3 Stocks Estimated To Be Trading Below Their Intrinsic Value

As major U.S. stock indexes continue to rise, with the Dow Jones Industrial Average nearing a record high despite recent employment concerns, investors are actively seeking opportunities in an evolving market landscape. In this environment, identifying stocks that may be trading below their intrinsic value can offer potential for growth and stability amidst fluctuating economic indicators.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Webull (BULL) | $9.26 | $17.92 | 48.3% |

| Super Group (SGHC) (SGHC) | $10.89 | $21.53 | 49.4% |

| Spotify Technology (SPOT) | $557.17 | $1095.48 | 49.1% |

| Sotera Health (SHC) | $16.84 | $33.44 | 49.6% |

| Lyft (LYFT) | $22.33 | $43.57 | 48.8% |

| Freshworks (FRSH) | $12.45 | $23.78 | 47.6% |

| DexCom (DXCM) | $64.85 | $126.43 | 48.7% |

| Chagee Holdings (CHA) | $15.28 | $29.66 | 48.5% |

| BioLife Solutions (BLFS) | $25.51 | $49.69 | 48.7% |

| Ategrity Specialty Insurance Company Holdings (ASIC) | $18.70 | $37.29 | 49.8% |

Let's dive into some prime choices out of the screener.

Caris Life Sciences (CAI)

Overview: Caris Life Sciences, Inc. is an artificial intelligence TechBio company that offers molecular profiling services both in the United States and internationally, with a market cap of $7.37 billion.

Operations: Caris Life Sciences generates revenue primarily from its biotechnology segment, totaling $649.06 million.

Estimated Discount To Fair Value: 40.5%

Caris Life Sciences is trading at US$27.24, significantly below its estimated fair value of US$45.75, suggesting potential undervaluation based on cash flows. The company has shown strong revenue growth, with a recent quarter reporting US$216.83 million compared to last year's US$101.62 million and expects annual revenue between US$720 million and US$730 million for 2025, reflecting substantial growth over 2024 figures. Additionally, Caris's earnings are projected to grow rapidly in the coming years.

- In light of our recent growth report, it seems possible that Caris Life Sciences' financial performance will exceed current levels.

- Get an in-depth perspective on Caris Life Sciences' balance sheet by reading our health report here.

Wix.com (WIX)

Overview: Wix.com Ltd. operates a cloud-based web development platform for users and creators globally, with a market cap of approximately $5.62 billion.

Operations: The company generates its revenue from the Internet Software & Services segment, amounting to $1.93 billion.

