Did Insider Buying Amid Mixed Q3 Results Just Shift Northwest Bancshares' (NWBI) Investment Narrative?

- On December 1, 2025, Northwest Bancshares director John P. Meegan purchased 1,500 shares of the bank’s common stock following the release of third-quarter results, which showed earnings per share below analyst expectations but revenue above forecasts.

- This combination of insider buying, mixed quarterly performance and flagged liquidity pressures is prompting investors to reassess the bank’s risk-reward profile and operational priorities.

- Next, we’ll examine how Meegan’s insider purchase, alongside mixed earnings and revenue, influences Northwest Bancshares’ existing investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Northwest Bancshares Investment Narrative Recap

To own Northwest Bancshares, you need to believe its community banking model, dividend record and regional growth plans can offset credit and efficiency challenges. Meegan’s insider purchase and the mixed third quarter, with earnings per share missing expectations but revenue beating forecasts, do not materially change the near term focus on balance sheet resilience and the key risk around liquidity and credit quality, especially given declining cash flow metrics and bearish technical signals.

The most relevant recent announcement here is the third quarter 2025 earnings release, which paired higher net interest income with sharply lower net income and flagged potential net charge offs of up to US$13 million in the fourth quarter. Against this backdrop, the insider buying sits alongside ongoing dividend payments and the longer term catalyst of integrating Penns Woods, as investors weigh whether earnings pressure and liquidity concerns are temporary or more persistent.

Yet behind the long dividend history, investors should be aware of...

Read the full narrative on Northwest Bancshares (it's free!)

Northwest Bancshares' narrative projects $909.9 million revenue and $249.6 million earnings by 2028. This requires 17.4% yearly revenue growth and a $106.2 million earnings increase from $143.4 million today.

Uncover how Northwest Bancshares' forecasts yield a $13.38 fair value, a 7% upside to its current price.

Exploring Other Perspectives

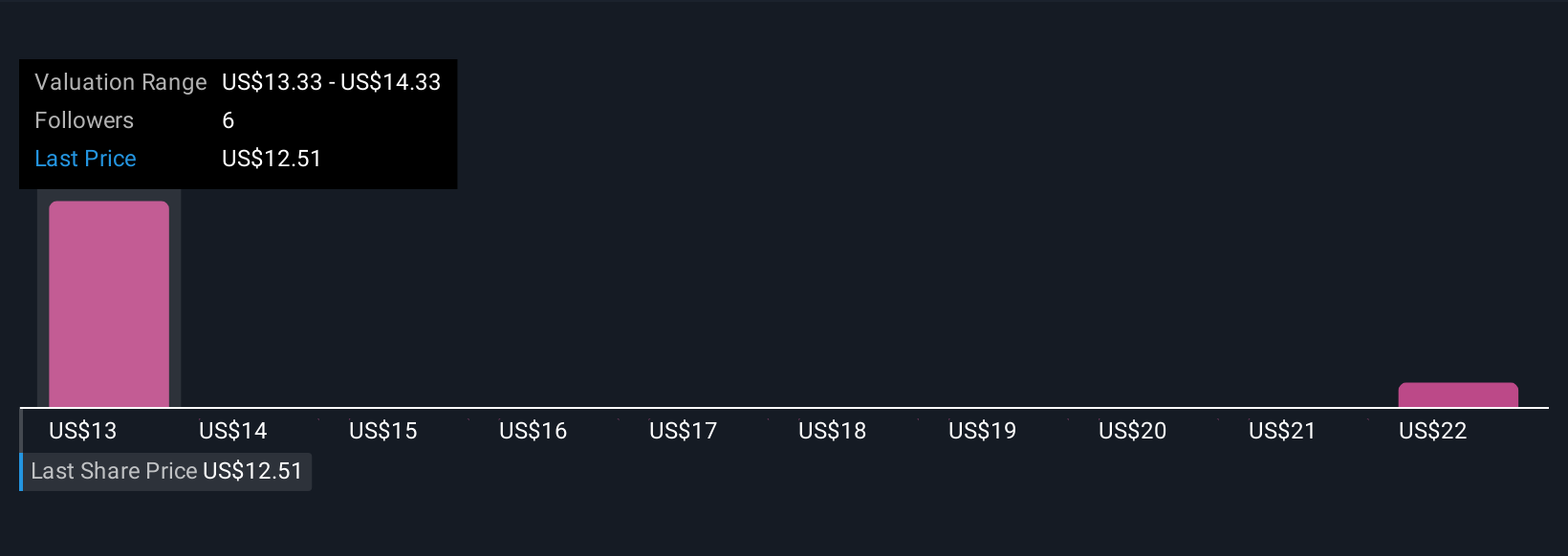

Three members of the Simply Wall St Community currently see Northwest Bancshares as worth between US$13.33 and US$22.10 per share, underscoring how far opinions can diverge. You will want to weigh those views against the highlighted liquidity and credit risks that could influence how the bank’s cautious third quarter earnings profile evolves from here.

Explore 3 other fair value estimates on Northwest Bancshares - why the stock might be worth as much as 77% more than the current price!

Build Your Own Northwest Bancshares Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northwest Bancshares research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Northwest Bancshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northwest Bancshares' overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报