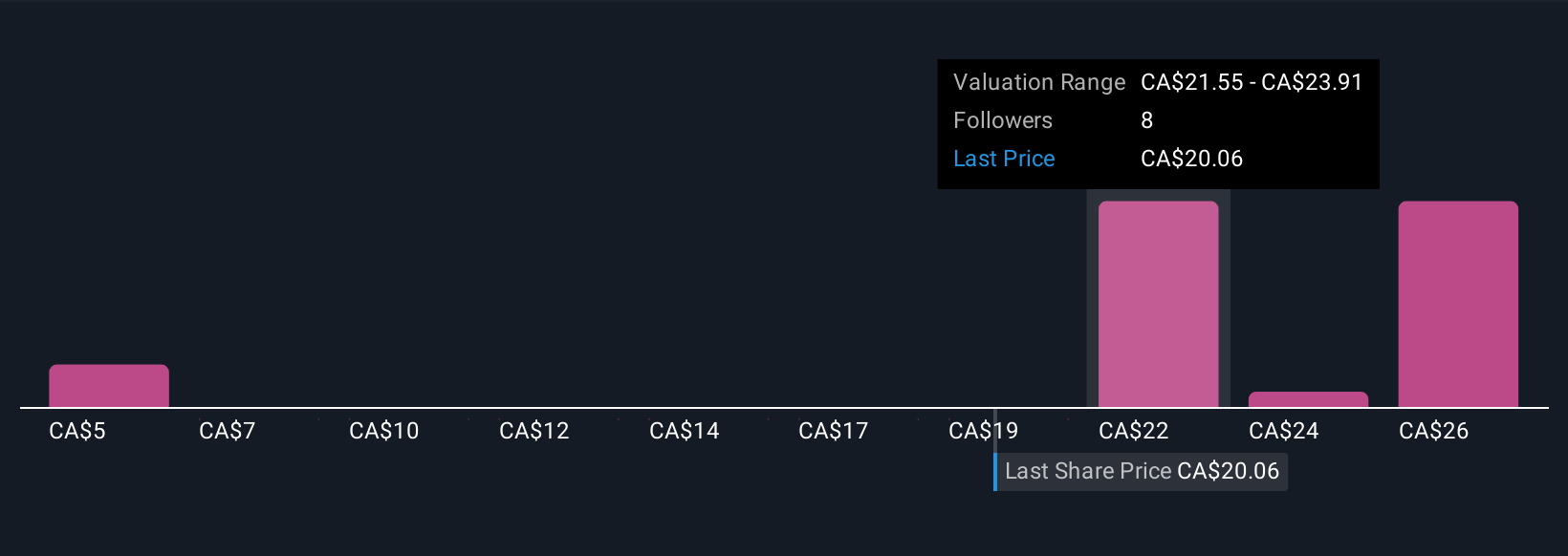

Five members of the Simply Wall St Community currently estimate fair value for 5N Plus between CA$5 and CA$31.47, highlighting very different return expectations. Set against this, the expanded First Solar agreement and broader push toward ultra pure specialty materials underline how contract concentration and technology shifts could both support and test the company’s earnings resilience over time, so it is worth comparing several viewpoints before forming a view.

Explore 5 other fair value estimates on 5N Plus - why the stock might be worth less than half the current price!

Build Your Own 5N Plus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your 5N Plus research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free 5N Plus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate 5N Plus' overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报