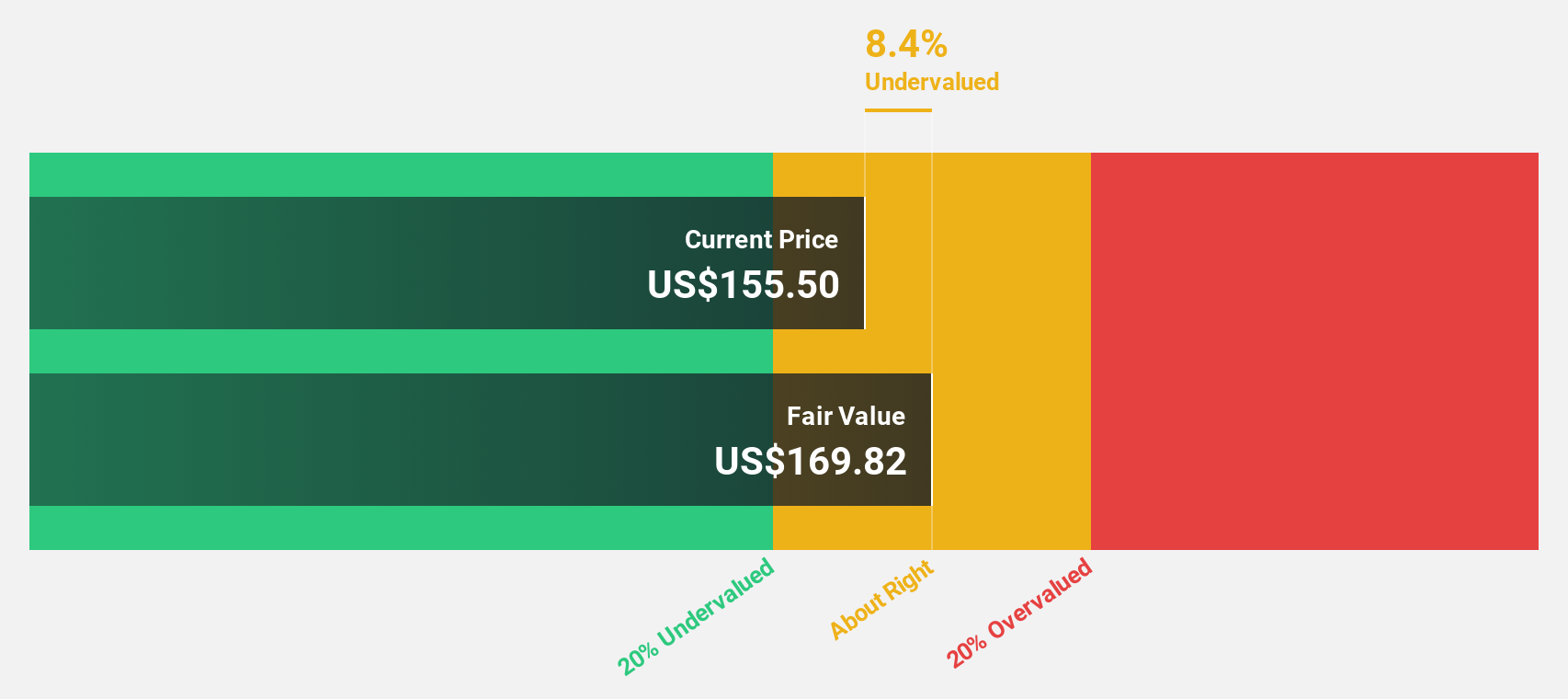

Estimated Discount To Fair Value: 33.6%

Wix.com, trading at US$102.76, is significantly undervalued with an estimated fair value of US$154.78 based on discounted cash flows. Despite a high debt level, its earnings are forecast to grow 25.7% annually over the next three years, outpacing the broader US market's growth rate. Recent quarterly revenue was US$505.19 million with a slight net loss of US$0.589 million, yet full-year guidance has been raised to nearly US$2 billion in revenue for 2025.

- According our earnings growth report, there's an indication that Wix.com might be ready to expand.

- Dive into the specifics of Wix.com here with our thorough financial health report.

Oracle (ORCL)

Overview: Oracle Corporation provides products and services for enterprise information technology environments globally, with a market cap of $573.29 billion.

Operations: Oracle's revenue segments include Hardware at $2.95 billion, Services at $5.32 billion, and Cloud and License at $50.75 billion.

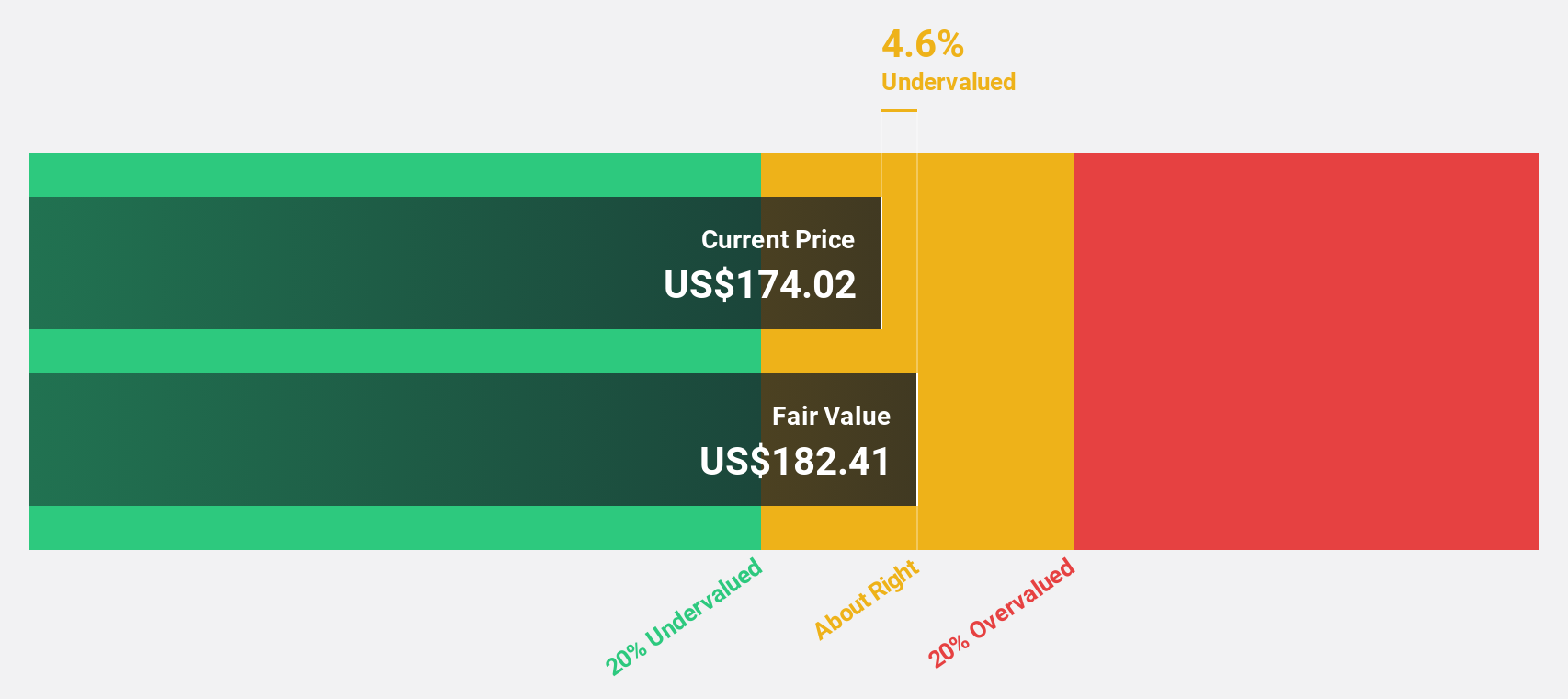

Estimated Discount To Fair Value: 17.6%

Oracle's current trading price of US$207.73 suggests it is undervalued, with a fair value estimate of US$252.08 based on cash flow analysis. While the company carries significant debt, its revenue is projected to grow at 27% annually, surpassing the broader market's growth rate. Oracle recently reported quarterly revenue of US$14.93 billion with net income slightly lower than last year at US$2.93 billion, alongside strategic expansions in multi-cloud capabilities to support innovation and client demands for hybrid solutions.

- The analysis detailed in our Oracle growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Oracle's balance sheet health report.

Turning Ideas Into Actions

- Discover the full array of 208 Undervalued US Stocks Based On Cash Flows right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报