Sprinklr (CXM) Net Margin Strengthens, Challenging Market Skepticism on Slower Revenue Growth

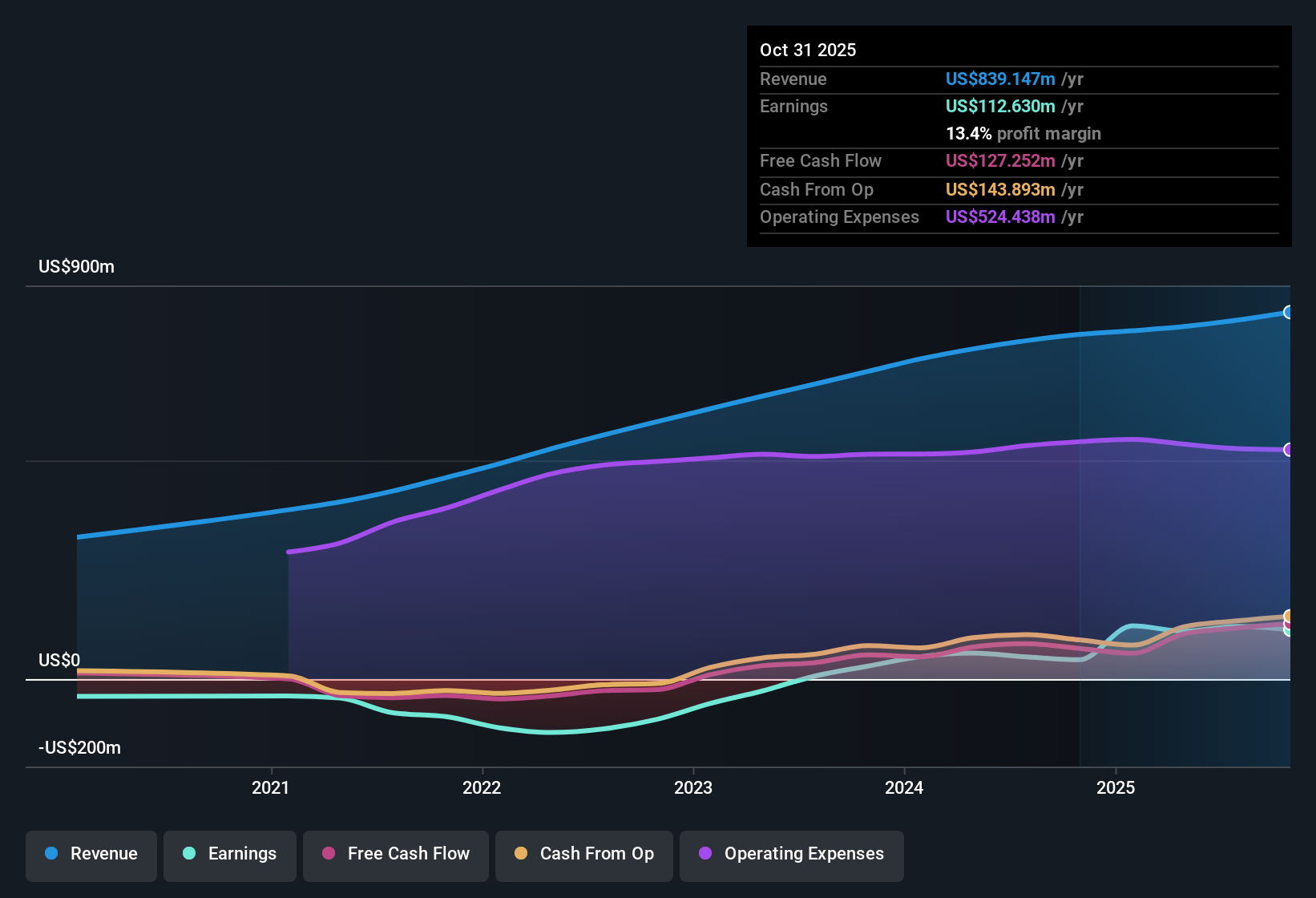

Sprinklr (CXM) has just posted another quarter of solid top line and bottom line numbers, with Q2 2026 revenue at about $212 million and basic EPS of roughly $0.05, supported by trailing 12 month revenue of about $821 million and EPS of around $0.47. The company has seen revenue move from roughly $196 million in Q1 2025 to about $212 million in Q2 2026, while basic EPS has ranged from about $0.04 in Q1 2025 to approximately $0.05 in the latest quarter. This sets up a story where profitability and margins are increasingly in focus for investors.

See our full analysis for Sprinklr.With the latest numbers on the table, the next step is to see how this earnings profile lines up, or clashes, with the key narratives investors and analysts have been building around Sprinklr.

See what the community is saying about Sprinklr

Net Margin Holds Near 14.6%

- Trailing 12 month net income is about $120.2 million on roughly $820.8 million of revenue, which lines up with a net margin of 14.6% compared with 6.5% a year earlier.

- What supports the bullish view is that this higher margin is coming alongside only mid single digit revenue growth, suggesting the business is getting more efficient rather than just bigger.

- Revenue over the last year is about $820.8 million, up from $754.9 million a year earlier, while earnings rose to $120.2 million from $59.2 million, so profits have grown much faster than sales.

- Analysts also expect earnings to grow about 24.6% per year even though revenue is only forecast to grow around 6.3% annually, which fits with the idea that margin improvements are a major earnings driver.

Earnings Growth Outpaces Sales

- On a trailing basis, earnings grew about 137.6% year over year while revenue increased more modestly from roughly $754.9 million to $820.8 million, and basic EPS over the last twelve months is about $0.47.

- From a bullish perspective, the combination of 70.2% annual earnings growth over five years and expectations for another roughly 24.6% per year ahead is being driven by operating improvements around AI features and efficiency programs rather than just chasing new customers at any cost.

- The consensus narrative highlights AI driven products, more digital channels, and operational efficiency projects as key drivers of higher contract values and better profitability, which is consistent with earnings rising significantly faster than revenue in the recent data.

- At the same time, analysts only model revenue growth of about 6.3% annually, so the growth outlook leans heavily on sustaining those margin gains, which is exactly what optimistic investors will be watching in future reports.

Valuation Discounts Revenue Concerns

- With the share price around $7.77, the stock trades below a DCF fair value estimate of about $12.06 and at a price to earnings ratio of roughly 15.8 times, compared with about 32 times for the broader US software industry and 38.5 times for peers.

- Bears focus on relatively modest expected revenue growth of about 6.3% per year and forecasts for margins to retreat from 14.6% to 3.6% by around 2028, which would pull earnings down to roughly $36.8 million despite revenue assumptions of about $1.0 billion.

- Even with that softer profit outlook, the analyst price target near $10.57 is still higher than the current price, implying the market is valuing the stock more cautiously than those models suggest.

- The key tension for a cautious investor is that the current low price to earnings multiple and discount to DCF fair value sit alongside expectations for slower revenue growth and lower future margins, so the debate is really about how sustainable today’s profitability levels are.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Sprinklr on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Use your own take to shape a fresh narrative in just a few minutes, then share it with the community, Do it your way.

A great starting point for your Sprinklr research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Sprinklr is translating efficiency gains into higher margins, its mid single digit revenue outlook and potential margin compression leave the long term growth story looking fragile.

If you want more consistent expansion and fewer question marks around future profitability, use our stable growth stocks screener (2070 results) to quickly zero in on businesses already delivering steadier revenue and earnings momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报