Is Stellantis (BIT:STLAM) Using the New Charger R/T to Reposition Its Performance Brand Strategy?

- Stellantis recently expanded its Dodge Charger lineup with the all-new 2026 Charger R/T, pairing a 3.0-liter, twin-turbo SIXPACK S.O. engine and advanced AWD/RWD capability with both internal combustion and fully electrified Daytona Scat Pack options in two- and four-door configurations.

- This launch underscores Stellantis’ bid to keep performance enthusiasts engaged while tightening emissions rules push the industry toward electrification, using high-output turbo technology and configurable drivetrains as a bridge between traditional muscle cars and future electric models.

- We’ll now examine how this high-performance yet electrification-ready Charger R/T launch could influence Stellantis’ broader investment narrative and outlook.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Stellantis Investment Narrative Recap

To own Stellantis, you need to believe the group can use its broad brand portfolio and electrification push to restore profitability while managing tariff uncertainty and pressure on European margins. The new Charger R/T and Daytona Scat Pack EV option help support that transition story, but this product news does not materially change the near term risk around trade policy costs or weaker European light commercial vehicle demand.

The upcoming Stellantis appearance at Goldman Sachs Industrials & Autos Week is particularly relevant here, as it gives management a chance to frame how performance oriented models like the updated Charger fit alongside its BEV roll out and margin improvement efforts. For investors watching catalysts, any added color on balancing internal combustion profitability with lower margin EVs could shape expectations around the timing and quality of a potential earnings recovery.

Yet while the Charger R/T broadens Stellantis’ appeal, investors should be aware that...

Read the full narrative on Stellantis (it's free!)

Stellantis’ narrative projects €175.3 billion revenue and €7.6 billion earnings by 2028.

Uncover how Stellantis' forecasts yield a €9.66 fair value, in line with its current price.

Exploring Other Perspectives

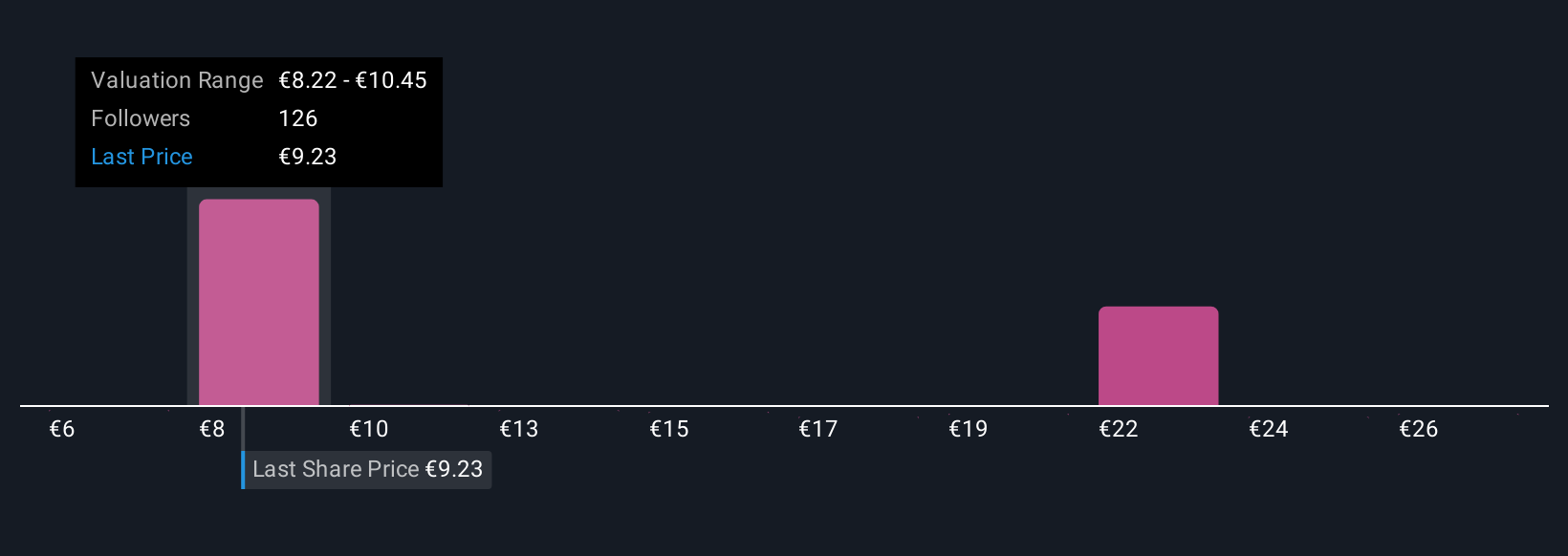

Thirty Simply Wall St Community fair value estimates for Stellantis range from €6.00 to €26.81, underlining how far opinions can stretch. As you weigh those views against the risk of margin compression from less profitable BEVs, it is worth exploring several perspectives before forming a conviction on Stellantis’ long term earnings power.

Explore 30 other fair value estimates on Stellantis - why the stock might be worth over 2x more than the current price!

Build Your Own Stellantis Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Stellantis research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Stellantis research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Stellantis' overall financial health at a glance.

No Opportunity In Stellantis?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报